The Rise of Disruptors in Finance

Disruptors have a knack for turning industries on their heads, sparking innovation, and outmaneuvering traditional competitors. The clash between Netflix and Blockbuster serves as a prime example in the entertainment sphere. From this seismic shift, investors can glean valuable insights.

Lessons from Netflix’s Success

Innovative business models mark disruptors’ territory, challenging existing norms. Netflix revolutionized the entertainment landscape with its pioneering subscription-based streaming model, leaving Blockbuster’s DVD rental stores in the dust.

Embracing Technological Advances

Disruptors like Netflix leverage technological advancements to cater to evolving consumer preferences. By capitalizing on online streaming, Netflix catered to the burgeoning demand for on-demand, digital content, setting a new standard in entertainment delivery.

Focus on Customer Experience

The hallmark of a successful disruptor lies in enhancing customer experience. Netflix’s on-demand streaming allowed users unprecedented freedom, eradicating the need for physical store visits, late fees, or DVD mail-outs. This customer-centric approach redefined market dynamics.

The Mortgage Market Beckons Disruption

The mortgage lending sector stands as a prime candidate for disruption, plagued by tedious processes, paperwork inundation, slow approvals, and opacity.

Disruptor #1: Rocket Companies (RKT)

Rocket Companies, hailing from Detroit, spearheads digital solutions in mortgage lending.

Enter the Era of Digital Mortgage Solutions

Rocket Mortgage’s online platform and mobile app streamline the mortgage application, approval, and closing processes, ushering in a new era of efficiency in securing home loans. By minimizing paperwork and accelerating approval timelines, Rocket Companies set a benchmark for convenience and transparency, resonating with modern consumers.

Robust Earnings Projections

Zacks Consensus Estimates project a staggering 557.14% growth in RKT’s EPS by 2024, underpinned by a history of surpassing expectations by an average of 75% in the past four quarters.

Disruptor #2: Blend Labs (BLND)

Blend Labs focuses on revolutionizing the mortgage lending process through cutting-edge software solutions.

The Dawn of Digital Mortgage Platforms

Blend Labs delivers a digital platform empowering lenders to offer a seamless mortgage application experience. Borrowers can conveniently complete applications online, upload documents, and monitor their application progress in real-time.

Automating and Integrating Processes

Automation lies at the heart of Blend Labs’ strategy, streamlining arduous tasks in the lending journey and enhancing efficiency for all stakeholders. Integration with diverse data sources expedites verification and processing, propelling the mortgage process forward.

Ensuring Compliance and Security

Blend Labs prioritizes regulatory adherence and data security, ensuring that its solutions align with industry guidelines. The platform’s design emphasizes safeguarding sensitive borrower information, instilling trust and confidence in users.

The Mortgage Maverick: Blend Labs

Revolutionizing Lending Processes

Blend Labs has forged robust collaborations with financial institutions, banks, and mortgage lenders to implement cutting-edge technology solutions. This strategic partnership aims to streamline the mortgage lending process, elevating efficiency, and enhancing the overall customer experience.

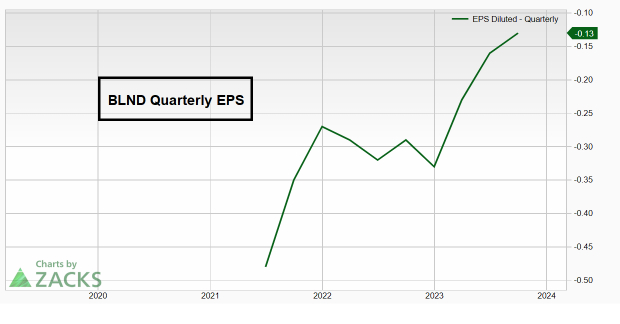

Image Source: Zacks Investment Research

Emerging Powerhouse in the Making

Despite its market cap being under $1 billion, BLND has exhibited remarkable growth, with EPS surging by an impressive 78% year-over-year in the last quarter. Since the company went public in 2021, it has consistently demonstrated EPS growth, setting a strong foundation for future endeavors.

Image Source: TradingView

Technical Resilience

Following a robust trend over several months, BLND shares have recently retracted towards the 50-day moving average, showing a rebound supported by significant trading volume. This confluence presents an enticing reward-to-risk scenario for investors keen on the stock’s potential.

The Brave New World of Mortgage Revolution

Rocket Companies and Blend Labs are spearheading a transformation in the age-old mortgage lending market, injecting innovation and efficiency into a sector ripe for disruption. Their innovative offerings have been gaining momentum, mirrored by robust fundamentals and a consistent track record of surpassing EPS estimates.