Beta, the metric used to gauge a stock’s volatility in relation to the broader market, is a powerful tool for investors seeking steadier waters for their investments. As a rule of thumb, the market registers a beta of 1.0. Any beta score above 1.0 signifies heightened volatility compared to the market at large, while a beta below 1.0 implies the opposite – a more stable investment option. Low-beta stocks, with their tranquil waters, not only bring about serenity but also offer a shield against market storms, making them a valuable addition to any investor’s arsenal.

These low-beta stocks not only provide a sanctuary from the market’s tempest but also weave in their unique fabric of benefits to investors, acting as a lighthouse in the sea of financial uncertainty.

Consider the trio of low-beta gems: Interactive Brokers (IBKR), Elevance Health (ELV), and Consolidated Edison (ED). These stalwarts are not only pillars of stability but also flaunt a favorable Zacks Rank, a testament to the optimism that echoes among analysts in the financial landscape.

Elevance Health Exceeds Expectations with Earnings Prowess

Elevance Health sets sail as a beacon in the healthcare sector, championing health benefits for consumers, families, and communities on the voyage towards a healthier life. Garnering a favorable Zacks Rank #2 (Buy), Elevance Health has been making waves in the financial waters, riding high on earnings growth, a trend that has left investors buoyant. The latest quarterly performance affirmed this delight, with Elevance surpassing Zacks Consensus EPS estimates by a noteworthy 1%, despite sales modestly falling short of initial expectations.

Earnings marked an impressive 12.5% year-over-year growth, while sales saw a modest 1% uptick. This trajectory of success is vividly depicted in the following revenue chart.

Image Source: Zacks Investment Research

Interactive Brokers: The Unwavering Trailblazer

Interactive Brokers Group stands tall as a global electronic market maker and broker, a pioneer in its domain. Analysts have showered the stock with positive revisions across various spectrums, steering the vessel towards a favorable Zacks Rank #2 (Buy).

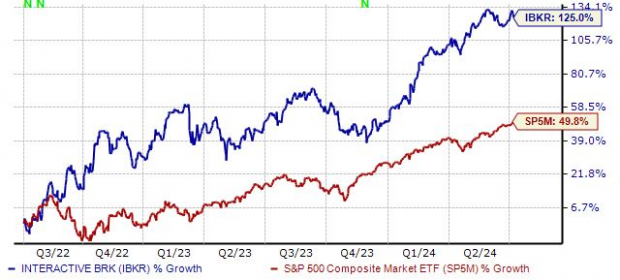

Notably, the stock emerges as a juggernaut over the past couple of years, leaving a remarkable trail of success in its wake by adding an impressive 125% in value – eclipsing the S&P 500’s 50% gain. The surge in trading activity has been a windfall for the company in recent times.

Image Source: Zacks Investment Research

Consolidated Edison: A Long-Standing Beacon of Empowerment

Consolidated Edison, a bastion in the utility sector, holds a Zacks Rank #2 (Buy), exemplifying its prowess as a diversified utility holding company with a blend of regulated and unregulated business ventures. Earnings have long been a forte for Consolidated Edison, consistently surpassing Zacks Consensus EPS estimates by an average of 6% across the last four cycles.

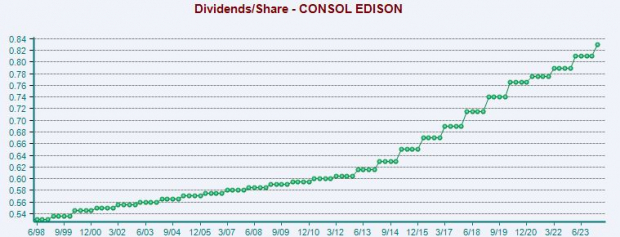

Income-oriented investors are drawn to ED shares, offering a solid 3.8% annual yield. The company’s commitment to dividend growth is evident, with a modest 2% five-year annualized dividend growth rate. Shareholders have reveled in the company’s generosity for years, as illustrated below.

Image Source: Zacks Investment Research

Embrace Stability: The Final Verdict

Low-beta stocks are not just a shield against market volatility, they also anchor a portfolio, enhancing its resilience. These low-beta luminaries offer investors a steadying hand amidst the stormy seas of financial markets, ensuring a more balanced and robust investment profile. For those seeking a conservative path in the investment landscape, look no further than the trio of low-beta gems: Interactive Brokers (IBKR), Elevance Health (ELV), and Consolidated Edison (ED). With favorable Zacks Ranks accentuating their appeal, these stocks stand as steadfast sentinels in the tempestuous world of finance.