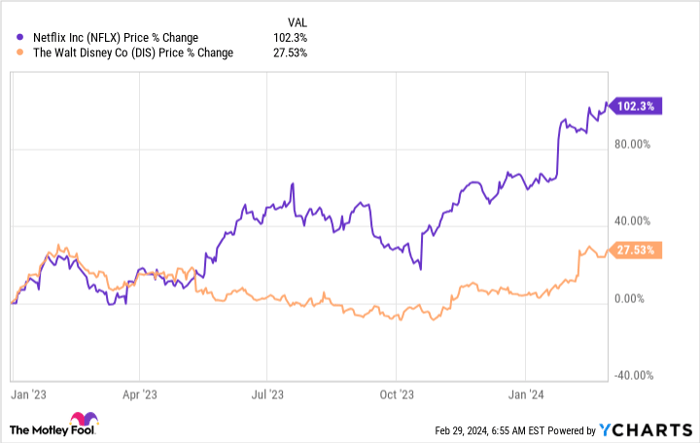

I’ve been skeptical of Netflix (NASDAQ: NFLX) for years, but 2023 was the year I started warming up to the idea of finally buying. For one thing, I needed a few stocks to replace my long-term market-losing position in Walt Disney (NYSE: DIS), which I finally exited after the most recent rally. It’s a late decision that cost me, as Netflix has been the obvious outperformer over the last year-plus since I put Disney on the chopping block.

In fact, much of the traditional media industry is a mess right now, with the exception of Netflix. Here’s what finally pushed me over the edge to pull the trigger on Netflix — even after the stock doubled in the last year.

Data by YCharts.

The Path to Profitability for Netflix

As I’ve explained for years, despite being a Netflix subscriber, I could never bring myself to own a slice of the business itself because of a lack of profitability. Sure, Netflix has been showing GAAP net income for quite some time. But on a free cash flow basis, Netflix was decidedly unprofitable.

But that changed dramatically in 2023. As Netflix has matured, it has become highly profitable by all measures over the last year. Free cash flow is now outpacing GAAP net income.

Data by YCharts.

Undoubtedly, the market has recognized Netflix’s newfound profitability, leading to a significant stock surge, especially since the onset of 2023. Despite trading at a premium of 50 times trailing 12-month earnings or nearly 40 times trailing 12-month free cash flow, many investors perceive it as too late to invest. But is it really?

Embarking on a Profitable Journey

Netflix’s subscriber base continues to soar, transcending international borders with ease, unlike the traditional U.S. TV business. The steadfast investment in a diverse content library has positioned Netflix for success. Total subscribers surged by 13% year over year in Q4 2023, surpassing 260 million.

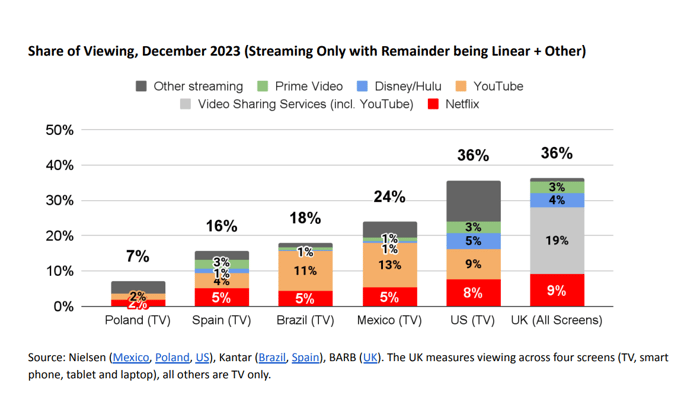

With a mere single-digit percentage share of global screen time, Netflix’s subscription prices are on an upward trajectory. The burgeoning ads business paints a picture of Netflix metamorphosing into something analogous to traditional cable, albeit with the added advantage of personalized content selection. The persistent growth in subscribers underpins Netflix’s ability to maintain a low-teens revenue growth rate in the foreseeable future.

Chart source: Netflix.

Management aims to incrementally boost profit margins. In 2024, the anticipated free cash flow mirrors the $6 billion Netflix generated in 2023. Despite a flat short-term outlook, Netflix remains financially sturdy with ample cash to catalyze its expansion strategies.

Moreover, shareholders are reaping the rewards, with Netflix channeling $6 billion back to them last year through stock repurchases. This, alongside the rich valuation of its stock, presents a promising outlook.

In conclusion, Netflix has undergone a significant transformation, evolving from the depths of a bear market into a realm of robust growth and profitability. The narrative around Netflix has shifted, and I am inclined to augment my investment in Netflix as the year unfolds.

Should you invest $1,000 in Netflix right now?

Before you consider investing in Netflix, bear in mind:

The Motley Fool Stock Advisor analyst team has pinpointed what they deem as the 10 best stocks for investors to capitalize on right now, with Netflix not making the cut. The identified stocks are poised to yield substantial returns in the forthcoming years.

Stock Advisor furnishes investors with a user-friendly roadmap to success, offering insights on constructing a diversified portfolio, regular updates from analysts, and two fresh stock picks per month. Since 2002, the Stock Advisor service has outperformed the S&P 500 return by more than threefold*.

*Stock Advisor returns as of February 26, 2024

Nick Rossolillo and his clients hold positions in Netflix. The Motley Fool also holds positions in and endorses Netflix and Walt Disney. The Motley Fool abides by a disclosure policy.