Investors navigated cautiously through the week’s opening, but the atmosphere shifted come Friday (August 23) afternoon following an auspicious announcement from US Federal Reserve Chair Jerome Powell during his Jackson Hole speech, hinting at potential interest rate cuts.

As the financial world buzzed with this news, cryptocurrency markets saw an upsurge, breaking free from a stalled pricing pattern that persisted over several weeks. Meanwhile, Waymo unveiled a fresh iteration of its self-driving technology, further solidifying its recent string of successes.

Stay updated on the latest from the tech and finance domains with the Investing News Network’s recap.

1. Markets Rally on Prospect of Rate Cuts

The week opened with a shaky start for stock markets, as the S&P 500 and Nasdaq Composite began below the previous week’s close on Monday (August 19) before rallying over the course of eight consecutive days, along with the S&P/TSX Composite Index. The Russell 2000 Index also saw gains of 1.1 percent during the day’s trading.

Trading cautiously, major indexes remained largely static on Tuesday (August 20) morning as investors awaited fresh inflation data. Wednesday (August 21) brought the release of US non-farm payroll benchmark revisions and minutes from July’s Federal Reserve meeting. The data from the Bureau of Labor Statistics showed that although the labor market was expanding, job growth in the period between March 2023 and March 2024 fell short of earlier estimates.

The minutes from the July Fed meeting revealed considerations of a quarter percentage point rate cut due to declining inflation and rising unemployment, bolstering expectations for a rate cut in September. This news drove the indexes higher, with the Russell 2000 leading the charge by gaining over 1 percentage point to close the day at 2,170.32.

The positive momentum carried into Thursday (August 22) morning, with most indexes opening above the previous day’s close, despite economic data showing a decrease in US manufacturing PMI and a slight uptick in initial jobless claims.

2. Industry Moves: AMD Acquisition and Crypto Expansion

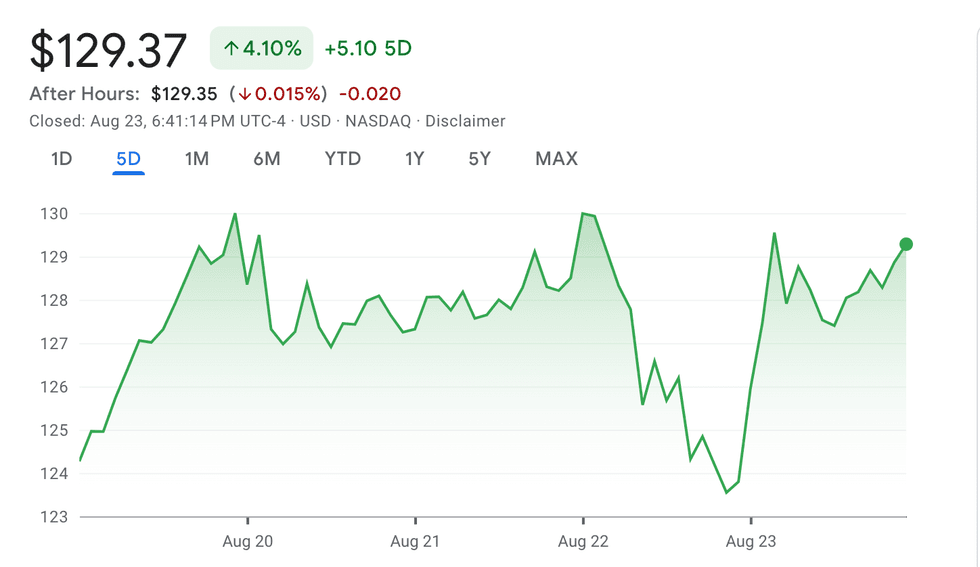

Chart courtesy of Google Finance.

NVIDIA performance, August 19 to August 23, 2024.

Amidst market shifts, AMD announced its plans to acquire ZT Systems, signaling a strategic move in the tech industry to bolster its position. Additionally, reports surfaced of Vice President Kamala Harris expressing support for policies aimed at expanding the cryptocurrency sector, hinting at potential shifts in regulatory outlook.

These developments add further intrigue to the evolving landscape of both the tech and finance sectors, offering investors new avenues to explore in the ever-changing market terrain.

The Week in Financial Markets: A Rollercoaster Ride of Resilience and Uncertainty

The Tech Labyrinth: NVIDIA’s Price Plunge and Powell’s Promises

As the sun set on the tech sector, NVIDIA (NASDAQ:NVDA) found itself caught in a storm, with its share price stumbling by 4.77 percent. Yet, a glimmer of hope emerged as Friday dawned and Powell, in his address at the Kansas City Fed’s annual economic symposium in Jackson Hole, Wyoming, hinted at an imminent rate cut without committing to the specifics. The market breathed a hesitant sigh of relief, unsure of the exact trajectory but buoyed by Powell’s assurances that policy would adjust in due course. Investors, like sailors tacking against a tempest, responded with newfound optimism. The Russell 2000, in particular, danced to its own tune, outperforming its larger siblings and climbing over 3 percent midday. An upward swing in mid-cap stocks mirrored this exuberance, a testament to the market’s keen sensitivity to the Fed’s tempo in recent times.

With the week drawing to a close, all four major indexes unfurled their sails to catch the wind, each up over 1 percent for the week. The Russell 2000, a beacon of resilience, glided up by more than 3 percent, closing the chapter on a tumultuous week with a flourish.

