Every few months, the financial world experiences a frenzy akin to revealing one’s financial statement to the public. It’s a time when companies disclose their financial performance, offering a glimpse into their inner workings.

Why does this matter so much, you might ask?

This period, known as earnings season, is not only chaotic but also holds immense importance for investors. Let’s delve into three key reasons that underscore its significance.

Earnings Season Provides Invaluable Business Insights

During earnings season, companies provide comprehensive reports detailing their revenues, expenses, and profits. This data offers investors a deeper understanding of the company’s operations, enabling them to spot potential risks or opportunities.

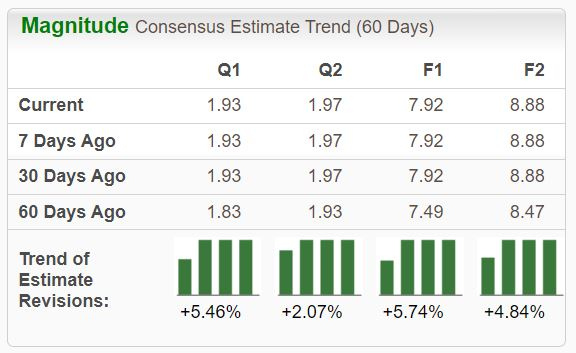

For instance, Arista Networks (ANET) recently raised its revenue growth guidance for the current fiscal year, resulting in a surge in its stock price. This update signifies robust demand for the company’s products, leading to positive investor sentiment.

Image Source: Zacks Investment Research

Impact of Quarterly Reports on Stock Prices

Quarterly earnings reports often trigger significant movements in a company’s stock price. Positive surprises or upward revisions in guidance can lead to bullish trends post-earnings, reflecting a healthy business environment.

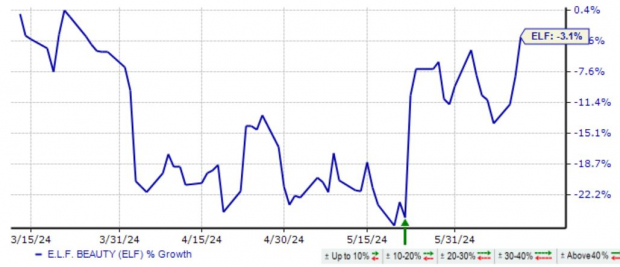

For example, e.l.f. Beauty (ELF) witnessed a substantial increase in its stock price following its latest earnings release. With a 15% growth in earnings and a 71% surge in sales, the market responded favorably to the company’s performance.

Image Source: Zacks Investment Research

Implementing protective measures like stop-loss orders can help investors navigate through the post-earnings volatility and safeguard their investments.

Spotlight on Current Market Trends

Earnings season also serves as a barometer for broader economic trends and industry performance. Strong quarterly results from multiple companies indicate a robust economy and potential market upswing.

Conversely, disappointing earnings across various sectors may signal an economic slowdown, impacting stock markets negatively.

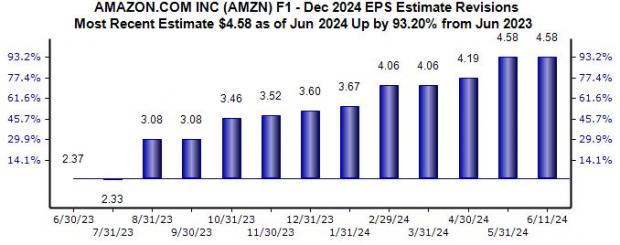

Furthermore, it sheds light on specific industry trends, aiding investors in making informed decisions. Amazon (AMZN), for instance, reported impressive results in its AWS segment, reflecting increasing demand for cloud computing services in the era of artificial intelligence.

Analysts have expressed bullish sentiments for Amazon’s fiscal year, with a significant uptrend in earnings estimates over the past year.

Image Source: Zacks Investment Research

While earnings season may induce a whirlwind of activity, it is a pivotal time for investors to stay informed about financial updates, navigate through market volatility, and grasp industry trends.