Amid a sea of investment choices, large-cap stocks often emerge as beacons of stability and reliability, enticing a cohort of investors seeking a proven track record and the allure of dividend payments. While generally perceived as a more conservative option than their small-cap counterparts, large-cap stocks can still offer compelling growth potential. The likes of Target (TGT), Cardinal Health (CAH), and Arista Networks (ANET) currently stand out among the crowd, flaunting favorable growth projections and earning a coveted Zacks Rank.

The Rise of Arista Networks

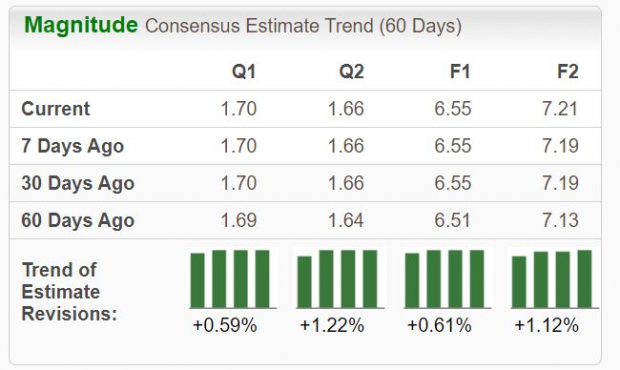

Arista Networks has ridden the wave of artificial intelligence fervor, capitalizing on its provision of network switches to hyperscalers, facilitating accelerated communication between computer servers. Boosted by a Zacks Rank #2 (Buy), the company’s stock continues to see upward momentum in earnings estimates across various time frames. Bolstering its allure is an impressive growth outlook, with consensus estimates projecting a remarkable 43% earnings surge and a 33% revenue upswing for the current fiscal year. The company appears poised to sustain its growth trajectory in FY24, with earnings anticipated to ascend by 10% and sales projected to climb by 11%.

Image Source: Zacks Investment Research

Target’s Evolution and Expansion

Target’s transformation from a traditional brick-and-mortar retailer to an omni-channel powerhouse has not gone unnoticed. With a Zacks Rank #2 (Buy) and a resounding chorus of burgeoning earnings estimates, the company is set to revamp its profitability landscape in the current fiscal year, with anticipated earnings growth of 40%. Moreover, investors are drawn to its sturdy dividend yield, currently standing at an impressive 3.1%. Target’s unwavering commitment to its shareholders is reflected in its substantial 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Cardinal Health’s Strong Foothold

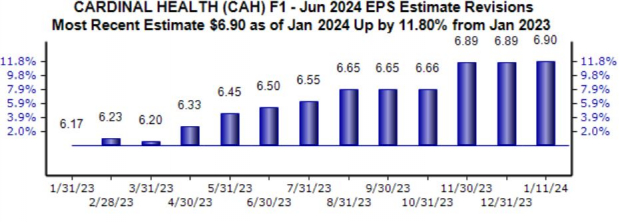

As a nationwide drug distributor and service provider to pharmacies, healthcare providers, and manufacturers, Cardinal Health has solidified its position as a Zacks Rank #2 (Buy) stock. Notably, the company has witnessed a robust upward trend in earnings estimate revisions for the current fiscal year, registering a 12% increase over the past year. The consensus expectations for the year point to a 20% surge in earnings and a 10% rise in sales. Looking ahead to FY25, a 12% leap in earnings and an 8% uptick in revenue are on the horizon, underscoring its sustained growth trajectory. The company has consistently outperformed earnings and revenue projections in its last five releases, perpetuating its track record as a resilient earnings performer.

Image Source: Zacks Investment Research

In Conclusion

In the realm of large-cap stocks, the triumvirate of Arista Networks, Target, and Cardinal Health stands out as heralds of growth potential. Bolstered by their respective Zacks Rank #2 (Buy) status and buoyant earnings estimates, these companies exude a sense of resilience and prosperity, poised to navigate the fluctuations of the stock market with steadfastness and fortitude.

The Appeal of Large-Cap Stocks: A Look at Target, Cardinal Health, and Arista Networks

Investors across the globe recognize the enduring charm of large-cap stocks. Renowned for their steadfast nature and history of success, these stocks remain integral components of nearly every investment portfolio.

Favorable Options for Large-Cap Exposure

For investors seeking large-cap exposure, a few options stand out. Notable among these are Target (TGT), Cardinal Health (CAH), and Arista Networks (ANET). All three of these companies display favorable prospects with improved earnings outlooks, making them compelling considerations for investment.

Potential for Growth

Target, with its diversified retail offerings, Cardinal Health in the pharmaceutical distribution sector, and Arista Networks specializing in cloud networking solutions, each hold substantial potential for growth in their respective industries.

Comparative Performance to Inspire Confidence

These companies have the potential to rival or even surpass the remarkable performance of other notable stocks. For instance, Arista Networks, much like recent standouts such as the Boston Beer Company and NVIDIA, has garnered attention for its impressive growth and could attract further interest from investors.

To read more valuable insights on these opportunities, consult the full report on Zacks.com by clicking here.