Artificial intelligence (AI) superstar stock Nvidia (NASDAQ: NVDA) recently made waves by announcing a stock split on May 22 this year. Since then, share prices have surged by a notable 36%. This remarkable success has undoubtedly caught the attention of other AI companies on Wall Street, sparking discussions around potential stock splits as a strategic move in response to the market trends (even though splits are not the sole driver of performance).

It’s crucial to remember that a stock split doesn’t alter the essence of a company or its fundamental values. Rather, it merely divides existing shares into smaller units, leading to a proportional decrease in share prices and financial metrics per share. Companies opt for stock splits for various reasons, such as enhancing share liquidity for employees who receive shares as part of compensation packages or for investors seeking accessible entry points.

Following Nvidia’s stock split completion on June 10, the spotlight now shifts to potential candidates in the AI sector. Three market analysts from Fool.com have singled out Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Super Micro Computer (NASDAQ: SMCI) as prime candidates for upcoming stock splits.

Let’s delve into the underlying reasons behind these speculations.

Microsoft: A Tech Titan Ready for Reshaping

Will Healy (Microsoft): Microsoft’s prominence as a tech juggernaut, which previously held the title of the world’s most valuable company, positions it as a logical contender for a stock split. Despite witnessing substantial stock appreciation in recent years, Microsoft hasn’t undergone a stock split in over two decades. Notably, during the late 1980s and early 2000s, characterized by Microsoft’s dominance in the PC operating system realm, the company split its stock nine times.

However, subsequent to the Dot-Com crash and the emergence of Apple with its groundbreaking iPhone in 2007, Microsoft faced market challenges, resulting in a 37% stock value decline between 2000 and 2014 under Steve Ballmer’s leadership.

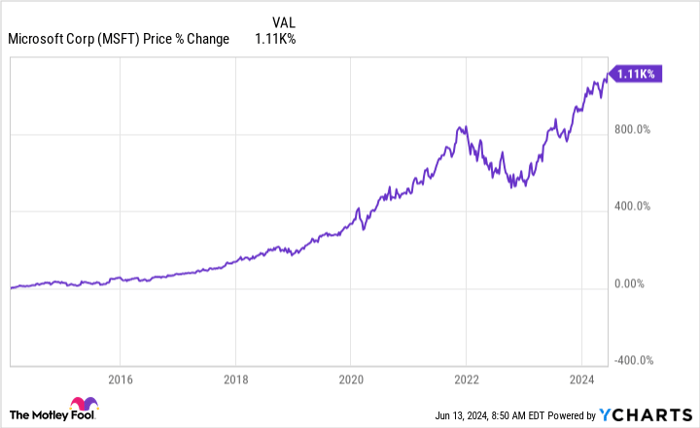

Significant turnaround transpired when Satya Nadella assumed the CEO role in 2014, reshaping Microsoft as a cloud and AI frontrunner. Over Nadella’s decade-long tenure, Microsoft’s stock skyrocketed by over 1,110%, soaring to $440 per share presently.

The notable stock growth accentuates the necessity for a split, especially with robust fiscal performance backing the case. Microsoft’s net income surged by 26% year-over-year in the initial three quarters of fiscal 2024, while projections for the remainder of the fiscal year indicate double-digit revenue growth.

Furthermore, Microsoft’s inclusion in the price-weighted Dow Jones Industrial Average raises the stakes, compelling the company to consider a split to prevent exerting undue influence on the index’s dynamics. Therefore, the longstanding 21-year stock split hiatus appears ripe for closure.

Meta Platforms: Embracing Evolution with a First-Ever Split

Jake Lerch (Meta Platforms): The year 2024 unfolds as a prosperous period for the “Magnificent Seven” stocks, with six out of seven showcasing impressive double-digit gains year-to-date, barring Tesla. Noteworthy among these performers is Meta Platforms, which stands out as the sole member yet to partake in stock splits. The time seems ripe for Meta’s inaugural split, driven by compelling factors.

