We have seen some breathtaking results from the titans – Microsoft MSFT, Meta Platforms META, and Amazon AMZN – cementing their unassailable position at the market’s helm.

These behemoths, joined by their peers in the esteemed ‘Magnificent 7’ cadre of stocks – Apple AAPL, Alphabet GOOGL, Tesla TSLA, and Nvidia NVDA – steered the market to greater heights last year, and this momentum has resolutely continued into the current year.

However, Tesla reported disappointing earnings, this marks the fourth quarter in a row of underperformance. Conversely, the other Mag 7 members, which have released their reports, have showcased remarkable growth figures. The market didn’t shower Alphabet and Apple with praise, yet both companies demonstrated Q4 earnings growth of +51.8% and +13.1%, respectively.

On the other hand, Tesla reported a -45.8% decline in Q3 earnings, with a gentle +3.5% uptick in revenue, struggling with narrowing margins in an escalating competitive EV market.

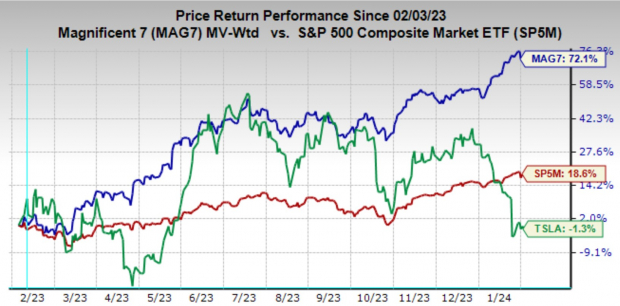

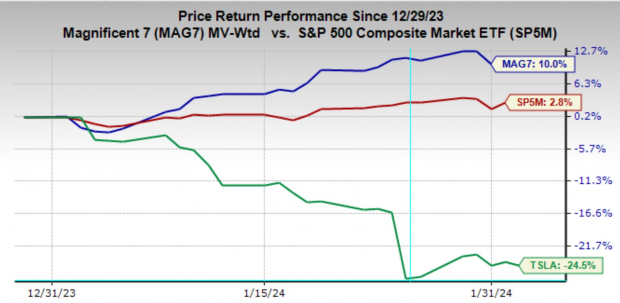

The graphics below highlight the one-year and January 2024 performance of the Magnificent 7 stocks compared to the S&P 500 index and Tesla.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

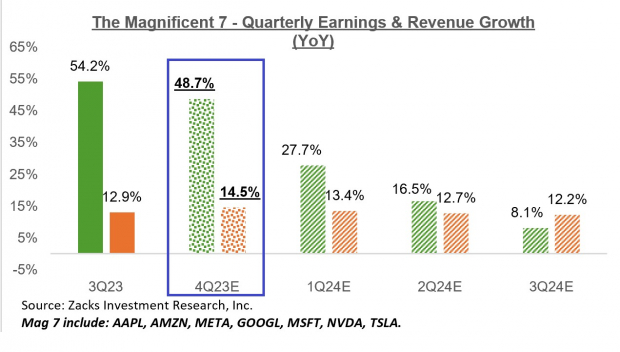

Factoring in estimates for Nvidia, which will announce its December-quarter results on February 21st, and actual results for the other six members of the group, total Q4 earnings for the Mag 7 are anticipated to surge by +48.7% from the same period last year, with revenues spiking by +14.5%.

The chart below illustrates the group’s Q4 earnings and revenue growth, juxtaposed against the preceding quarter and the expectations for the following three quarters.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

