The Tumultuous Terrain of US Home Sales

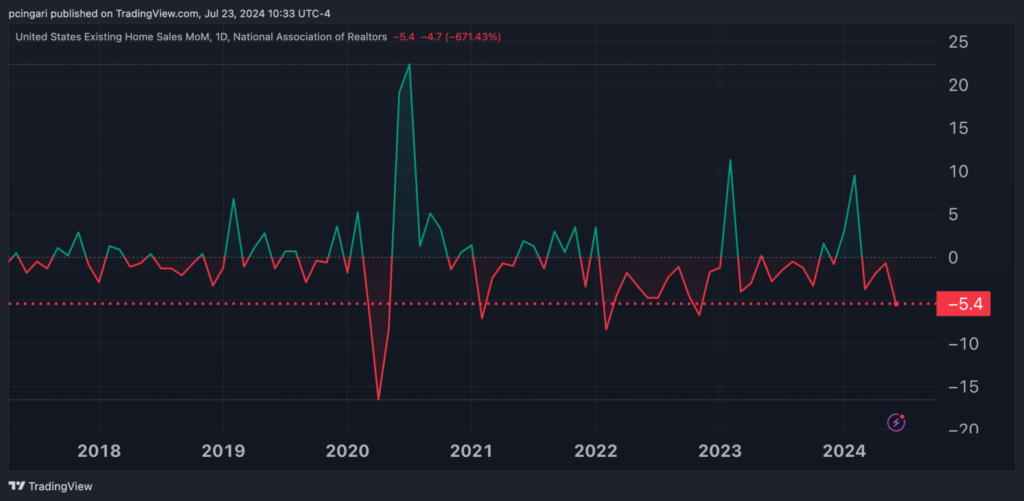

A staggering descent was witnessed in existing home sales in the United States during June 2024, plummeting by 5.4% from the previous month – a steep nosedive not encountered since November 2022. This regression is ascribed to mounting buyer unease, with the median sales price soaring to an unprecedented high for the second consecutive month.

June 2024 saw a total of 3.89 million units sold, a stark decline from May’s 4.11 million, according to data divulged by the National Association of Realtors (NAR) on Tuesday. Year-over-year, sales also experienced a 5.4% reduction.

The median for existing-home prices across all housing types in June stood at a record $426,900, showcasing a 4.1% surge from $410,100 a year prior.

The overall housing inventory by the close of June stood at 1.32 million units, exhibiting a 3.1% increase from May and a substantial 23.4% surge from the previous year (1.07 million). Unsold inventory now holds a 4.1-month supply at the current pace of sales, up from 3.7 months in May and 3.1 months in June 2023.

Chief economist of NAR, Lawrence Yun, remarked, “We’re observing a gradual transition from a seller’s market to a buyer’s market.” He added, “Properties are lingering on the market for extended durations, fetching fewer offers. A surge in demands for home inspections and appraisals is noted, paralleled by a definitive nationwide escalation in inventory.”

Graphical Accountability of Home Sales Downturn in June

Performance Scale Across Regions

All four regions within the U.S. observed a simultaneous dip in sales accompanied by a hike in prices.

- In the Midwest, existing-home sales recorded an 8% decline from the previous month, settling at an annual rate of 920,000 in June, marking a 6.1% drop from the prior year. The median price in the Midwest climbed to $327,100, reflecting a 5.5% increase from June 2023.

- Down South, existing-home sales dwindled by 5.9% from May, aligning to an annual rate of 1.76 million in June, down 6.9% from a year earlier. The median price within the South was $373,000, depicting a 1.7% escalation from the previous year.

- Conversely, existing-home sales in the West experienced a 2.6% retreat in June, pegging the annual rate at 740,000, a similar figure to the preceding year. The median price in the West rose to $629,800, marking a 3.5% increase from June 2023.

- In the Northeast, existing-home sales saw a 2.1% decrease from May, clocking an annual rate of 470,000 in June – a 6% fall from June 2023. The median price within the Northeast spiked to $521,500, witnessing a substantial 9.7% upswing from the previous year.

Buyer Trends and Interest Rates on Mortgages

Typically, properties remained listed for 22 days in June, dwindling from 24 days in May yet escalating from 18 days in June 2023, as per the monthly Realtors Confidence Index.

First-time buyers constituted 29% of sales in June, a decline from 31% in May but an uptick from 27% in June 2023. NAR’s 2023 Profile of Home Buyers and Sellers – unveiled in November 2023 – disclosed that first-time buyers comprised 32% annually.

Freddie Mac recorded the 30-year fixed-rate mortgage averaging at 6.77% as of July 18, dropped from 6.89% a week prior and 6.78% a year ago.

All-cash transactions represented 28% of sales in June, unchanged from May and up from 26% the previous year. Individual investors or second home buyers, constituting a substantial fraction of cash sales, procured 16% of homes in June, mirroring May but down from 18% in June 2023.

Distressed sales – comprising foreclosures and short sales – were responsible for 2% of sales in June, a status unchanged from the previous month and year.

Market Dynamics and Oscillations

Stocks in the real estate segment, tracked by the Vanguard Real Estate ETF VNQ gained 0.4% on Tuesday, trending towards closing at the highest echelon since February 2023.

Leading the sector in performance were Opendoor Technologies Inc. OPEN, Compass, Inc. COMP, and eXp World Holdings, Inc. EXPI, each registering gains between 3% and 3.5%.

Contrarily, NexPoint Diversified Real Estate Trust NXDT, Office Properties Income Trust OPI, and Alexandria Real Estate Equities, Inc. ARE experienced declines of 3.5%, 2.9%, and 2.6%, respectively.