Primarily, Meta’s stock carries a hefty price tag, hovering around $504 per share, placing it beyond the reach of many retail investors. Opting for a 3-for-1 or 5-for-1 split could significantly slash share prices, democratizing ownership by making the stock more accessible to retail investors unable to transact in fractional shares, potentially driving prices down to a more approachable $100 to $175 range.

Recent insights from Bank of America emphasize another pivotal reason for Meta to initiate a split: enhanced market outperformance. Analyses on historical stock splits highlight that companies often witness advantageous trading outcomes following such strategic maneuvers.

The Power of Stock Splits in Tech Companies

In the annals of market history, the notion of stocks splitting has been a beacon for investors seeking favorable returns. A seminal study in 1980 unveiled a captivating trend: post-split, stocks tend to outperform the S&P 500 over the next 12 months, an effect observed consistently across four decades.

The Meta Platforms Conundrum: To Split or Not to Split

Amidst this backdrop, Meta Platforms stands as an intriguing case study. Despite the allure of a potential stock split rallying shareholders, Meta’s leadership remains steadfast against such maneuvers. Unlike tech behemoths like Adobe and Microsoft, which embraced multiple stock splits in their formative years, Meta has abstained from such actions during its 12-year public tenure.

Nonetheless, the astute investor would do well to monitor Meta’s trajectory closely. With a formidable presence in the digital advertising domain, the company continues to emerge as a stalwart performer in the tech stock universe. Notably, with Q1 revenues escalating by 27% year-over-year and profits skyrocketing by 127%, Meta exhibits robust fundamentals that render it an enticing long-term investment prospect.

A Potential Renaissance: The Case for Super Micro Computer

Enter Super Micro Computer, a stalwart in the provision of modular server systems tailored for data centers. While overshadowed by Nvidia in recent market memory, Super Micro Computer—or Supermicro, in colloquial parlance—holds the promise of a resurgence, potentially fueled by a strategic stock split.

Market data indicates a sharp uptick in Supermicro’s revenue growth, surging by 200% annually, a testament to its alignment with the AI zeitgeist. Projections from industry experts suggest that the sustained data center fervor, propelled by AI initiatives, could catalyze a twofold surge in Supermicro’s revenues, catapulting it to potentially over $23 billion by the coming year’s midpoint.

Analysts further reinforce this positive outlook, envisioning a robust 52% annual uptick in earnings per share over the subsequent three to five years. Such auspicious forecasts affirm the enduring allure of AI advancements and Supermicro’s inherent value proposition, heralding an upward trajectory for the company’s shares and, by extension, investor portfolios.

So, why the clarion call for a stock split?

Despite its meteoric ascent of over 9,400% since its IPO, Super Micro Computer remains reticent on stock splits. Nevertheless, with shares trading at a premium over $800 apiece, liquidity constraints may impede ease of transaction for investors, necessitating a recalibration through a stock split. Not only does this tactical maneuver enhance share accessibility, but it also echoes the potential for renewed market interest, providing a dual benefit proposition for stakeholders.

Unraveling Microsoft: A Testament to Strategic Investment

As the investment landscape unfolds, Microsoft stands as a beacon of strategic decision-making, emblematic of prudent investment choices. While recent exuberance around the tech titan may have overshadowed it in certain circles, Microsoft’s legacy of consistent performance underscores its enduring value proposition.

The discerning investor would be wise to heed the counsel of investment experts, who pinpoint the ten best stocks contemporaneously evocative of prodigious returns. While Microsoft may not feature prominently on this list, a historical perspective reveals that astute investments in industry juggernauts can yield remarkable returns, as exemplified by Nvidia’s transformational journey.

As investors navigate this realm, the Motley Fool Stock Advisor offers a compass for navigating the complexities of the market, replete with insights, updates, and proprietary stock picks. This service has significantly outpaced the S&P 500 since its inception, a testament to the potential for savvy stock selections to augur substantial financial gains.

*Stock Advisor returns as of June 10, 2024