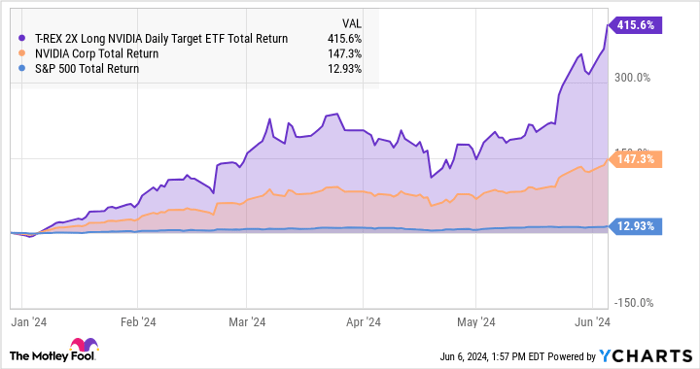

Chip designer Nvidia (NASDAQ: NVDA) is currently basking in the glory of its jaw-dropping stock market performance. Over the period starting from 2024, Nvidia’s stock has scaled remarkable heights, boasting a total return of 147%, a feat that leaves the S&P 500 (SNPINDEX: ^GSPC) index in the dust with a mere 13% total return.

However, in the midst of Nvidia’s soaring success, a looming investment specter casts a shade of caution. An investment beast beyond compare, one that I would avoid like the plague, or even recoil from with a thousand-watt laser pointer or an AI-generated digital finger.

The Driving Forces Behind Nvidia’s Triumph

Let’s start with the basics. Nvidia has convincingly asserted its dominance in the market for artificial intelligence (AI) accelerator chips. The likes of its A100 and H100 processors are omnipresent in the supercomputing realm, powering cutting-edge generative AI systems like OpenAI’s ChatGPT. With the future heralding the Blackwell platform, set to serve as the backbone for the next wave of large-scale AI operations.

Nvidia’s stock ascent is fueled by strong business fundamentals, riding on the coattails of remarkable financial performance. Nevertheless, the exuberance of the AI wave may have propelled Nvidia’s stock valuation to dizzying heights, especially in the face of intensifying competition from established semiconductor players.

In essence, while Nvidia remains a commendable investment, the timing might not be opportune for purchasing Nvidia shares. And delving into the exponential gains of a particular exchange-traded fund (ETF) is a venture I would counsel against wholeheartedly.

The T-Rex 2x Long Nvidia Daily Target ETF (NYSEMKT: NVDX) represents a leveraged ETF endeavoring to double the daily price swings of Nvidia’s stock. If the lofty valuation of Nvidia is a source of unease, the amplified version in the form of the T-Rex fund is nothing short of a financial fright fest.

NVDX Total Return Level data by YCharts

Weighing the Pros and Cons

The T-Rex ETF has indeed delivered exhilarating returns thus far, outstripping Nvidia’s recent gains comprehensively. It may be tempting to extrapolate this success into the future. As long as Nvidia stock continues its upward trajectory, this leveraged financial instrument is poised to soar even higher.

Yet, there exist several caveats to this approach.

- In times of prosperity, the exhilarating highs are offset by precipitous declines during market downturns. Recall the inflation-induced market debacle of 2022? The Invesco QQQ Trust (NASDAQ: QQQ), tracking the tech-heavy Nasdaq-100 index, nosedived by 32.6% in that year. Its 2x leveraged counterpart, the ProShares Ultra QQQ (NYSEMKT: QLD), plummeted a staggering 60.5% during the same period. Now envision a correction in Nvidia’s stock price; doubling that agony brings the T-Rex ETF into the realm of financial peril.

- Leveraged ETFs are inherently volatile creatures, ill-suited for mirroring long-term market returns and tailored more for short-term speculative forays.

- Some leveraged ETFs exhibit low trading volumes, leaving investors adrift when attempting to divest their holdings. The T-Rex 2x Nvidia fund remains relatively modest, managing assets worth a mere $525 million and witnessing its inception only last October.

In essence, while the T-Rex ETF appears dazzling under the sun of prosperity, it’s prudent to steer clear when the storm clouds gather on Wall Street. Back in 2022, Nvidia’s stock plummeted by 50.3%, a scenario where doubling the plunge defies the foundational laws of arithmetic—stock and ETF prices can’t venture into negative territory.

Foreseeable Hurdles on the Horizon

While I hesitate to predict a recurrence, economic upheavals perpetually loom, capable of undermining the tech sector’s growth momentum without forewarning. Moreover, the mere possibility of Intel (NASDAQ: INTC) or Advanced Micro Devices (NASDAQ: AMD) encroaching on Nvidia’s AI accelerator contracts poses a plausible yet uncertain risk.

Therefore, I strongly advise against venturing into the T-Rex 2x Nvidia fund amidst Nvidia’s record-breaking ascent. While the fund may continue its winning streak temporarily, the repercussions of a substantial price correction could inflict severe financial strain. Opting for conventional Nvidia shares affords ample risk-aligned excitement, albeit against the backdrop of an already staggering $3 trillion market capitalization.

Debunking Investment Myths: Unmasking Opportunities Amidst Risks

Before considering an investment in the ETF Opportunities Trust – T-Rex 2x LongIDIA Daily Target ETF, deliberate on the following:

Unraveling the Investment Landscape: Analyzing the Rise of Stock Advisor

Analyzing the Stock Market Chessboard

When considering the labyrinth of the stock market, investors often seek the sage advice of financial gurus to navigate the twists and turns. Just like a chess grandmaster strategizing each move on a board, investors yearn for the perfect playbook to unlock untold riches.

A Glimpse into Historical Triumphs

Reflecting on historical feats can illuminate the potential of astute investment decisions. Take, for instance, the case of Nvidia making the coveted list back on April 15, 2005. For those who heeded this call to action and invested $1,000, the returns would have skyrocketed to an impressive $740,688. An eye-watering return that stands as a beacon of hope amidst the volatility of the financial markets.

The Emergence of Stock Advisor

Enter Stock Advisor, an oasis in the desert of uncertainty that provides investors with a roadmap to success. Boasting an easy-to-follow blueprint, Stock Advisor offers pearls of wisdom on portfolio construction, regular analyst updates, and two fresh stock picks monthly. A sacred ground for discerning investors on the hunt for lucrative opportunities.

Charting Unprecedented Growth

Since its inception in 2002, the Stock Advisor service has proven its mettle by outshining the S&P 500, quadrupling its returns. A testament to the undeniable prowess of an expertly curated selection of stocks that have weathered financial storms and emerged victorious, much like a mighty vessel navigating turbulent seas.

Embracing the Future with Stock Advisor

As investors look forward to the horizon, Stock Advisor stands as a stalwart companion, guiding them through the treacherous waters of the stock market. With historical triumphs as their North Star, investors can glean insight and confidence in their journey towards financial prosperity.