Investors spent the weekend mulling over the quarterly financials from tech giants Amazon, Apple, and Meta Platforms, each revealing their fiscal performance last Friday. Meta Platforms surprised the market by declaring its debut dividends. All three firms outperformed expectations but let’s delve into Amazon and Apple’s latest performance to determine if now is the time to consider investing in these iconic tech companies.

Amazon’s Strong Q4 Performance

Rounding out its fiscal 2023, Amazon reported Q4 earnings of $1.01 per share, surpassing the Zacks Consensus of $0.81 by 24%. Q4 earnings saw a staggering 380% increase from the comparative quarter, reaching $169.96 billion in sales, a 14% YoY leap. The e-commerce giant’s net income for Q4 was a remarkable $10.6 billion, a sharp rise from the $300 million reported a year ago.

Amazon credited its exceptional Q4 results to a record-breaking holiday season, reflecting 13% and 17% growth in its North America and International segment sales, respectively. While its AWS segment sales were up 13% to $24.2 billion during Q4, it narrowly missed estimates of $24.37 billion.

In FY23, Amazon’s total sales increased by 12% to $574.8 billion, with net income climbing to $30.4 billion from a net loss of -$2.7 billion a year ago. This translated to annual earnings of $2.90 per share, marking a 308% surge from 2022.

Apple’s Robust Q1 Growth

Reporting its fiscal first-quarter results last Friday, Apple’s Q1 earnings of $2.18 per share were up 16% YoY, setting a new record high and surpassing the Zacks Consensus of $2.09 by 4%. The company’s quarterly sales reached $119.57 billion, topping estimates by over 1% and marking a 2% YoY increase. Apple reported a net income of $33.92 billion, representing a 13% surge from the prior year quarter.

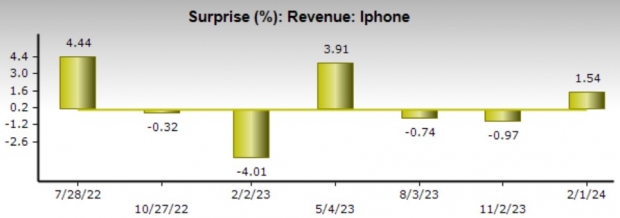

Apple’s Q1 growth was driven by iPhone sales and an all-time revenue record in its Services segment, which includes Apple News, Music, TV, App Store, iCloud, AppleCare, and Apple Pay. While iPhone sales exceeded expectations by 1%, Services sales of $23.11 billion fell slightly short of the consensus of $23.39 billion.

Bottom Line

Following their favorable quarterly results, Amazon’s stock currently holds a Zacks Rank #2 (Buy), while Apple sits at a Zacks Rank #3 (Hold). Positive earnings estimate revisions are expected to continue for Amazon, but investors should be cautious of Apple’s warning of softer iPhone sales during the current quarter, despite the company’s large market presence.