Exploring the World of Growth Investing

Investors across the financial landscape gravitate towards growth stocks, those promising companies poised to catapult their earnings and revenues to superlative heights. This trajectory is often the harbinger of stock price outperformance, a golden fleece coveted by the investing community.

The Volatile Path to Prosperity

However, the corollary of investing in growth stocks is the elevated volatility these dynamic entities face. Unforeseen challenges can cast a shadow on their promising horizons, adding a plot twist to the investing tale.

A Closer Glimpse at the Contenders

For investors seeking a trio of robust growth stocks, the triumvirate of Nvidia NVDA, e.l.f. Beauty ELF, and Wingstop WING beckon as intriguing prospects. Let’s delve deeper into their narratives.

Nvidia’s Meteoric Odyssey

Nvidia’s latest quarterly performance transcended expectations, propelled by an insatiable demand for AI chips that fuelled a phenomenal financial upswing. Earnings catapulted by an awe-inspiring 460%, while revenues surged by a formidable 260%. Particularly, the Data Center segment witnessed a jaw-dropping 430% uptick from the same juncture last year.

The quantum leap in share value post-earnings unveiling launched Nvidia into an orbit of exuberance. The company’s decision to embark on a 10-for-1 stock split and augment its quarterly dividend payout by 150% underscored its affinity towards nurturing shareholder prosperity.

Nvidia’s earnings vista only augurs more brilliance, with the stock maintaining the prestigious Zacks Rank #1 (Strong Buy). An investment in Nvidia presents a captivating opportunity for enthusiasts of AI technology, tailored to ride the wave of unwavering demand.

Image Source: Zacks Investment Research

The Renaissance of e.l.f. Beauty

e.l.f. Beauty’s shares soared post-earnings revelation, marking a watershed moment in breaking free from a downturn spiral. Garnering nearly a 30% surge in 2024, the company’s stock outstripped the S&P 500, building on a legacy of stellar gains. The company’s unparalleled consistency in quarterly performance, surpassing earnings and revenue projections in 10 consecutive quarters, commands unwavering attention.

The company’s growth chronicle is nothing short of extraordinary, with consistent double-digit year-over-year sales expansion. In its latest narrative, earnings surged by 15% alongside a substantial 71% upswing in sales.

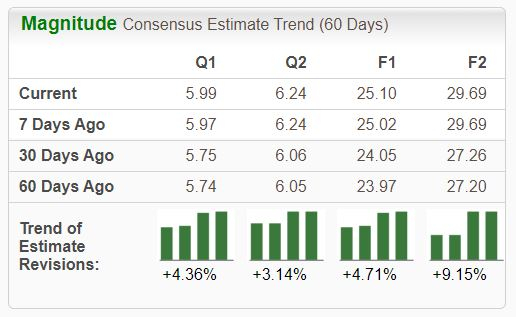

Peering at the trajectory of revenue quarter by quarter below unfolds the testament to e.l.f. Beauty’s financial narrative.

Image Source: Zacks Investment Research

The stock retains its allure for growth enthusiasts, grounded in its Style Score boasting a ‘B’ grade for Growth, a testimony to its promising trajectory.

The Flight of Wingstop

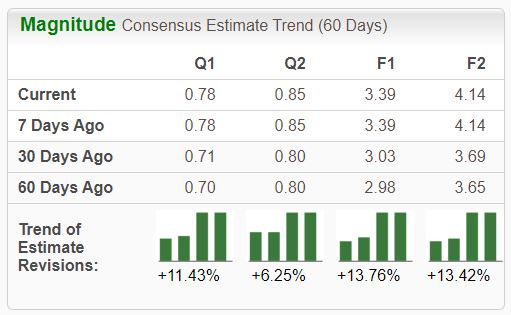

Wingstop’s shares surged magnificently in 2024, fueled by a stellar financial performance trumping expectations and notching up nearly a 44% gain, vastly outperforming the S&P 500 index. Adorned with the prestigious Zacks Rank #1 (Strong Buy), the stock basks in higher earnings estimates across the spectrum with a promise of continued growth.

Image Source: Zacks Investment Research

Prognosticators anticipate a trajectory of robust expansion, with consensus projections for the ongoing fiscal year painting a portrait of 37% earnings growth atop a 27% surge in sales. The growth saga is poised to transcend into FY25, with earnings and revenues forecasted to burgeon by 22% and 17%, respectively.

In Conclusion

A treasure trove of rewards awaited growth-centric investors over the preceding year, reaping bountiful profits amidst the ebullient market atmosphere.

For those eager to partake in this journey, the three luminaries on the horizon – Nvidia NVDA, e.l.f. Beauty ELF, and Wingstop WING – beckon for a discerning gaze.

Adding a cherry on top, all three eminences flaunt a coveted Zacks Rank, reflecting a consensus of optimism among astute analysts.