Investor fascination with artificial intelligence (AI) stocks is not new. The likes of Nvidia and Super Micro Computer have experienced meteoric rises, fueled by the promise of AI technology. Riding this wave are other companies with the potential for exponential growth.

Alibaba: Navigating Risk and Reward

Among these rising stars is Chinese tech behemoth Alibaba. Despite geopolitical tensions casting shadows on its future, Alibaba remains a retail giant and a major player in China’s AI landscape.

By seamlessly integrating cloud AI and data intelligence, Alibaba boasts a formidable infrastructure to tackle complex problems through cutting-edge algorithms. Its Qwen model, facilitating generative AI applications, showcases the company’s commitment to innovation.

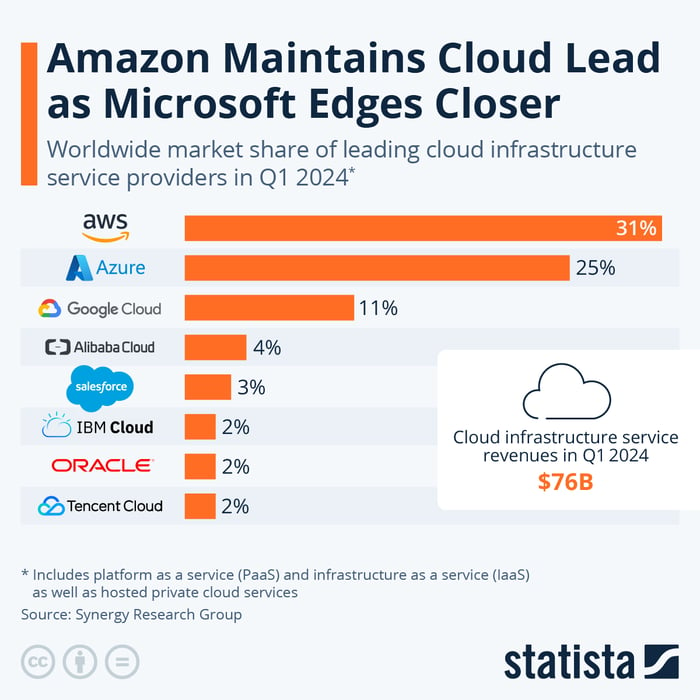

Image source: Statista.

Despite posting robust financial gains, with earnings soaring from 23 billion yuan ($3.2 billion) in 2014 to 71 billion yuan ($11 billion) in 2024, Alibaba’s stock price has not fully reflected this growth. A current P/E ratio of 17 positions Alibaba as an undervalued gem when compared to its regional peers. The complex geopolitical landscape may deter some risk-averse investors, but those undeterred by uncertainty might witness the stock achieving parabolic growth.

Innodata: Harnessing AI Innovation

Similar to Super Micro Computer’s trajectory, Innodata has ridden the AI wave to newfound heights after initially struggling in the market. The data engineering company leverages AI-driven processes to revolutionize data collection, digital transformation, and industry-specific business processes.

With a remarkable 1,670% surge in stock value over the past five years, Innodata emerges as a prime contender in the AI sector. The company’s revenue growth of 41% in the first quarter of 2024 and strategic cost management have further cemented its standing. Forecasting 40% revenue growth for 2024, investors have a unique opportunity to tap into Innodata’s growth potential at an early stage.

While its soaring price-to-sales ratio presents a challenge, currently standing at 5.5, the company’s trajectory indicates further upside potential. As awareness around Innodata continues to grow, investors poised to seize this opportunity may reap substantial rewards in the future.

In Conclusion

The landscape of AI stocks offers a mixed bag of risk and reward. Companies like Alibaba and Innodata showcase the vast potential of AI technology, but also come with their own set of challenges. For investors willing to navigate uncertainties and harness the power of AI innovation, these stocks could pave the way for significant growth opportunities in the future.