Investors eyeing pivotal moments in the communication services sector may perceive enticing prospects amidst oversold stocks that provide an entry point into undervalued entities.

Utilizing the Relative Strength Index (RSI) to evaluate market momentum, traders gauge a stock’s strength on upward versus downward price days, offering insight into potential short-term performance indicators. A stock with an RSI below 30 signals an oversold status, as per industry standards.

Here’s a snapshot of the top contenders exhibiting an RSI near or under the pivotal 30 mark:

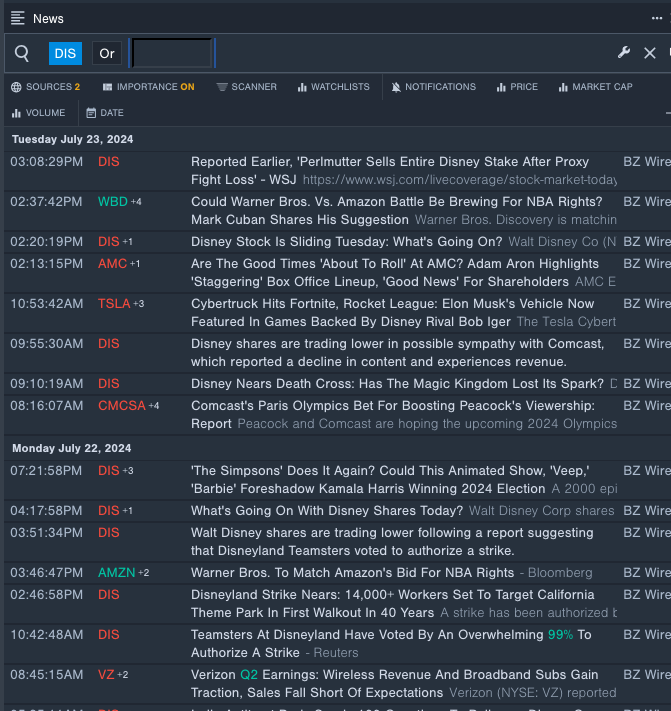

Disney – Opportunities Amidst Obstacles

- Concerns surrounding an $8.5 billion merger between Disney’s media assets and Reliance Industries triggered skepticism from India’s antitrust entity on July 22, leading Disney’s stock to plummet by approximately 11% in the past month, hitting a 52-week low of $78.73.

- RSI Value: 20.76

- DIS Price Action: Disney’s share price dipped by 3.4% to $90.94 during Tuesday’s trading session, accentuating the challenges facing the entertainment conglomerate.

- Real-time insights from Benzinga Pro served as a beacon amidst the tempestuous market environment for Disney.

iQIYI Inc – ADR – Navigating Troubled Waters

- Amidst a downgrade from HSBC analyst Charlene Liu on July 23, iQIYI faced additional pressure as its stock plummeted by approximately 15% over the previous five days, hitting a 52-week low of $3.06.

- RSI Value: 26.29

- IQ Price Action: iQIYI shares dived by 6.5% to $3.16, underscoring the challenges encountered by the online entertainment platform.

- Benzinga Pro’s analytical prowess illuminated the dim prospects surrounding iQIYI’s financial health.

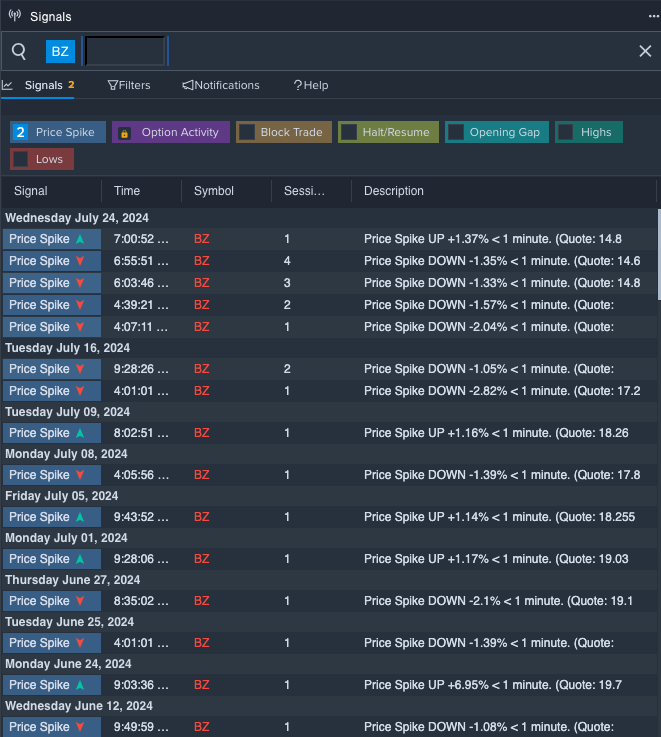

Kanzhun Ltd – Weathering the Storm

- Despite experiencing a 22% decline in its stock value over the past month, Kanzhun found solace in upbeat quarterly results announced on May 21 by Mr. Jonathan Peng Zhao, the company’s Chairman and CEO, signaling positive growth in user metrics and paid enterprise clientele.

- RSI Value: 24.19

- BZ Price Action: Kanzhun shares experienced a modest 0.8% downturn to close at $15.93, reflecting the resilience displayed by the talent acquisition platform.

- Benzinga Pro’s perceptive signals indicated potential for a market upturn amidst Kanzhun’s fluctuating share value.

Read Next: