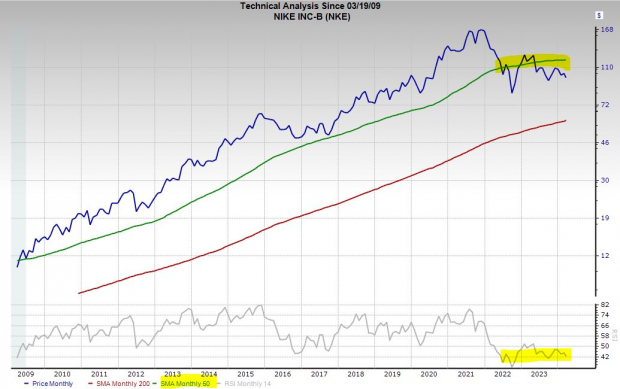

The Downtrend

Nike’s stock is down 45% as it approaches its Q3 FY24 earnings release, facing challenges from competitors like Hoka and On in the running shoe segment and pressures in the athleisure and streetwear markets from brands such as Lululemon, Adidas, and emerging digital players.

Additionally, a broader consumer discretionary selloff, fueled by higher rates and changing post-pandemic consumer behaviors, has impacted Nike’s performance and the sector, with the Zacks Consumer Discretionary sector declining 37% over the last three years.

Wall Street’s concerns over Nike’s digital push and leadership under CEO John Donahoe add to the stock’s challenges, compounded by disappointing guidance, reflecting macroeconomic headwinds.

Short-Term Projections

Nike’s recent initiatives aim to address setbacks by streamlining operations to save up to $2 billion in three years. The upcoming earnings report is expected to show a 13% YoY drop in adjusted quarterly earnings but signal a near-term stabilization.

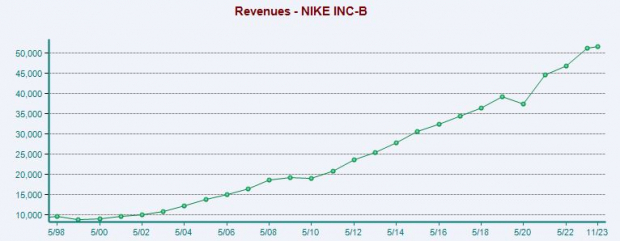

After strong revenue growth in past years, Nike faces a slowdown but projects a 1% revenue climb in FY24 and a 6% jump in FY25, with adjusted earnings expected to increase by 10% and 17% in FY24 and FY25 respectively.

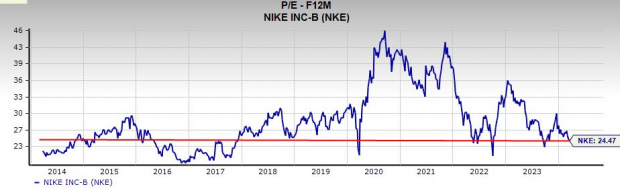

Stock Performance and Valuation

Despite past successes, Nike’s stock has declined from its highs, trading 22% below its average Zacks price target and 45% below all-time highs. The company also lags behind in technical levels and valuation metrics, with a 10% discount to its 10-year median forward earnings ratio.

Final Thoughts

While Nike currently holds a Zacks Rank #3 (Hold) and faces uncertainties in meeting earnings estimates, investors with a long-term perspective may view the stock as a resilient player in the global apparel and footwear market. Although challenges persist, Nike’s history of competitiveness suggests it is not one to fade easily.