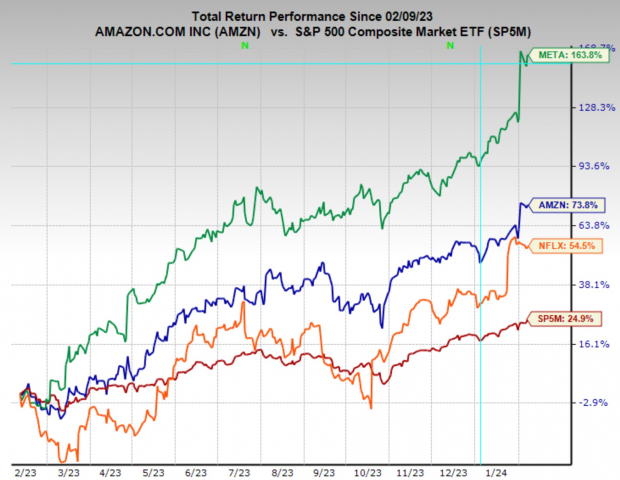

Juggernauts in the tech industry have once again displayed exceptional resilience and profitability, asserting their dominance following the recent earnings season. Among the standout performers, Amazon (AMZN), Meta Platforms (META), and Netflix (NFLX) reported remarkable earnings, experiencing substantial upward momentum in the aftermath of their earnings announcements.

Despite reservations among some investors about entering or expanding positions in large-cap tech stocks after an extended rally, it’s important to remember that a stock’s ascension is not always a ceiling but can often serve as a stepping stone to loftier heights.

Image Source: Zacks Investment Research

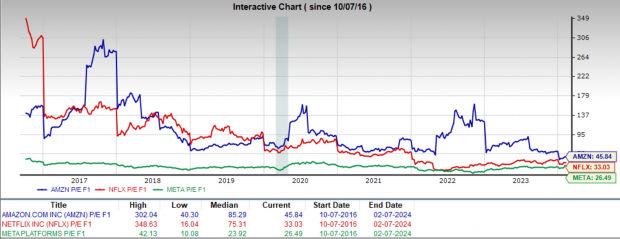

These three titans currently trade at historically fair relative valuations, and following their robust growth, profitability, and earnings estimate upgrades, their valuations appear even more justified.

Image Source: Zacks Investment Research

Netflix’s Ascendancy

Netflix’s recent quarterly earnings exemplified an impressive feat, surpassing both top and bottom-line estimates, and recording record subscriber growth with 261 million paid subscribers, adding 13 million in Q4 alone.

They also announced plans to enrich their content offerings and inked a deal with WWE to stream the Raw wrestling program weekly. With a Zacks Rank #1 (Strong Buy), analysts have consistently raised their earnings estimates across various timeframes, reflecting a high probability trade.

Image Source: TradingView

Meta Platforms’ Fiscal Triumph

Meta Platforms reported a stellar earnings report, outperforming sales and earnings estimates and registering a 25% YoY surge in Q4 sales to $40.1 billion while decreasing expenses by 8% YoY. Additionally, they announced their inaugural dividend payout with a cash reserve of $60 billion and a $50 billion share buyback program.

Amid these achievements, the stock sports a Zacks Rank #1 (Strong Buy), accompanied by unanimous earnings estimate hikes, making it an investment worth considering.

Image Source: TradingView

The Amazonian Momentum

Amazon continues its triumphant march with yet another quarter of surpassing analyst estimates and a burgeoning advertising business. Bolstered by a Zacks Rank #1 (Strong Buy), AMZN stock exhibits a setup akin to post-earnings bull flags, indicating potential breakout levels.

Image Source: TradingView

Zacks Investment Research