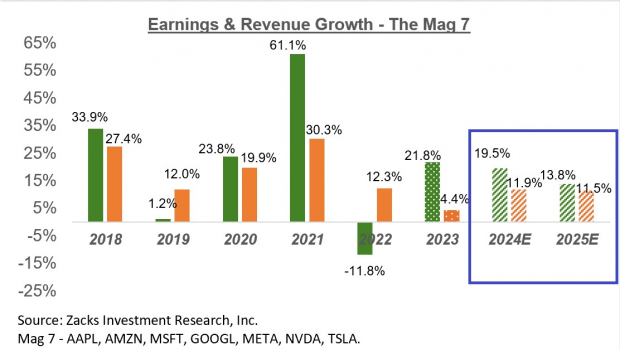

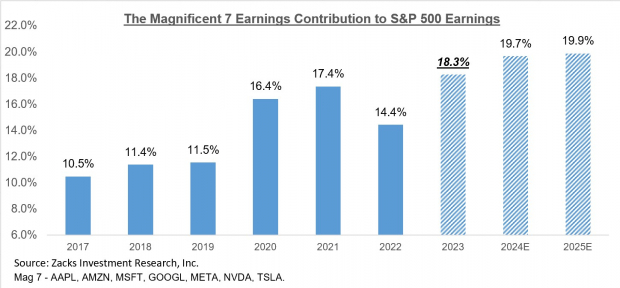

It is important to note that the Mag 7 companies currently command 28.6% of the S&P 500 index’s total market capitalization and are forecasted to contribute 19.5% of the index’s total earnings in 2024. For 2023 Q4, the Mag 7 group held a more sizeable weightage, driving 23.1% of all S&P 500 earnings.

The graphic below showcases the group’s earnings contribution to the index over time and provides the current expectations for the next two years.

Image Source: Zacks Investment Research

Given their substantial earnings prowess and growth potential, it’s challenging to dispute the group’s dominance. Notably, analysts had been increasing their estimates for the group even before the December-quarter results, with these numbers further fueling the positive revision momentum.

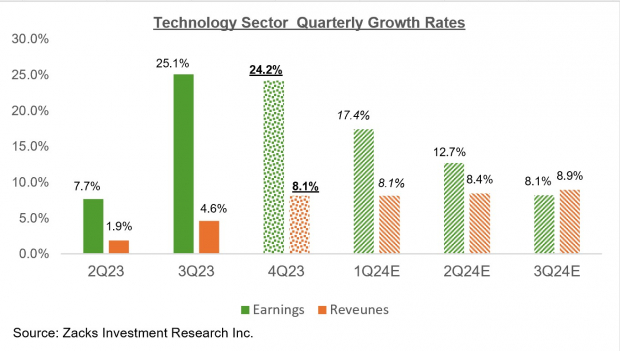

Beyond these mega-cap players, the Technology sector’s overall Q4 earnings are projected to soar by +24.2% from the same period last year, riding on +8.1% higher revenues.

The illustration below presents the sector’s Q4 earnings and revenue growth potential in the context of previous quarters and the upcoming four periods.

Image Source: Zacks Investment Research

The Enormous Earnings Picture

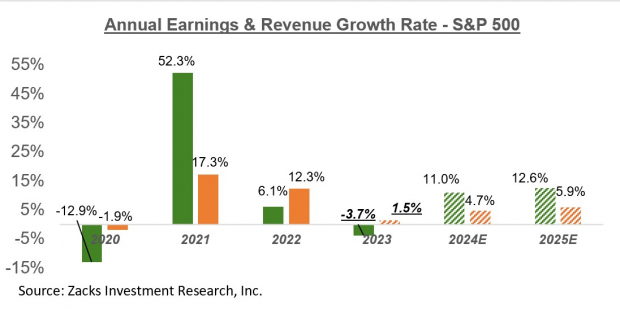

The graphic below showcases the earnings and revenue growth rates achieved in the preceding four quarters and the current earnings and revenue growth projections for the S&P 500 index for 2023 Q4 and the subsequent three quarters.

