Homebuilder stocks reached new heights on Friday, as a surge in inflation report led to speculations of upcoming interest rate cuts in September.

The Personal Consumption Expenditure (PCE) price index, a key inflation measure for the Fed, dropped from 2.6% to 2.5% in June 2024, aligning with market expectations.

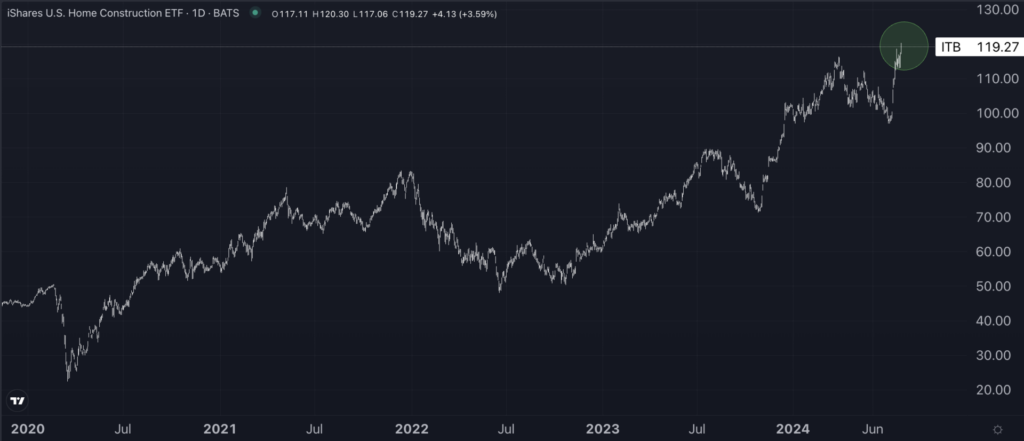

The iShares U.S. Home Construction ETF (ITB), reflecting U.S. homebuilder equities, leaped 3.8%, capping a third week of consecutive gains.

Graphic: U.S. Home Construction ETF Hits All-Time Highs

During the past three weeks, U.S. homebuilder stocks sprinted over 20%, fueled by expectations of lower interest rates poised to benefit sectors like home construction.

With the market now fully anticipating a Federal Reserve rate cut in September and the possibility of further reductions by year-end, the outlook for homebuilders appears optimistic.

“Homebuilders are currently trading at historically high valuation levels, supported by improved return-on-equity (ROE). Our projections indicate an average 22% ROE, well above the 2019 level of 20%,” noted Bank of America analyst Rafe Jadrosich in a recent report.

Bank of America underscored that previous instances of similar valuation levels in 2018 and 2021 triggered sharp declines as the Fed raised rates. However, the current landscape in the latter half of 2024 signals a different scenario, with rate cuts expected from the Fed.

On Friday, Bank of America elevated Mohawk Industries, Inc. (MHK) from Underperform to Buy, raising their price target from $120 to $177 post better-than-expected Q2 2024 earnings.

Top-Performing Homebuilder Stocks in July 2024

The standout performers in the U.S. Home Construction ETF this July include:

| Name | Price Chg. % (MTD) |

| Mohawk Industries, Inc. | 37.16% |

| M/l Homes, Inc. MHO | 35.92% |

| Green Brick Partners, Inc. GRBK | 31.50% |

| American Woodmark Corporation AMWD | 28.44% |

| Dream Finders Homes, Inc. DFH | 27.42% |

| JELD-WEN Holding, Inc. JELD | 26.80% |

| Installed Building Products, Inc. IBP | 26.65% |

| D.R. Horton, Inc. DHI | 26.29% |

| Tri Pointe Homes, Inc. TPH | 26.26% |

| Century Communities, Inc. CCS | 26.05% |

Current Mortgage Rates and Housing Market Data

The Mortgage Bankers Association disclosed a 5 basis point decline in the average contract interest rate for 30-year fixed-rate mortgages under $766,550, down to 6.62% for the week ending July 19, 2024.

Despite the reduction in borrowing costs, several housing market indicators paint a bleak picture.

Homebuilder confidence hit a low of 42 in July, marking the lowest reading this year as reported by Bank of America.

Chief economist for LPL Financial, Jeffrey Roach, commented on the situation, citing, “The low home supply and high interest rates have severely impacted affordability.”

The National Association of Realtors noted a significant 5.4% drop in existing home sales in June, representing the sharpest monthly decrease since 2022.

Moreover, the U.S. Census Bureau disclosed a 0.6% decline in new single-family home sales, dropping to 617,000 in June 2024, the lowest in seven months and below the forecast of 640,000. High prices continued to hinder affordability, with the median sales price of existing homes soaring 4.1% year-over-year, setting a new record high.

Next in Line: