For investors, the assessment of brokerage recommendations is a time-honored tradition before making crucial stock decisions. In the case of Jabil (JBL), the verve around Wall Street analyst ratings and, more so, the actual impact of such assessments on stock movements, begs scrutiny.

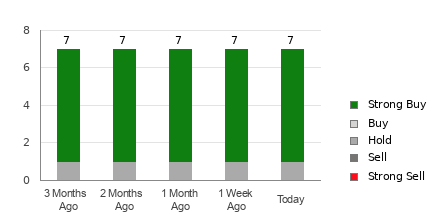

Currently, Jabil boasts an average brokerage recommendation (ABR) of 1.29 on a Strong Buy to Strong Sell scale. This figure results from the aggregated recommendations made by seven brokerage firms, with a majority of six Strong Buy ratings translating to 85.7% of the total count.

Brokerage Recommendation Trends for JBL

The allure behind the ABR for Jabil is evident, yet imperative analysis should temper any decision based solely on this metric. Research demonstrates the questionable effectiveness of brokerage recommendations in identifying stocks with the highest potential for price appreciation, primarily due to the vested interests of these firms, which tend to breed strong positive bias in their analysts’ ratings.

While brokerage endorsements may lack nuance, another tool, the Zacks Rank, spearheads a more holistic approach, leveraging trends in earnings estimate revisions to categorize stocks from Strong Buy to Strong Sell. This model stands as a fruitful complement to validate or contradict brokerage recommendations, thereby informing more profitable investment choices.

Zacks Rank Should Not Be Confused With ABR

Distinguishing between the ABR and Zacks Rank is crucial, despite their numerical semblance. The former clutching decimals, is steered solely by brokerage recommendations. Conversely, Zacks Rank, a quantitative model, hinges on earnings estimate revisions, with whole number displays ranging from 1 to 5. Such delineation underscores the pronounced variance between these measures.

In defiance of brokerage recommendations, perennially steeped in optimism and conflict of interest, the Zacks Rank offers a heartening alternative with its proven correlation between earnings estimate trends and stock price movements. It maintains equitability and relevancy through proportional application to all stocks with current-year earnings estimates provided by brokerage analysts.

Freshness further delineates the ABR from the Zacks Rank, with the latter ensuring timelier reflections of shifting business trends through prompt updates. This sharp contrast underscores the Zacks Rank as a more prescient barometer for future stock performances, imbued with a sense of immediacy that the ABR fails to match.

Should You Invest in JBL?

Contemplating the Zacks Consensus Estimate for Jabil, an unchanged value of $9.11 over the past month denotes analysts’ steadfast confidence in the company’s earnings prospects. This stability translates to a Zacks Rank #3 (Hold) for Jabil, indicative of a tempered yet credible endorsement aligned with market expectations.

Notwithstanding, the Buy-equivalent ABR for Jabil warrants prudent consideration, echoing the prudence found in the Zacks Rank #3 for the stock.

Zacks Names #1 Semiconductor Stock

Embarking on a journey a mere fraction of the size of the behemoth NVIDIA, a semiconductor stock is poised to make substantial strides owing to robust earnings growth and a burgeoning customer base. This pivotal juncture promises formidable growth potential, further fueled by the soaring demands for Artificial Intelligence, Machine Learning, and Internet of Things.

See This Stock Now for Free >>

Jabil, Inc. (JBL) : Free Stock Analysis Report