Inflation Statistics and Stock Market Impact

The core personal consumption expenditure (PCE) price index reading was slightly lower than expected, which is beneficial for the Federal Reserve’s effort in achieving a soft landing. However, a dip in the personal savings rate deserves close attention as consumer health is crucial for supporting stock market gains in the long run.

IBM’s AI Transformation and Remarkable Gains

IBM’s strategic shift towards artificial intelligence (AI) software has propelled its stock performance, resulting in remarkable gains for investors. The company’s transition to a hybrid cloud and AI business model, characterized by divestments and key acquisitions, has garnered significant attention from macro experts like Eric Fry.

Potential AI Profits and the Semiconductor Sector

The surge in AI demand represents just the tip of the iceberg as the vast majority of corporate AI adoption is anticipated to drive substantial economic activity and investment wealth in the foreseeable future. The rapid growth of AI technology is poised to unlock a multitude of investment opportunities, particularly within the semiconductor sector, a critical component in the ongoing “AI Wars of 2024.”

The Race for Technological Supremacy

The intensifying competition between the U.S. and China for technological dominance, particularly in the realm of advanced AI capabilities, underscores the significance of semiconductor chips. These chips, pivotal to the operation of AI-driven technologies, have become the focal point in the race for global technological superiority.

The CHIPS Act and Implications for Investors

The passage of Federal Law 117-167, also known as The CHIPS And Science Act Of 2022, aims to bolster domestic microprocessor manufacturing and reduce reliance on overseas chip supply chains. This initiative, backed by substantial government subsidies, presents a compelling opportunity for investors to capitalize on the imminent influx of capital into the semiconductor industry.

Eric Fry’s Strategic Investment Approach

Eric Fry’s insight into the evolving landscape has led to impressive returns for investors, particularly in his recommended trade on Intel. With the impending deadline of February 1st for companies vying for government support, Fry’s strategic move to capitalize on the CHIPS Act exemplifies his proactive and foresighted approach to investment opportunities.

The Intel Revival: A Renaissance in Semiconductors Sparks Investor Optimism

Eric, the guru of semiconductor investment, calls for a second round of trading at Intel. The rationale behind this recommendation is plain and simple: the Intel trade is expected to gain momentum throughout 2024 and into 2025, positioning readers to profit from Intel’s resurgence.

Furthermore, the stock could see a sudden spike upon receiving major funding from the CHIPS Act, potentially setting it on an upward trajectory.

A Dip in the Market

If you’re fresh to Intel, you’ve stepped in at the right time. The chip giant suffered an 11% decline based on Q1 guidance, disappointing Wall Street. However, Intel is on a path of transformation, evolving into a next-generation chip powerhouse, akin to taking “two steps forward, one step back.” Therefore, for long-term investors, this setback presents a chance to enter at a discounted price.

Beyond Intel, Eric doesn’t limit his semiconductor recommendations to riding the AI boom. His recent portfolio spans a diversified basket of AI plays, broadening investment opportunities in this space.

Reflecting on the Past to Foresee the Future

Consider the proliferation of tech products and services in the last decade: smartphones, tablets, computers, smartwatches, smart TVs, earbuds, electric vehicles – the list goes on. Understanding that semiconductor chips power all things “tech,” coupled with the nascent adoption of AI, it’s reasonable to anticipate a substantial surge in demand for semiconductor chips over the next decade.

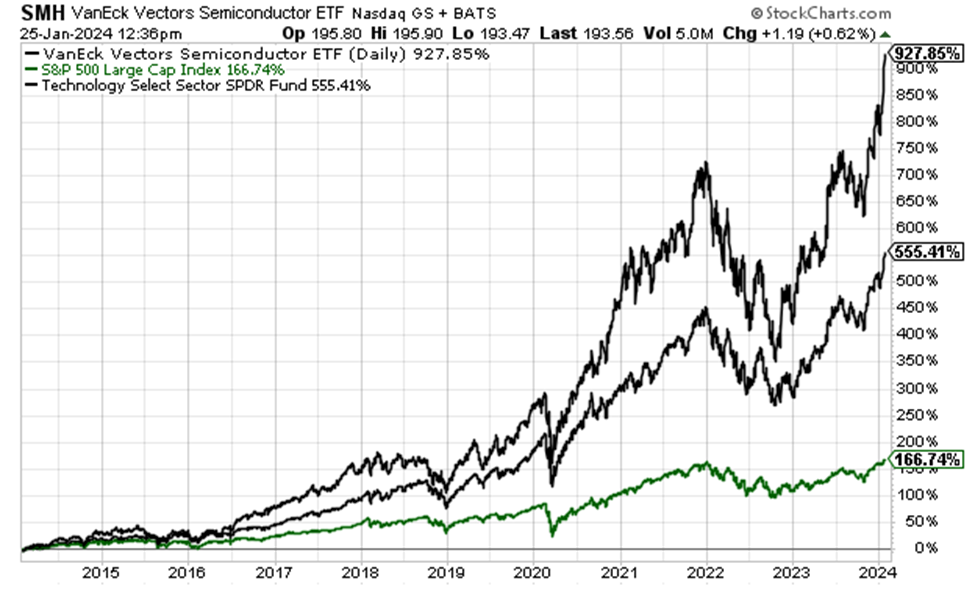

Looking back at semiconductor stock performance over the last 10 years, with just a year of AI on the scene, gives a telling narrative. For context, the S&P index recorded a 166% climb over this period, while the SPDR Technology Select Sector ETF XLK, composed of major tech names like Microsoft and Apple, boasted a 555% rise, surpassing the S&P’s gain.

The Surging Potential of Semiconductors

Contrasting these gains, the VanEck Vectors Semiconductor ETF SMH surged by an impressive 928% over the same period, nearly doubling XLK’s performance.

If we assume that the forthcoming decade will witness substantially greater chip demand than the last 10 years, then the question arises – why wouldn’t long-term investors be rushing into top-tier semiconductor stocks today? The fact is, they are indeed doing so, following the example set by Eric.

It’s clear that the AI Wars are just commencing, with unfathomable wealth-creation potential on the horizon. Despite inevitable volatility, as evidenced by Intel’s current position, the historical context and the integration of AI suggest a significant surge in chip stocks a decade from now.

This article has just scratched the surface of the AI Wars. To delve deeper into Eric’s full presentation, click here. In any case, don’t overlook this opportunity today. Have a good evening,

Jeff Remsburg