In a surprising turn of events, Chipotle Mexican Grill’s CEO Brian Niccol has announced his departure to take over the reins at Starbucks. This leadership shuffle has left investors contemplating which of these key retail restaurant stocks – Chipotle (CMG) or Starbucks (SBUX) – presents a more lucrative investment opportunity with Niccol set to transition to his new role as Starbucks’ CEO in September.

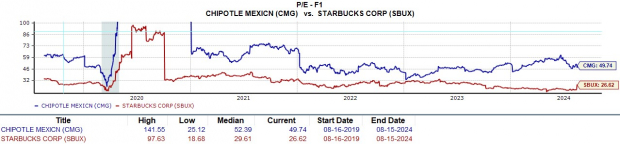

The standout performance of Chipotle under Niccol’s guidance, witnessing a staggering stock surge of over +200% in the last five years compared to Starbucks’ mere -2% growth, certainly catches the eye. However, as the adage goes, past performance is no crystal ball for the future. This juxtaposition begs the question: Which stock holds the upper hand for prospective investors in the current market climate?

Growth Prospects Comparison

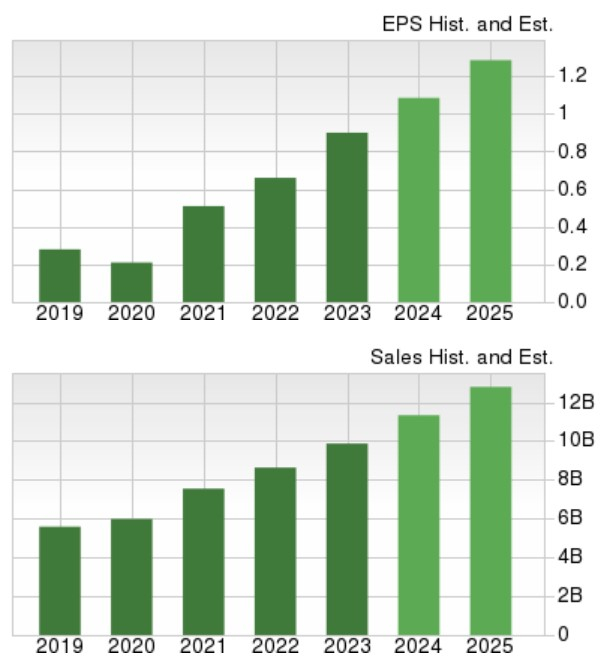

Following an unprecedented 50-1 stock split in June, Chipotle is anticipated to witness a substantial increase of 20% in annual earnings for fiscal 2024, with projected earnings per share (EPS) reaching $1.08 compared to last year’s 0.90 ($45 per share/50). Moreover, an 18% growth in EPS is on the horizon for FY25.

On the revenue front, Chipotle’s total sales are expected to see a 15% upsurge this year, with further growth forecasted at 13% in FY25, culminating in a total sales estimate of $12.79 billion.

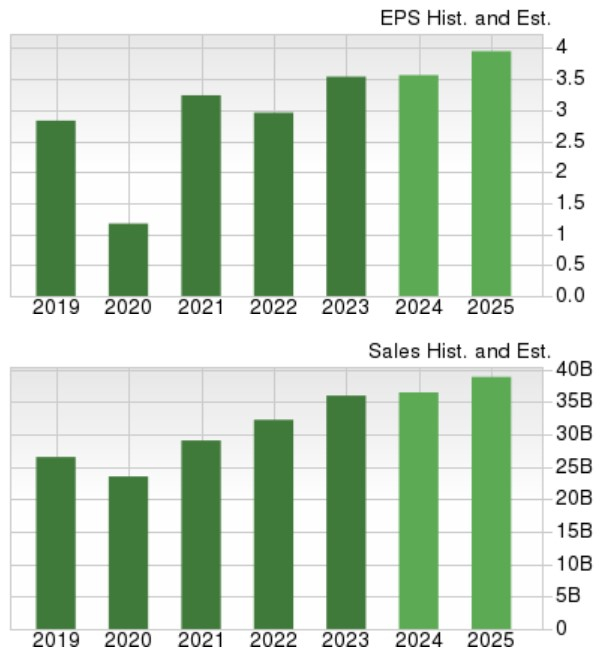

Turning the spotlight to Starbucks, the company is slated for nearly flat annual earnings in FY24, but a promising 11% increase is projected for FY25, with EPS forecasted at $3.94 per share. Starbucks’ total sales are expected to witness a slight 1% uptick in FY24, followed by a 6% expansion in the subsequent year, reaching $38.84 billion.

Valuation Analysis

While Chipotle’s growth trajectory appears robust, Starbucks’ valuation is deemed more appealing. In this context, SBUX is trading at 26.6 times forward earnings, closely aligned with the S&P 500’s 23.3X. Conversely, CMG is commanding a noteworthy premium over the broader market, trading at 49.7 times earnings.

Financial Health Comparison

Financial stability often serves as a pivotal factor in investment decisions, and while Starbucks boasts a higher cash reserve, Chipotle showcases a more robust balance sheet.

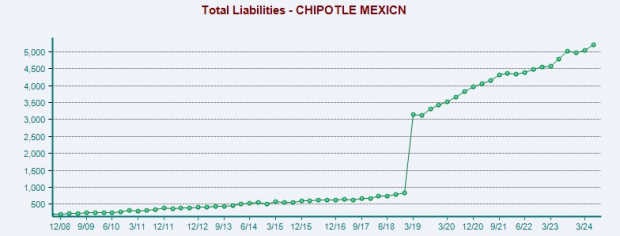

For instance, Chipotle currently holds $1.49 billion in cash and equivalents, with total assets amounting to $8.92 billion against total liabilities of $5.2 billion.

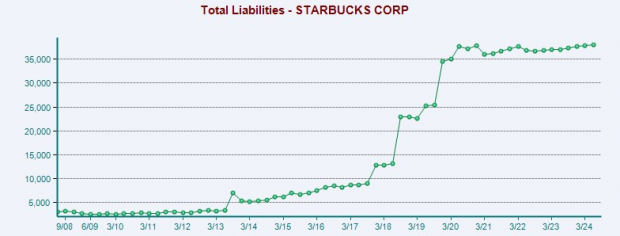

On the other hand, Starbucks has $3.39 billion in cash and equivalents, accompanied by total liabilities of $38.04 billion against total assets of $30.11 billion.

Insightful Conclusions

Undoubtedly, Starbucks requires a revival in its operational performance, as highlighted by concerns surrounding insolvency reflected in the company’s balance sheet.

Nonetheless, under Brian Niccol’s astute leadership, there’s optimism that he can propel Starbucks to the same heights of success witnessed during his tenure at Chipotle. Presently, both Starbucks and Chipotle stocks hold a Zacks Rank of #3 (Hold), making them viable long-term investment options given their promising prospects, albeit with potential for better entry points in the future.