Reflecting on the First Quarter

As the saying goes, “time flies when you’re having fun.” For equity bulls, the first quarter of 2024 seemed to whiz by in a blaze of green. Major U.S. indices have sprinted ahead, with the Nasdaq 100 ETF (QQQ) and the S&P 500 Index ETF (SPY) leading the charge with solid gains of around 10% each. Surmounting challenges such as escalating interest rates, regional banking scares, “stagflation” fears, and geopolitical tensions, the bull market persists, scaling the metaphorical “wall of worry.”

Amidst the haste of the present and anticipation of the future to reap profits from the market, wise investors appreciate the value of revisiting the past. The trends of the first quarter of 2024 offer insights that trends tend to extend longer than commonly perceived. Here, we extract three pivotal learnings from Q1 2024:

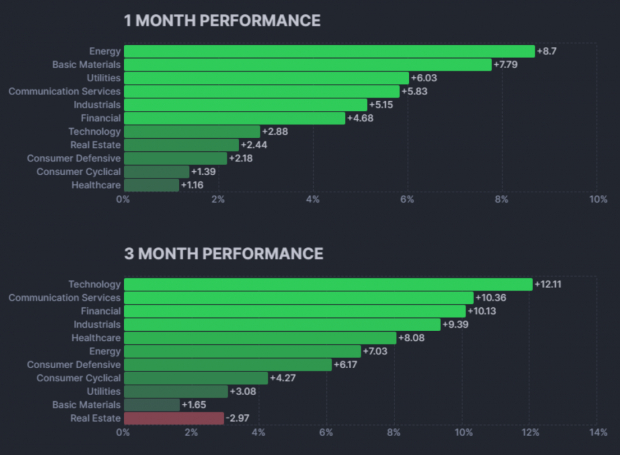

Tech Sector Reigns Supreme, Energy Rebounds

The tech sector maintained its dominance from 2023 into 2024.

Image Source: FinViz

Key takeaways include:

· The tech sector boasted the highest performance across all sectors, securing a 12.11% surge.

· Despite concerns surrounding regional banking and commercial real estate, financials claimed the third top spot in sector performance.

· Real estate languished as the poorest performing sector due to the Federal Reserve’s extended “higher-for-longer” interest rate strategy.

· Sectors branded as “old economy,” like energy and basic materials, initially lagged but roared back in the final month of Q1, leading in performance.

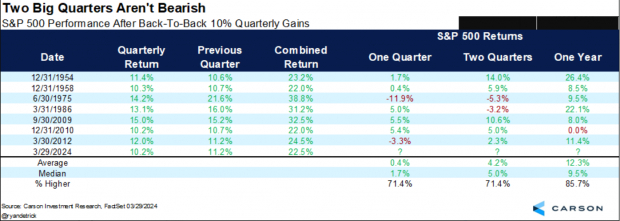

S&P 500 Demonstrates Uncommon Prowess

The S&P 500 Index recorded back-to-back 10% gains, a feat achieved merely eight times since 1950. Contextualizing these remarkable surges, the S&P 500 Index has averaged a 10% gain annually over the last thirty years. The implications for investors in light of such vigor are encouraging. Ryan Detrick of Carson Research delved into the historical data, instilling confidence in the bullish sentiment. A year later, the S&P 500 Index typically boasts a 12.3% gain, with only one instance of decline (less than 1% dip in that singular occurrence).

Image Source: Ryan Detrick, Carson Research

Champions & Underdogs

The AI Revolution exhibited relentless momentum. Super Micro Computer (SMCI) witnessed staggering growth surpassing 200% for the quarter post an early Q1 earnings preview. Stocks linked to crypto, such as MicroStrategy (MSTR) and Coinbase (COIN), surged with the approval of Bitcoin ETFs like the iShares Bitcoin Trust (IBIT).

Tesla (TSLA) plunged nearly 30%, grappling with escalated rates and heightened Chinese competition. Boeing (BA) faltered significantly in the S&P 500 Index as safety concerns jolted investors.

Conclusion

The tenacity witnessed in the first quarter of 2024 amidst a myriad of adversities is commendable. Despite challenges like escalating interest rates and global tensions, the major U.S. indices surged, with technology spearheading the charge.