Market Expectations

Observers eagerly await earnings reports from the two stalwarts of ‘the Magnificent 7’ this week, hoping for a reversal in the recent market downturn. The waning market sentiment can be attributed to uncertainties surrounding regulatory policies post recent elections. Coupled with seasonally sluggish trends, caution is advised in interpreting the Mag 7 stocks’ recent performances, given their stellar trajectory thus far.

Quarterly Performance

Chart tracking the Mag 7 stocks since July reveals Tesla’s exceptional rise, with Microsoft and Alphabet closely trailing. Shifting the starting point to the beginning of 2024 Q4, the stock hierarchy presents a stark contrast, showcasing the fickle nature of market dynamics.

Upcoming Reports and Estimates

Anticipation surrounds Alphabet and Tesla’s Q2 results, with unchanged Zacks Consensus estimates for both. Growth forecasts hint at promising figures, with the market often responding more to qualitative aspects than mere EPS surprises.

Future Projections for the “Magnificent 7”

Analysis predicts an uptick in earnings and revenues for the Mag 7 cohort, signaling a return to regular growth patterns following temporary demand surges. Such projections anchor the market’s expectations and trajectories.

Broader Technology Sector Outlook

Technology sector earnings are slated for a notable increase, with past trends and future forecasts painting a picture of sustained growth. The echoes of past demand fluctuations resonate in projections for consistent expansion.

Historical Context and Market Sentiment

The Tech sector’s resilience post-pulled revenues underscores a positive revisions trend, with Mag 7 stocks setting the pace for heightened earnings estimates. Market sentiments ride high on the anticipated growth trajectories.

Key Insights and Earnings Landscape

The ongoing Q2 reporting cycle showcases strong results from S&P 500 members, hinting at positive earnings and revenue trends. With an extensive line-up for the week, including industry giants across sectors, market dynamics are poised for intriguing shifts.

The Earnings Ascendancy: S&P 500 Shows Resilience and Growth

Unprecedented Growth in Sight

Achieving a remarkable feat, the S&P 500 is set to witness a substantial +9% surge in earnings compared to the same period last year, accompanied by a robust +4.8% increase in revenues. This upswing is slated to mark the most accelerated quarterly growth pace since the +10% earnings spike in the initial quarter of 2022.

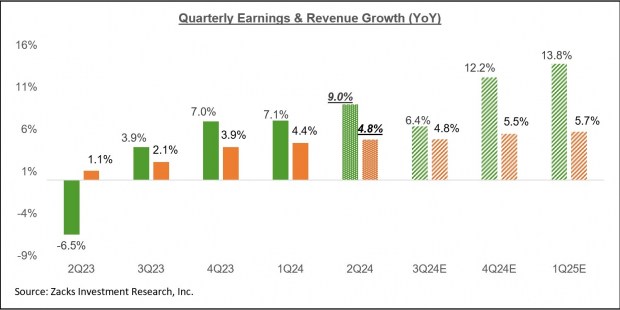

Charting the Course: A Comprehensive View

The visual representation below delineates the year-over-year earnings and revenue growth for the second quarter of 2024 against the backdrop of the preceding four periods and the forthcoming three periods.

Image Source: Zacks Investment Research

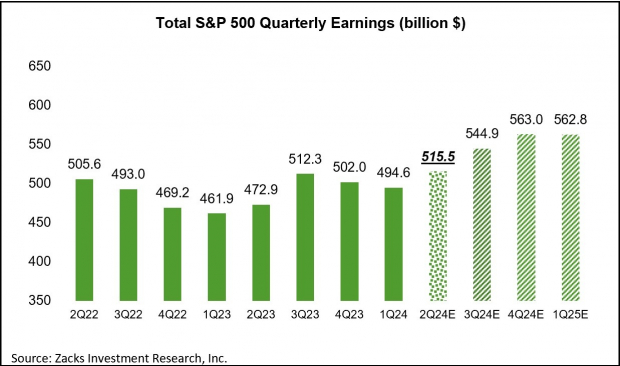

Records Shattered: New Heights in Earnings

The aggregate earnings of the S&P 500 for Q2, amounting to $515.5 billion, surpass the earnings of $512.3 billion recorded in the third quarter of 2023. This remarkable performance underlines the index’s resilience and upward trajectory.

Image Source: Zacks Investment Research

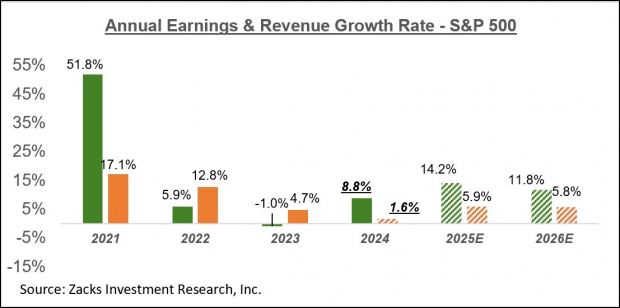

Looking Ahead: Growth Projections

Long-term projections indicate that the total 2024 S&P 500 earnings are expected to surge by +8.8% amidst a +1.6% growth in revenue. Moreover, excluding the Finance sector from the equation improves the projected revenue growth to +3.9%, with the index’s aggregate earnings growth for the year declining marginally to +8.7% on an ex-Finance basis.

Image Source: Zacks Investment Research

Closing Thoughts

In conclusion, the S&P 500’s robust earnings growth trajectory, coupled with resilient revenue projections, paints a positive outlook for investors. The index’s stellar performance not only reflects its resilience but also underscores its potential for sustained growth in the foreseeable future. Amidst economic uncertainties, the S&P 500 shines as a beacon of stability and prosperity in the financial landscape.