Reevaluating AI’s Influence on AMD

Morgan Stanley’s Joseph Moore cautions investors on the perceived promise of the AI chip sector. He believes that while AMD, notably, holds potential, sky-high expectations for its AI business may not align with reality.

A David vs. Goliath Scenario

AMD’s attempt to challenge AI chip giant Nvidia seems to face formidable odds, according to Moore. The forthcoming Blackwell GPU architecture from Nvidia could further widen the gap between the two companies, a factor he deems overlooked by many.

Threatening Clouds Hovering over AMD

Although AMD is seen as a contender to Nvidia, particularly due to its ability to operate in multiple cloud environments, Moore highlights that Nvidia is aggressively defending its market share. Nvidia’s strategies in pricing and product roadmap adjustments pose challenges that AMD must navigate to achieve its aspirations.

The Shifting Landscape for AMD

Moore also notes a shift in AMD’s core business trajectory. While initially poised for growth following a market downturn, AI’s role has evolved from a supporting factor to a primary driver. This shift signals a need for realistic expectations.

Morgan Stanley’s Stance on AMD

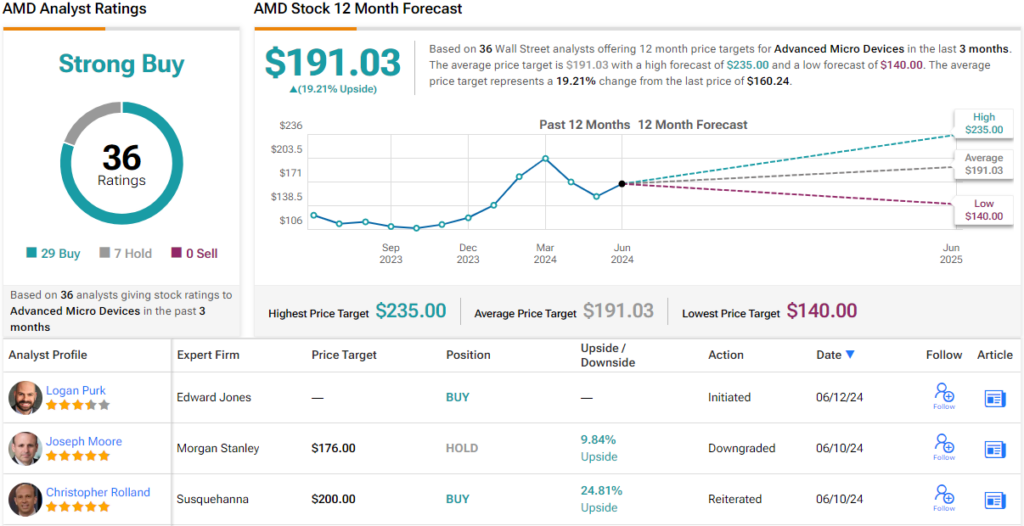

Adjusting his position, Moore downgrades AMD from Buy to Neutral, citing concerns about inflated AI expectations. Despite this, he maintains a price target of $176, leaving room for a 9.5% increase from current levels.

Analysts’ Consensus and Forecast

With a Strong Buy consensus rating based on 29 Buy recommendations, analysts foresee a 19% premium in AMD stock price, reaching an average target of $191.03 within a year.

To explore undervalued stock options, TipRanks’ Best Stocks to Buy tool provides comprehensive equity insights.

Disclaimer: The opinions presented are solely those of the analyst. This content serves informational purposes; please conduct personal analysis before investment decisions.