Image Source: Zacks Investment Research

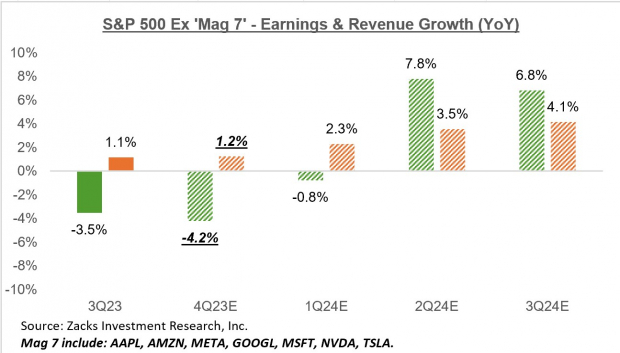

The robust Tech results this week have bolstered the aggregate earnings growth outlook for the S&P 500 index to +4.3% from last week’s +1.1% trajectory. Should the Mag 7 stocks be excluded, Q4 earnings for the rest of the index would plummet by -4.2%, as demonstrated in the chart below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Q4 Earnings Season Scorecard

To date, we have Q4 results from 230 S&P 500 members, representing 46% of the index’s total membership.

This week is poised to witness the release of over 500 company earnings, including 106 S&P 500 members. The lineup for this week includes an impressive array of index bigwigs such as Disney, Elli Lilly, MacDonalds, DuPont, Caterpillar, Ford, Pepsi, Chipotle, Uber, PayPal, Expedia, and many others.

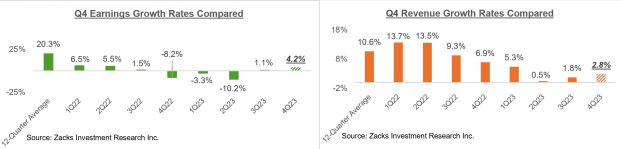

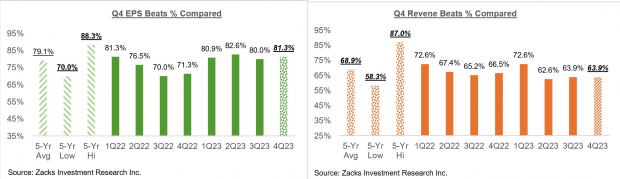

For the 230 index members that have already reported their Q4 earnings, there has been a +4.2% surge from the comparable period the previous year, accompanied by a +2.8% increase in revenues. Notably, 81.3% beat EPS estimates, while 63.9% surpassed revenue estimates.

The comparative illustrations below place the Q4 earnings and revenue growth rates within a historical context, as well as the Q4 EPS and revenue beats percentages.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>

The Resilient Tech Sector: A Beacon of Positive Earnings Growth

Stunning Tech Performance in 2024

It has been a remarkable journey for the tech sector as it continues to flourish amidst the market swings and economic uncertainties. The Q4 earnings have once again proven that the tech companies have not only weathered the storm but have showcased an outstanding growth trajectory. The dire forecasts around the pandemic’s impact on tech have been debunked as top tech giants continue to assert their dominance with staggering numbers. The consistent success of tech leaders has indeed been a bright spot amid the investment landscape.

The Stellar Quartet: Amazon, Apple, Microsoft, and NVIDIA

Among the elites, Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) have been the torchbearers of this remarkable performance. These industry leaders have not just delivered strong earnings, but have set the stage for what can only be described as a phenomenal showing. The outstanding performance of these tech titans serves as a testament to their unwavering resilience and unwavering appeal to investors.

Tesla and Meta: A Force to Reckon With

Furthermore, Tesla (TSLA) and Meta Platforms (META) have been pivotal in their respective niches, presenting robust earnings results that have solidified their positions as key players in the industry. The impressive performance by these companies underscores the investors’ unrelenting confidence in their capacity to innovate and drive higher returns.

Embracing Change and Innovation

Amidst economic turmoil and global unrest, the tech sector has remained dynamic and adaptable, embracing change and innovation as the cornerstones of its success. The ability to pivot swiftly and pivot with agility has been a defining feature of these companies, allowing them to sustain growth even in tumultuous times.

Investor Resonance with Tech Leaders

Investors have continued to resonate with these tech leaders, recognizing their unyielding potential and strategic foresight. The market leadership demonstrated by these companies amid uncertainties reflects their capability to navigate challenges and deliver consistent, robust performance, gaining the admiration of investors in the process.