Market Resilience Post-Powell’s Speech

The bulls fought back on Thursday following a late-afternoon selloff that washed away the initial post-Fed pop.

Powell appeared to rule out the possibility of the Fed hiking rates, helping the bulls feel comfortable pushing the S&P 500 and the Nasdaq near their 21-day moving averages.

The unknowns around the corner shouldn’t deter investors since the last several years show how difficult market timing is.

Investors who want to stay constantly exposed to stocks might consider buying these strong tech stocks in May.

Opportunity 1: Arista Networks (ANET)

Arista Networks is a networking infrastructure provider and a leader in data-driven, client-to-cloud networking for large data centers and beyond. ANET has accumulated over 8,000+ cloud customers worldwide, including the likes of Microsoft (MSFT), Meta (META), and many other tech titans. The firm’s offerings are at the cutting edge and critical considering that six of the largest cloud service providers based on annual revenues are Arista Networks clients.

Image Source: Zacks Investment Research

ANET stock has skyrocketed 1,800% during the last 10 years to blow away the Zacks Tech sector’s 340%, Meta’s 630%, and Microsoft’s 1,100%. Arista Networks has soared 95% in the last 12 months, yet it is down 15% from its March records and trades 12% below its average Zacks price target. The stock is trying to find support at its 21-week moving average and it is on the cusp of retaking its 21-day.

Image Source: Zacks Investment Research

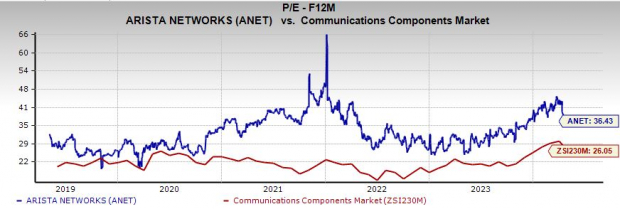

Arista Network trades at a 65% discount to its 10-year highs and near its median at 36.4X forward 12-month earnings and at a 45% discount to its three-year highs. Arista Networks has a stellar balance sheet and its Communication – Components industry is in the top 9% of over 250 Zacks industries.

Arista Networks is projected to post strong earnings and revenue growth in 2024 and 2025, and its upbeat EPS revisions help it land a Zacks Rank #1 (Strong Buy).

Opportunity 2: Uber Technologies, Inc. (UBER)

Uber posted its first full-year profit as a public company in 2023 by expanding its ride-hailing and delivery businesses while streamlining its operations. Uber’s CEO called 2023 an “inflection point” proving it can “continue to generate strong, profitable growth at scale.”

Uber grew its monthly active platform consumers by 15% YoY in Q4 to 150 million, fueled by growth across ride-hailing and delivery. The firm’s two core businesses are especially popular with higher-income consumers who are less impacted by lingering inflation and various economic cycles. Uber also still has an eye on its autonomous vehicle future via strategic partnerships with Waymo and others.

Image Source: Zacks Investment Research

Uber grew its revenue by 17% in 2023 after its sales soared 83% in 2022 and 56% in 2021. Uber is projected to post 16% growth in both 2024 and 2025 to hit $50.49 billion next year (vs. $13 billion in pre-Covid 2019).

Uber is expected to post 41% adjusted EPS growth in 2024 and 66% in FY25 to reach $2.04 per share (vs. an adjusted loss of -$4.65 a share in 2022). Uber’s upbeat EPS revisions earn it a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

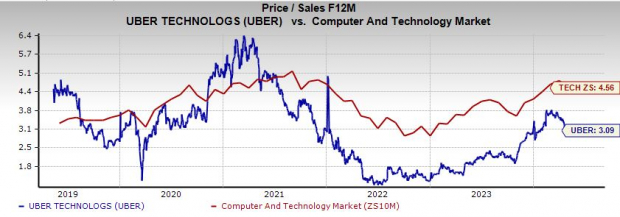

Uber has climbed 80% during the last year to hit new all-time highs in mid-February. The stock is trading 15% below its records and 26% below its average Zacks price target. Uber is attempting to find buyers at its 21-week moving average, while trading between its 21-day and 50-day and at some of its most oversold RSI levels over the last five years.

The Curious Case of Falling Shopify Stock Amidst a Sky-High Valuation

Revved up for Resilience

Shopify, the revolutionary force behind “essential internet infrastructure for commerce,” has been a stalwart in the volatile realm of e-commerce. Focused on nurturing sellers instead of fixating solely on consumers like behemoth Amazon, Shopify’s business model has withstood the test of time.

Growing Pains and Price Surges

Despite the exuberant growth of the past, Shopify made a strategic pivot by increasing its prices in 2023, marking its first rate adjustment in over a decade. While the days of meteoric revenue expansion may have waned, Shopify is projected to reap a sales growth of 21% and 20% in 2024 and 2025, respectively, stepping steadily towards the $10.20 billion benchmark.

Earnings Soar, Stock Falls

Although Shopify’s stock has slumped 57% from its peak in November 2021, it defied gravity by surging 160% from its 2022 lows. This rollercoaster movement underscores the stock’s resilience, amplifying the stark contrast from Amazon’s 750% surge over the same horizon. Despite enduring disparate market sentiments, notably caught in the crosswinds of volatile interest rates, Shopify’s lustrous balance sheet remains a beacon of stability amidst the tempest of tech stocks teetering at all-time highs.

A Glance at the Extravagant Landscape

Casting a discerning eye on the metrics, Shopify emerges as a gem with a PEG ratio of 0.9, cruising at 30% beneath the Zacks tech sector. Its soaring sales at 3.2X forward sales illustrate a sound investment prospect beckoning amidst the tempest of the market. Though Shopify may paint a picture of volatility, its trajectory speaks volumes of resilience amidst the backdrop of finicky investor sentiment.

Evaluating the Fortunes of the Cryptoverse

Reflecting on the capricious realms of investment, Bitcoin emerges as a shining star, eclipsing all other asset classes in profitability. Despite its inherent vagaries, history bears witness to Bitcoin’s monumental returns during presidential election years, showcasing staggering spikes at +272.4% in 2012, +161.1% in 2016, and +302.8% in 2020. These remarkable feats, shrouded in uncertainty, foretell a promising future trajectory amidst the precarious dance of the financial markets.