Two consumer discretionary stocks have recently ascended to the Zacks Rank #1 (Strong Buy) list, signaling a potential upward trajectory for cruise line operators Norwegian Cruise Line (NCLH) and Royal Caribbean Cruises (RCL).

The spring and summer months traditionally mark the peak travel season for leisure and recreation activities, making Norwegian and Royal Caribbean’s shares appear undervalued at their current levels.

Post-Pandemic Recovery & Growth Prospects

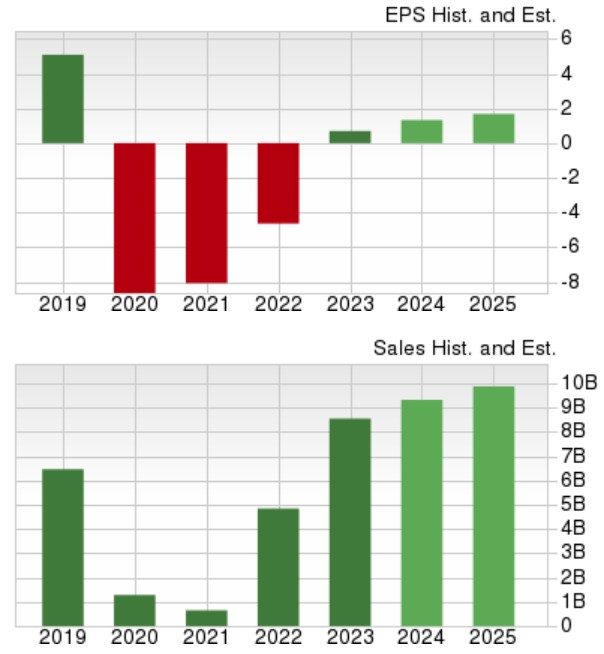

With more than three years elapsed since the height of the COVID-19 pandemic, the broader cruise industry is witnessing a robust recovery phase. Norwegian’s total sales are forecasted to climb by 9% in fiscal 2024 and further increase by 6% in FY25 to reach $9.93 billion. Crucially, Norwegian’s annual earnings are expected to surge by 94% this year to $1.36 per share from $0.70 per share in 2023. Looking ahead, FY25 EPS is projected to grow by another 27% to $1.73 per share.

While Norwegian’s earnings are yet to reach the pre-pandemic levels of $5.09 per share in 2019, the company has already surpassed its pre-COVID sales figures from the same year, which stood at $6.46 billion.

Image Source: Zacks Investment Research

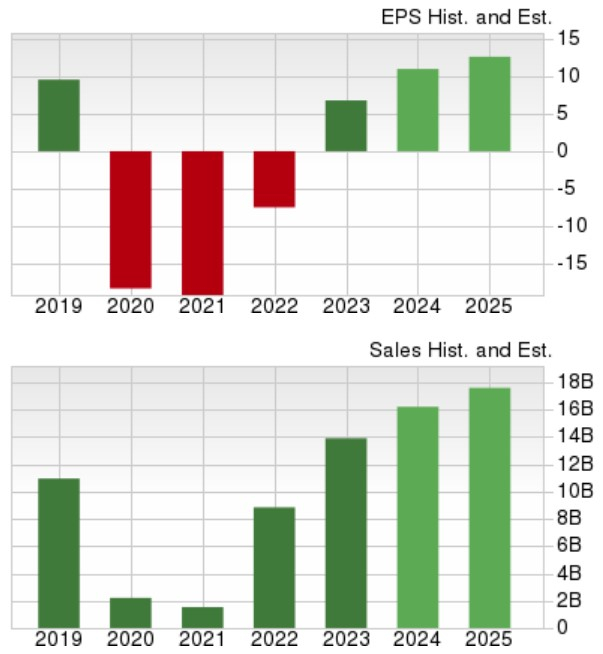

On the other hand, Royal Caribbean is poised for a 16% revenue expansion in FY24, with a further 9% growth expected in FY25 to reach $17.63 billion. Moreover, Royal Caribbean’s yearly earnings are projected to climb by 62% in FY24 to $10.96 per share, compared to $6.77 per share in the previous year. Additionally, a 15% increase in EPS is anticipated for FY25. Notably, Royal Caribbean is set to surpass its pre-pandemic earnings of $9.54 per share in 2019 and has already exceeded pre-COVID sales figures of $10.95 billion.

Image Source: Zacks Investment Research

Appealing P/E Valuations

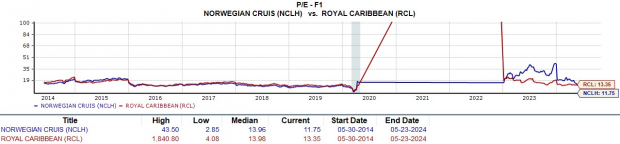

In addition to the encouraging post-pandemic recovery outlook, Norwegian and Royal Caribbean boast attractive P/E valuations. Norwegian’s stock is currently trading at 11.7X forward earnings, while Royal Caribbean stands at 13.3X, representing a notable discount compared to the Zacks Leisure and Recreation Services Industry average of 18.7X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

Final Thoughts

Amid their recovery momentum and appealing P/E ratios, earnings estimate revisions continue to trend upwards for Norwegian Cruise Line and Royal Caribbean for FY24 and FY25. This trend underscores the notion that the stocks of these companies are attractively priced and likely have further room for growth from their current levels.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to explore potential opportunities in the market.