The Bitcoin halving event is a symphony for cryptocurrency investors, each note echoing implications that resonate with financial harmony. As miners brace for impact and the market gyrates in anticipation, a deeper dive into this orchestrated event unveils essential insights for portfolio navigation.

Delving into the annals of past halvings and dissecting current trends, investors can create a roadmap to weather the impending storm and position themselves adeptly in the cryptocurrency arena.

The Fundamentals of the Bitcoin Halving

At the core of Bitcoin’s soul lies the halving—a scheduled event that slashes the Bitcoin reward granted to miners for block discovery. This ritualistic affair, happening approximately every four years or after unearthing 210,000 blocks, embodies the essence of Bitcoin’s scarcity magic, a spellbinding act that curtails inflationary forces and maintains the currency’s value.

The upcoming halving, slated for around April 20, 2024, will deflate the rewards to 3.125 Bitcoins per block, continuing the age-old tradition that aligns supply dynamics and market equilibrium in a delicate dance.

Navigating the Miner’s Labyrinth

The journey of Bitcoin miners through the halving labyrinth is fraught with uncertainty and volatility. As the mining landscape shifts, driven by hash rate fluctuations and competitive rigmarole, miners are forced to adapt swiftly to survive the turbulent waters.

With the halving event on the horizon, miners are gearing up for the storm, bolstering their arsenals with new machinery and shedding archaic relics. This fervor for efficiency not only sustains operations but also presents an opportunity for investors to reap the rewards of a strategic mining ecosystem.

Unveiling the Veil of Bitcoin Price

Bitcoin’s price narrative is a tale as old as time, painted with fervent peaks and turbulent troughs. As the halving looms large, investors brace for the impending price rollercoaster, a journey fraught with uncertainty and boundless possibilities.

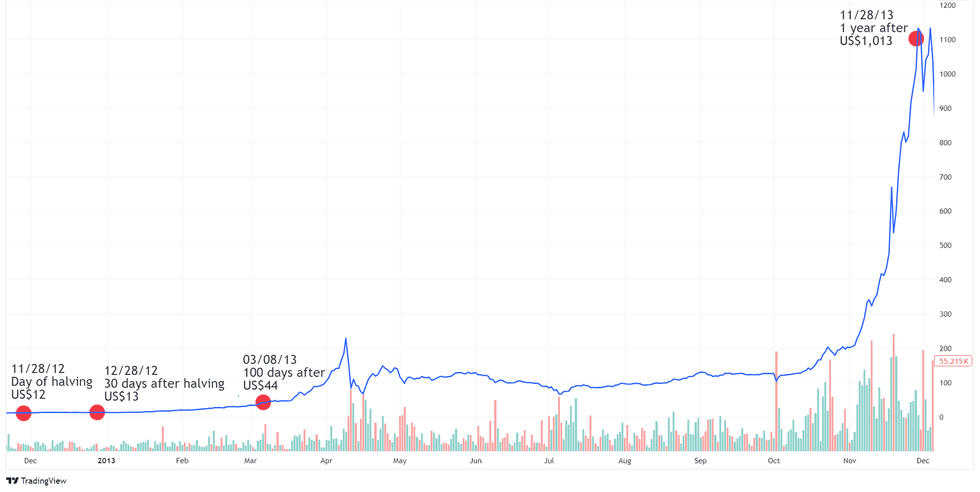

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The Intriguing Saga of Bitcoin’s Evolution: A Closer Look at Halvings, Financial Magnates, and ETF Anticipation

The Ebb and Flow of Bitcoin’s Price: A Reflective Journey

From its humble beginnings, where a single Bitcoin could be snagged for a meager couple of dollars, to the staggering highs of the present day — Bitcoin has endured a rollercoaster journey of price fluctuations and market excitement.

The Rise, Fall, and Surge of Bitcoin: A Historic Perspective

Embarking on its quest for recognition as a viable alternative asset class, Bitcoin weathered the storm of highs and lows following its halving events. Peaks were scaled only to be followed by troughs, with values fluctuating like a pendulum in motion.

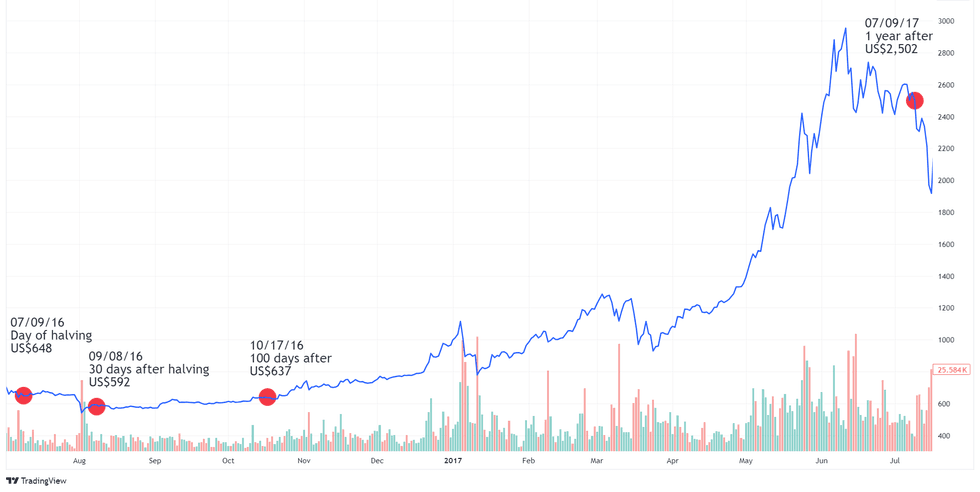

Reflecting on the landmark halving event of July 9, 2016, Bitcoin’s value experienced a resurgence, climbing steadily to reach unprecedented summits surpassing $2,500 by June 3, 2017. The glory was short-lived but left an indelible mark on the landscape of cryptocurrency.

