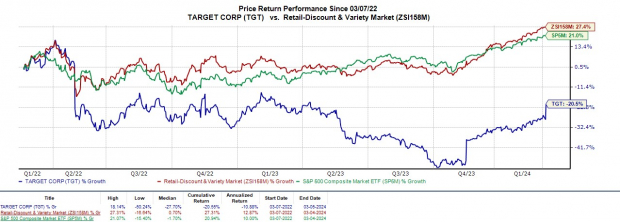

Target grabbed the spotlight in Tuesday’s trading session, witnessing a staggering 12% surge after surpassing fourth-quarter expectations. Despite a 17% year-to-date surge, the retail giant’s stock remains down by 20% over the past two years. However, with CEO Brian Cornell’s promise to reignite the company’s profitability and success, Target’s trajectory is now under fresh scrutiny.

Image Source: Zacks Investment Research

Revived Traffic Trends Fuel Q4 Triumph

Target’s recent success can be attributed to a surge in store traffic, driving its post-earnings rally. Consumer preference, gravitating towards the omni-channel experience, has favored Target over the last few years amid significant inflation. Notably, the company’s same-day services escalated by 13.6% sequentially, signaling a promising shift as in-store pickups, drive-ups, and home deliveries now comprise 10% of Target’s total sales.

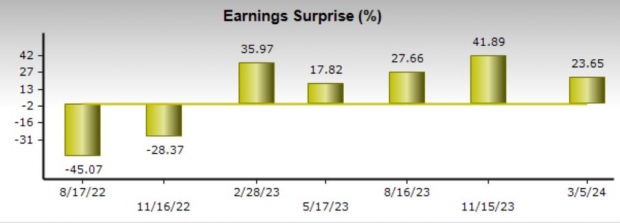

Year-over-year, Target’s fourth-quarter earnings skyrocketed by 57% to $2.98 per share, surpassing the Zacks Consensus estimate by 23%. Accompanying this was a 2% YoY rise in fourth-quarter revenue to $31.91 billion, beating estimates by $31.84 billion. Despite a 1% decline in total revenue to $107.4 billion for fiscal 2024, Target’s annual earnings almost doubled to $8.94 per share.

Image Source: Zacks Investment Research

Bullish EPS Guidance & Prospects

For the upcoming quarter, Target projects an EPS range of $1.70-$2.10, aligned with the existing Zacks Consensus poised at $2.07 per share, reflecting a modest 1% growth. Looking ahead, the company foresees an annual EPS of $8.60-$9.60 for FY25, mirroring Zacks estimates of $9.17 per share, signaling a 9% growth.

Attractive Valuation Metrics

Target’s P/E valuation stands as a sturdy foundation for its recent surge, with TGT shares trading at 16.4X forward earnings – a favorable discount compared to the Zacks Retail-Discount Stores Industry average of 22.4X. Furthermore, Target’s stock shares trade below the S&P 500’s 21.4X and Walmart’s 25.3X, offering a compelling investment proposition for discerning investors.

Image Source: Zacks Investment Research

Final Thoughts

Target’s comeback story is progressively gaining traction, with cash from operations more than doubling in FY24 to a notable $8.6 billion. Noteworthy is Target’s current Zacks Rank of #2 (Buy), foretelling continued outperformance in the short term, surpassing broader market expectations.

Get ready to dive into a treasure trove of investment opportunities with Target’s resurgence in the limelight!