The Crypto Odyssey: Bitcoin’s Quest Above US$60,000

Bitcoin, a volatile ship on the digital sea, faced turbulent waters as it dipped below US$58,000 at the start of the week’s journey. Trading in treacherous territory, it grappled with the waves but found its way back above US$61,000 by the week’s midpoint. A sudden squall on Tuesday, mirroring a dip in US stock indexes, rattled Bitcoin’s course. The K33 analysts’ warning of growing short bets hinted at a potential squeeze, further roiling the waters. Yet, like a seasoned mariner adjusting the sails, Bitcoin weathered the storm. A midweek resurgence saw it breaking through US$60,000 and then US$61,000, holding firm above the US$60,000 mark for the week. Despite whispers of weakening demand, long-term holders continued to buoy the cryptocurrency, while institutional investors showed a steadfast 14 percent growth in Bitcoin ETF holdings, underscoring sustained interest from major players.

Fairlead Strategies’ cautious tale of a downturn as signaled by the 14-month stochastic indicator cast a shadow over Bitcoin’s horizon. As the week drew to a close, the crypto market rejoiced at the scent of positive tidings. The looming promise of a September rate cut, cemented by Powell’s declaration in Wyoming’s Jackson Hole, breathed fresh life into Bitcoin’s sails, propelling its price above US$64,000 by week’s end. Ether, too, caught the wind, experiencing a surge and trading above US$2,770 in the same breath.

The Political Frontier: Democrats’ Silence on Crypto, Harris’s Enigmatic Stance

Against the backdrop of the political stage, the Democratic National Convention unveiled its 2024 Platform, a voluminous tome covering various issues but conspicuously silent on Vice President Kamala Harris’s stance on cryptocurrency and web3 infrastructure. The absence of clarity left a lingering question mark, with the crypto community hopeful yet unsure of Harris’s leanings towards the industry. While whispers of a more welcoming approach from Harris circulate, the veil shrouding her views on decentralized finance remains intact.

Amidst the chatter, the platform’s reference to “Biden’s second term” added an intriguing twist. With the clock ticking, the final draft hinted at the unknown future, leaving observers peeking through a fog of uncertainty with bated breath.

Exploring Recent Developments in the Tech World

Revolution in the Race: Biden Out, Harris In, Americans Bet on Crypto

As President Joe Biden unexpectedly withdraws from the 2024 race, Vice President Kamala Harris steps into the spotlight amidst whispers of a potential stronger stance on cryptocurrency. The Democratic National Convention in Chicago witnessed Brian Nelson, the campaign’s senior policy adviser, hint at Harris’s support for the growth of emerging technologies, a breath of fresh air for crypto enthusiasts.

Prior to Harris’s ascent, Republican contender Donald Trump’s embrace of Bitcoin seemed to give the GOP an edge with crypto-centric voters, a trend that was hard to miss.

Now engaged in a fierce battle of wits on the crypto-betting platform Polymarket, the pendulum has swung drastically. Just a fortnight ago, odds on Polymarket favored a Democratic victory, propelling Harris to the forefront. However, recent developments show Trump reclaiming the lead, leaving pundits and spectators startled.

With the shadow of uncertainty looming over the Democratic Party’s stance on cryptocurrencies, Decrypt suggests that this ambiguity may have inadvertently paved the way for Trump’s resurgence in the digital asset realm.

Waymo Overtakes Boundaries: Unveiling the 6th Generation of Self-Driving Tech

Waymo, a subsidiary of Alphabet (NASDAQ:GOOGL), shatters barriers with its latest innovation – the 6th Generation Waymo Driver. This next iteration, unveiled on a momentous Monday, promises a blend of enhanced capabilities and cost efficiencies, heralding a new era in self-driving technology.

The upgraded Waymo Driver boasts an extended range of vision, up to 500 meters, and enhanced resilience in adverse weather conditions. With a suite of cutting-edge hardware featuring advanced sensor technologies and an improved camera-radar surround view system, navigational prowess is set to reach new heights.

Backing up this cutting-edge technology with real-world metrics, Waymo CEO Tekedra Mawakana proudly shared that Waymo One’s robotaxi service successfully hit a milestone of 100,000 rides per week – a clear testament to the technology’s growing impact. Partnering with Uber, Waymo has set its sights on a future full of promise and innovation.

Beginning as a mere self-driving project in 2009, Waymo’s evolution underscores the profound potential within the autonomous driving space. Alphabet’s committed investment of US$5 billion in Waymo, as disclosed during their recent earnings call, underscores the confidence in the technology’s trajectory.

AMD’s Bold Leap: Acquiring ZT Systems to Unlock AI Potential

Advanced Micro Devices (AMD) (NASDAQ:AMD) demonstrates its strategic foresight with the announcement of plans to acquire ZT Systems, a specialist in server and network equipment development. This bold move, unveiled on a momentous Monday, marks a pivotal step in AMD’s journey to bolster its prowess in data center artificial intelligence (AI) technologies.

Dr. Lisa Su, AMD’s Chair and CEO, articulates the significance of this acquisition, framing it as a critical milestone in the company’s AI strategy. Valued at a noteworthy US$4.9 billion, the deal structure combines cash and stock components, with potential additional payouts based on post-closure performance milestones.

The market’s response was swift, with AMD shares rallying by 4.66 percent on Monday, reaching a peak valuation of US$161.57 during Tuesday’s trading session. Closing the week at US$154.97, the stock posted a commendable 4.46 percent increase, painting a picture of investor optimism surrounding the acquisition.

Don’t forget to follow us @INN_Technology for real-time news updates!

The latest advancements in the tech landscape truly exemplify the relentless pursuit of innovation and the ever-evolving nature of the industry. With each new development, the boundaries of what is possible continue to be stretched, paving the way for a future ripe with possibility and transformation.