$200 billion. That’s the revenue Apple (NASDAQ: AAPL) generated last year from iPhone sales.

Most people think that is why Apple is the most valuable company in the world. And they’re not entirely wrong. But it is more complicated than that.

Let’s explore how Apple makes its money, and why the company is investing hefty sums of cash in a business often overlooked by investors.

Image source: Getty Images.

Evolution of Revenue Streams

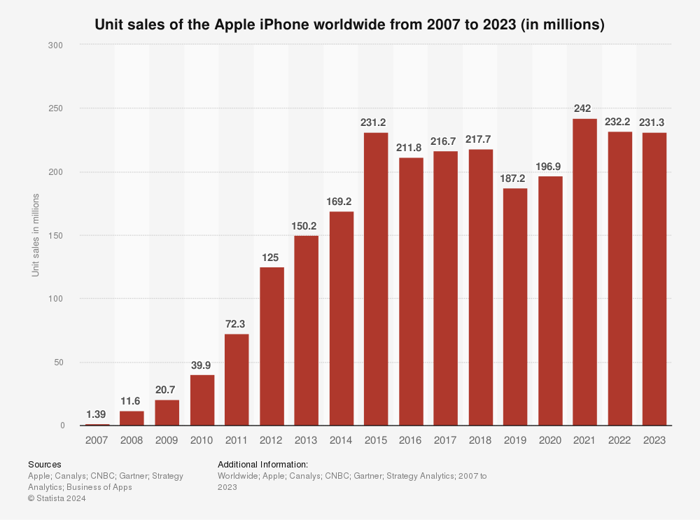

When you think of Apple, iPhones likely come to mind. However, despite being a cash cow, iPhone sales have stagnated for nearly a decade:

Image source: Getty Images.

Apple’s growth driver in recent years has been its services segment, encompassing the App Store, iTunes, AppleCare+, ads, and subscriptions to apps like iCloud+, Apple Fitness, and AppleTV+.

Significantly, Apple’s services unit is even more profitable than its product segment, with a gross profit margin of 75% compared to the 33% from products.

This shift signifies Apple’s strategic emphasis on expanding its services revenue and profits – the current value powerhouse of the company.

Apple’s $20 Billion Bet on Apple TV+

Apple has invested over $20 billion in Apple TV+ productions to compete with major players like Netflix, Amazon, and Disney. This foray into the “streaming wars” has proven costly for Apple.

Despite a Best Picture win for Coda in 2022, many other high-budget projects failed to elevate Apple TV’s viewership. Reportedly, Apple TV garners monthly viewership equivalent to Netflix’s daily viewers.

Acknowledging the downside, Apple is now scaling back budgets for its streaming projects, turning attention to new AI tools that could elevate services revenue further.

The heavy investment in AI may signal the end of Apple TV’s lavish spending era, redirecting resources towards enhancing services and AI ventures.

Apple ventured into the streaming battleground, expending billions that could have fueled AI innovation. Recognizing this financial misstep, Apple is now reining in extravagant streaming budgets. The move allows Apple to refocus resources on fortifying its services business, the current growth engine, and advancing its AI aspirations for the future.

The Unearthed Treasures: An Analysis of the Top Stock Picks for Discerning Investors

Imagine a scenario where the winning lottery numbers are revealed to everyone around you, except you chose to pick different numbers. This is akin to the recent revelation of the 10 best stocks for investors to acquire, with a shocking twist – Apple was notably absent from this elite lineup. Dive into the essence of these chosen few, heralded as potentially yielding remarkable returns in the forthcoming years.

A Blast from the Past: NVIDIA’s Stardom on April 15, 2005

Reflect back to April 15, 2005, a date etched in financial history when NVIDIA secured a spot on this coveted list. For those who heeded this recommendation and funneled $1,000 into the NVIDIA stock, they would now be sitting on a staggering sum of $792,725*. A testament to the power of making informed investment decisions.

Stock Advisor offers a comprehensive roadmap for investors seeking success, complete with a step-by-step guide on structuring a robust portfolio, periodic insights from industry analysts, and two fresh stock suggestions each month. The service has not merely doubled, not tripled, but magnified returns by over four times the S&P 500 benchmark since its inception in 2002*.

Curious to uncover the identities of these 10 standout stocks that have the potential to rewrite the future of investments? Delve deeper into their profiles to glean insights that could redefine your investment strategy for years to come.

*Performance as of August 22, 2024.