Wall Street analysts are like lighthouses guiding investors through turbulent financial waters. Their recommendations can set the course for stock purchases, but are these beacons always reliable?

Before delving into the world of brokerage advice, let’s take a peek at what the financial experts are saying about Duke Energy.

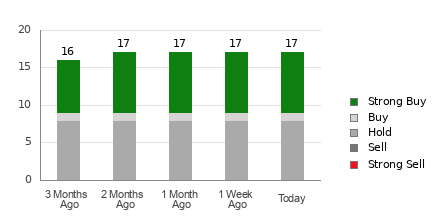

Currently, Duke Energy boasts an average brokerage recommendation (ABR) of 2.00 from 17 brokerage firms. This places it in the “Buy” zone on a scale of 1 to 5, where Strong Buy and Buy recommendations constitute nearly 53% of all analyst opinions.

Tracking Broker Recommendations for Duke Energy

While the herd suggests buying Duke Energy, relying solely on this guidance may not be the wisest choice. Research indicates that brokerage agencies, with their vested interests, tend to skew ratings positively. For every “Strong Sell” rating, five “Strong Buy” ratings are ladled out, reflecting the analysts’ proclivity for optimism.

Investors seeking a steady hand in the stormy seas of stock trading might turn to Zacks Rank, a time-tested tool that classifies stocks based on their performance potential.

Decoding the ABR vs. Zacks Rank Conundrum

Although ABR and Zacks Rank both sport a 1-5 range, they are as distinct as sushi and a hotdog stand.

ABR hinges solely on brokerage recommendations, reflected in decimal points (like 1.28), while Zacks Rank uses earnings estimates to rank stocks from 1 to 5.

Brokers often dish out sunshiny ratings, while Zacks Rank stays grounded on earnings projections. Studies link the Rank’s revisions to imminent stock price shifts—a stark contrast to the brokerage ratings’ reliability.

Moreover, Zacks Rank keeps its algorithms fresh, adapting quickly to earnings estimate revisions. This nimbleness contrasts the ABR’s potential staleness, as it relies on static brokerage opinions.

Is Duke Energy Stock Worth the Gamble?

Duke Energy’s future may not gleam as brightly as its past. The Zacks Consensus Estimate for the current year has waned by 0.1% in the last month to $5.97. This, coupled with broader negative sentiment among analysts, has etched a Zacks Rank #4 (Sell) for the energy giant.

Given this trend, investors might want to take the Buy-suggestive ABR for Duke Energy with a pinch of skepticism.

Zacks’ Top 3 Hydrogen Stocks

Demand for hydrogen energy is set to skyrocket. Zacks has its sights on three leading companies poised to dominate this sector, each with a unique story of success.

One has outperformed the market by leaps and bounds, another has substantial commitments to low-carbon hydrogen, and a third has maintained a decade-long streak of increasing dividends.