As the tides of time ebbed and flowed, Bitcoin propelled to stratospheric heights, culminating in a record high of $19,783.21 in December 2017, capturing the attention of financial behemoths and solidifying its position in the financial realm.

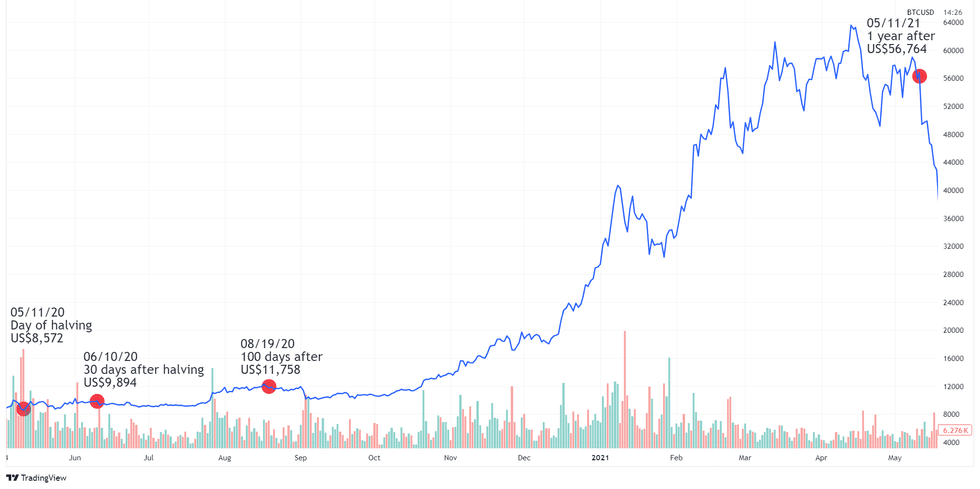

The most recent halving on May 11, 2020, dawned with Bitcoin priced at $7,935.10, marking a pivotal moment in the annals of cryptocurrency history. What ensued was a transformative year for the crypto realm, as a confluence of events drove Bitcoin’s price action, forever altering the landscape of finance.

The Dawn of a New Era: Bitcoin Halving and the Ripple Effect

With the recent surge in market activity fuelled by the approval of spot Bitcoin ETFs, the stage is set for the most highly anticipated halving event in 2024. This pivotal moment has invigorated enthusiasts, heralding a new age of possibilities and financial opportunities.

Spot Bitcoin ETFs have ushered in a new wave of investors, providing a streamlined avenue for price exposure without the complexities of direct Bitcoin ownership. The allure of Bitcoin has transcended traditional boundaries, captivating a broader audience seeking to partake in its meteoric rise.

The latter half of 2023 witnessed a resurgence in the crypto sphere, fuelled by legal victories and the promise of spot Bitcoin ETFs. Institutional investments surged, rekindling faith in the inherent potential of the cryptocurrency market.

As the price of Bitcoin soared to dizzying heights following the approval of Bitcoin ETFs, market dynamics shifted significantly, propelling Bitcoin to unprecedented values not witnessed since its historic highs in 2021. The fervor surrounding the upcoming halving acted as a catalyst, propelling Bitcoin’s price above $69,000 on March 5, igniting a renewed demand for Bitcoin ETFs.

The Bitcoin Halving: A Glimpse into Future Investment

Anticipating the Bitcoin Halving Impact

As the Bitcoin halving approaches, investors are closely monitoring the market dynamics for potential opportunities. Historically, leading up to the halving event, there is a notable decrease in price followed by a significant uptrend post-halving. However, this time around, a unique trend is emerging. The usual sell pressure from miners upgrading their equipment seems to be mitigated by the increasing demand from Exchange-Traded Funds (ETFs), potentially setting the stage for remarkable gains in the coming months.

Insights on Investing Amidst Halving Speculation

Renowned analyst Peter Brandt has raised eyebrows with his bullish prediction of Bitcoin reaching US$200,000 by September, a substantial leap from his prior estimate. With the ease of access to ETFs, retail investors are expected to join the frenzy, driving prices to unprecedented levels before an inevitable correction. While projections vary from US$75,000 to US$150,000 in the next 12 to 18 months, the overarching sentiment remains positive, with a focus on breaking all-time highs and maintaining market optimism.

For investors considering Bitcoin as part of their portfolio diversification strategy, incorporating a modest 3 to 5 percent allocation could prove beneficial. By rebalancing quarterly and leveraging Bitcoin’s volatility, overall portfolio performance can be enhanced. The inclusion of this non-correlated asset can lead to reduced volatility and increased expected returns over time, as highlighted by industry experts.

Regarding portfolio management, a key takeaway is the importance of balancing investment size to manage volatility effectively. Regardless of the asset class, if an investment’s fluctuation keeps an investor awake at night, it might be a sign of an oversized position rather than inherent market volatility. Strategic allocation and regular assessment are vital components of a resilient investment strategy.

Stay updated with real-time news by following us on Twitter @INN_Technology!