It’s a new year, the ideal time to start investing. Compounding does its best work late, and the earlier you start, the more wealth you’ll build over time.

One of investing’s beautiful facets is that the stock market welcomes everyone. Whether you’re affluent or starting with just $500, you can benefit from owning stocks.

Palantir Technologies – The Rising Star

Palantir Technologies (NYSE: PLTR) is a relatively new software company that has made a mark on Wall Street. The company specializes in building proprietary platforms for government and enterprise customers. Its software helps analyze data and support real-time decision-making. Palantir’s technology is crucial in optimizing supply chains, detecting financial fraud, and running military operations.

PLTR Total Return Price data by YCharts.

In 2023, the company launched its Artificial Intelligence Platform (AIP)—a platform for launching artificial intelligence (AI) models. The demand for this platform has been tremendous, indicating positive long-term growth prospects. The stock has outperformed the market since its IPO, and this trend could continue with the growing opportunity in AI.

Advanced Micro Devices – The Power Within

Advanced Micro Devices (NASDAQ: AMD) plays a vital role in providing the enormous computing power required for AI. The company recently introduced a new generation of AI chips that it claims can outperform its competitor’s core data center product. AMD’s CEO, Lisa Su, predicts that the AI chip market could reach $400 billion by 2027, positioning the company for significant growth. As technology advances, the demand for more advanced chips continues to grow, providing a compelling case for AMD’s long-term potential in the AI market.

AMD Total Return Price data by YCharts.

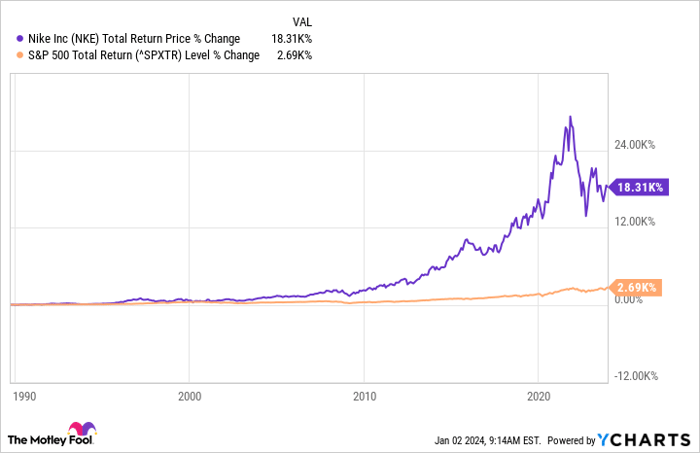

Nike – The Global Icon

Nike (NYSE: NKE) is a well-established sports apparel giant with a strong foothold in global culture. The company’s success in associating its brand with the biggest names in the sports world has led to many years of market-beating growth. With a market cap of $165 billion, achieving blistering returns may be more challenging due to its sheer size. However, Nike has adapted by building a flourishing direct-to-consumer business that allows it to engage directly with customers and expand into emerging markets like India and China—where consumer spending still offers ample room for growth.

NKE Total Return Price data by YCharts.

Shopify – Fueling E-Commerce Growth

Shopify (NYSE: SHOP) is a key player in helping companies worldwide compete with Amazon. The company’s software platform simplifies the process of setting up and running an online store, catering to a wide spectrum of users from individual entrepreneurs to corporations. In Q3 alone, $56 billion in transactions flowed through Shopify, highlighting its significant presence in the e-commerce sector. With just 15% of retail being online in the United States, the growth story of e-commerce is far from over. Shopify is well-positioned to continue riding this wave of e-commerce growth.

SHOP Total Return Price data by YCharts.

Icons of Wall Street: The Longevity of 5 Brands

Walt Disney: Shaping the Future in the Media Realm

Walt Disney, a commanding presence in the world of media, holds sway over a treasure trove of intellectual property, comprising Pixar, Star Wars, Marvel, Disney, ESPN, and more. It has capitalized on this wealth of media by venturing into theme parks, cruise lines, and merchandise that spans the globe. Despite its monumental fame, it surprisingly trails behind the broader market over its lifetime, painting a picture quite contrary to its glamorous facade.

DIS Total Return Price data by YCharts.

The company embarked on a shift towards streaming, launching Disney+ in 2019. This transition brought forth a few tumultuous years as Disney prioritized expanding its streaming subscriber base over raking in profits. However, with over 100 million households subscribing to Disney+, the winds of change may finally be breezing into Disney’s favor. It is difficult to ignore the potential for Disney’s formidable media empire to generate substantial value for its shareholders in the long haul.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies failed to make the cut. Out of the selected 10, each of these stocks has the potential to reap substantial returns in the forthcoming years.

Stock Advisor offers investors a clear roadmap for success, complete with guidance on constructing a strong portfolio, regular updates from analysts, and two fresh stock selections each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 returns by over threefold*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Nike, Nvidia, Palantir Technologies, Shopify, and Walt Disney. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.