Industry Performance and the Market Landscape

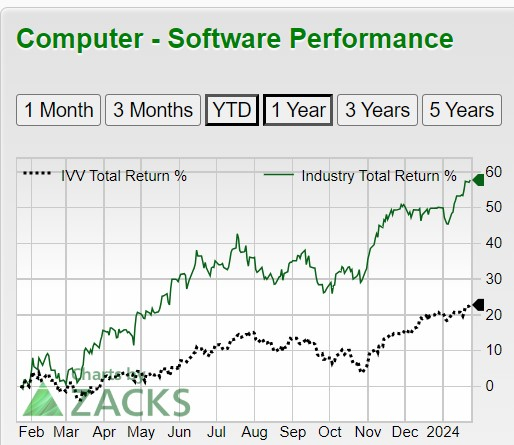

The Zacks Computer-Software Industry has been a crucial catalyst driving the remarkable upsurge in the Nasdaq’s performance over the past year, soaring with a one-year return of +58%, surpassing the S&P 500’s +21%, and even outpacing the Nasdaq’s +36%. This stupendous industry performance has been facilitated by the prospects of receding inflation and lower interest rates, setting the stage for a resurgence in consumer spending on non-essential tech products.

Blackbaud

Image Source: Zacks Investment Research

Blackbaud BLKB

Possessing a Zacks Rank #1 (Strong Buy), Blackbaud provides a comprehensive suite of cloud-based and on-premise software solutions tailored for social causes. Its robust financial performance has propelled the stock up by +35% over the past year, with a projected 43% earnings growth to $3.86 per share in fiscal 2023 and an additional 17% expansion in FY24 EPS. The company is expected to witness a 5% rise in total sales in FY23 and an 8% surge to $1.2 billion in FY24, surpassing earnings expectations for six consecutive quarters.

Microsoft

Image Source: Zacks Investment Research

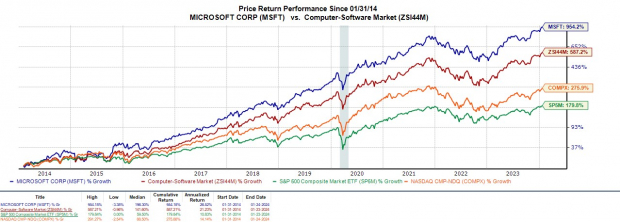

Microsoft MSFT

With a Zacks Rank #2 (Buy) and an “A” Zacks Style Scores grade for Growth, Microsoft’s shares have surged +64% in the past year, bolstered by a remarkable 273% growth over the last five years. The company’s robust performance has been underpinned by its enterprise-to-consumer software solutions and leading cloud capabilities through Microsoft Azure, as well as strategic acquisitions including LinkedIn, Skype, and the recent addition of Activision Blizzard.

Trend Micro

Image Source: Zacks Investment Research

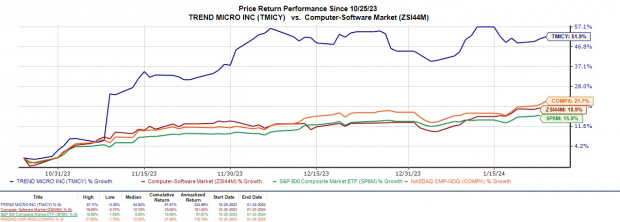

Trend Micro TMICY

Despite being a late bloomer in the growth story, Trend Micro’s stock has garnered an “A” Zacks Style Scores grade for Momentum and holds a Zacks Rank #1 (Strong Buy). The Japan-based software solutions provider has witnessed a notable +15% rise in its stock over the last year, with a remarkable rebound and a soaring +52% in the last three months. Forecasts for fiscal 2024 EPS have surged 20% in the last 30 days, with projections escalating from $1.48 to $1.78 per share.

Positive Growth Forecast and Q4 Results Expected for Trend Micro and Software Industry

The software industry is poised for further growth, with Trend Micro’s revenue forecasted to rise 3% in FY23 and an additional 9% in FY24 to $1.93 billion. This optimistic projection sets the stage for Trend Micro’s Q4 results, scheduled for release on February 15. A positive guidance for the company’s FY24 outlook could fuel continued market momentum.

Bottom Line

Currently, the Zacks Computer-Software Industry stands in the top 40 percentile of over 250 Zacks industries, with Blackbaud, Microsoft, and Trend Micro standing out as recent success stories.