The close of the 2024 Q2 earnings season is upon us, with a multitude of companies already presenting their quarterly reports to eager investors.

Unveiling higher profitability through substantial margin expansion were Deckers Outdoor DECK, Kimberly Clark KMB, and Walmart WMT. Let’s delve deeper into each company’s recent quarterly performance.

Deckers Outdoor: Stepping Up with Brand Momentum

Deckers Outdoor demonstrated another strong quarter, surpassing both earnings and revenue expectations significantly and maintaining a streak of positive earnings. The company experienced a remarkable 90% year-over-year growth in EPS, with sales jumping 22% compared to the same period last year.

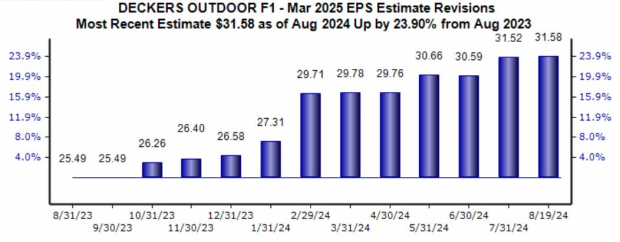

Continued brand momentum, particularly with UGG and Hoka shoes, played a pivotal role in these robust results, prompting the company to adjust its fiscal year outlook upwards. Analysts have revised their expectations accordingly, with the Zacks Consensus EPS estimate of $31.58 indicating an 8% annual growth.

Image Source: Zacks Investment Research

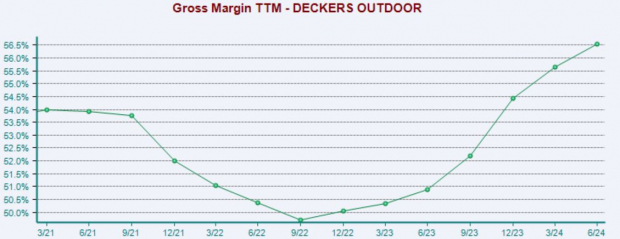

Deckers Outdoor has been riding the wave of margin expansion, enhancing its profitability outlook significantly. This trend continued in the latest quarter, with the gross margin expanding to 56.9% from 51.3% in the previous year.

Please note that the following chart is based on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Kimberly-Clark: Flexing Its Defensive Nature

KMB shares have exhibited a robust performance year-to-date, climbing over 15%. The company’s defensive posture, stemming from its position in the consumer staples sector, affords it the advantage of consistent demand for its products in various economic climates.

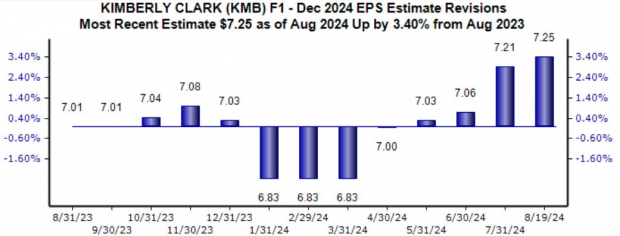

The stock flaunts a Zacks Rank #2 (Buy), with increased earnings projections for the current fiscal year following an optimistic guidance revision.

Image Source: Zacks Investment Research

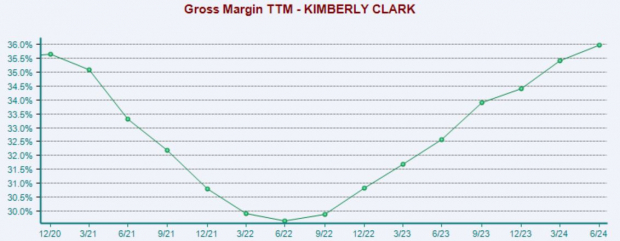

Effective cost management strategies have significantly contributed to the company’s profitability, with adjusted EPS of $1.96 in the latest quarter marking a 20% year-over-year surge. The displayed margin expansion further reflects investor satisfaction.

Keep in mind that the subsequent chart reflects a trailing twelve-month period.

Image Source: Zacks Investment Research

Walmart: Reveling in Elevated Profits

In terms of headline figures, retail giant Walmart demonstrated a remarkable 22% growth in EPS on nearly 5% higher sales, surpassing consensus forecasts for both metrics.

The company operated at full throttle during the period, witnessing a 43-basis-point enhancement in its gross margin and experiencing a rise in its operating income. Notably, the increasing penetration of eCommerce continued to drive positive performance across all segments.

Shown below is a chart depicting the company’s gross margin over a trailing twelve-month period.

Image Source: Zacks Investment Research

Walmart has leveraged its digital initiatives to fuel growth, consistently delivering robust results in recent quarters. Global eCommerce sales surged by 21%, with a growing preference among customers for pickup and delivery services.

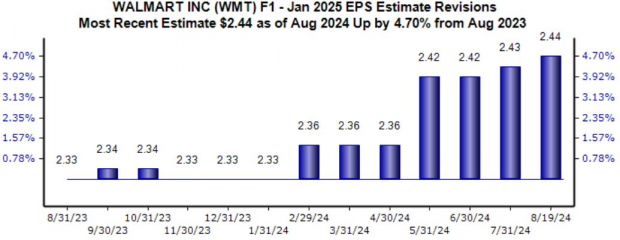

Following the earnings release, Walmart raised its FY25 net sales and adjusted operating income guidance, eliciting a positive market response. Analysts adjusted their earnings estimates accordingly, with the Zacks Consensus EPS estimate of $2.44 indicating a 10% annual increase.

Image Source: Zacks Investment Research

In Conclusion

All three companies – Deckers Outdoor DECK, Kimberly Clark KMB, and Walmart WMT – delivered exceptional quarterly results, benefiting from margin expansion trends throughout their respective reporting periods.

Important: Information in this article is solely for educational and illustrative purposes and does not intend to provide specific investment advice or recommendations. Always do your research and consult with a qualified investment professional before making investment decisions.