Positive Trends in the Finance Sector

In the finance arena, 73% of Zacks Finance sector companies have been exceeding their quarterly earnings estimates, lead by the stellar performances of JPMorgan (JPM), Citigroup (C), and other major players.

Impressive Onset to Earnings Season

JPMorgan and Citigroup’s buoyant commencement to the first quarter earnings season for financials has sent ripples of optimism across the sector, propelling many finance stocks to higher ground. As the Q1 reports loom on the horizon for some top-rated finance stocks, the present moment may offer a valuable window for investment.

Investment Potential in Three Key Players

Brown & Brown (BRO)

Brown & Brown, with its diverse array of insurance products and services, is poised attractively in the market, primarily operating in the United States alongside properties in London, Bermuda, and the Cayman Islands.

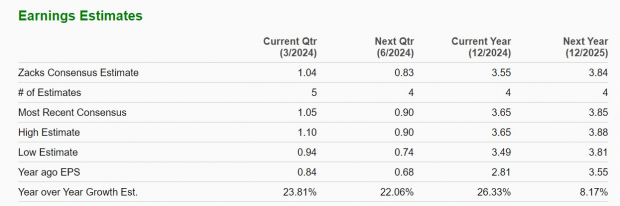

Brown & Brown’s Q1 estimated EPS rise of 24% to $1.04 from $0.84 in the previous year is promising. With expected quarterly sales growth of 8% to $1.21 billion, annual earnings in fiscal 2024 are anticipated to surge by 26% to $3.55 per share. The future looks bright, with an additional 8% EPS expansion forecast for the subsequent year, alongside high single-digit growth in the company’s top line in FY24 and FY25.

Equity Lifestyle Properties (ELS)

One REIT standout for consideration is Equity Lifestyle Properties, overseeing a self-administered portfolio of home sales and rental activities, encompassing manufactured homes, recreational vehicle communities, and marinas.

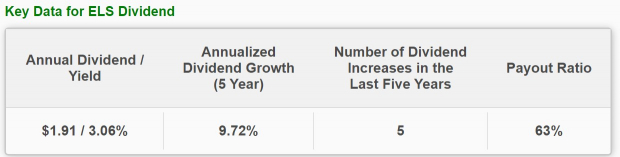

Forecasts predict a 4% increase in Q1 earnings to $0.77 per share, with a 5% sales upturn to $389.49 million. Looking ahead, a 5% EPS increment is expected for FY24, with projected FY25 earnings growth of 6% to $3.08 per share. Total sales are set to rise by single digits in FY24 and FY25, with Equity Lifestyle’s annual dividend of 3.06% beginning to entice income investors, especially since the company has consistently enhanced its payout over the last five years, boasting a 9.72% annualized dividend growth rate during this span.

Globe Life (GL)

Functioning as an insurance holding company, Globe Life is expected to witness a 10% uptick in Q1 EPS to $2.80 per share, accompanied by a 5% sales increase to $1.43 billion. The company’s subsidiaries cater to lower to middle-income households across the U.S., offering individual life and supplemental health insurance.

Projections indicate an 8% EPS growth for FY24 and FY25, with total sales set to elevate by 5% in the current year and tentatively 4% in FY25, reaching $6.1 billion. Globe Life is beginning to appear undervalued with a 5.6X forward earnings multiple, complemented by a 1.48% annual dividend.

Key Considerations

As Brown & Brown, Equity Lifestyle Properties, and Globe Life gear up for what is expected to be a robust quarter, these three finance stocks could potentially offer a lucrative opportunity for investors. All boasting a Zacks Rank #2 (Buy), if they can reaffirm their positive outlook, there may be further potential for stock appreciation.