The Regret of Missed Opportunities

Woody Harrelson reveals a poignant investment tale of passing on an offer to invest in Elon Musk‘s groundbreaking electric vehicle company, Tesla Inc. TSLA. This narrative of regret was unveiled by the actor himself in a recent interview.

An Opportunity Lost: In a revealing dialogue with Marketwatch published recently, Harrelson expressed profound remorse over declining the chance to invest in Tesla prior to its public listing.

Recalling the pivotal moment, Harrelson shared how one of Musk’s confidants visited him at his residence with a “really fancy, superfast car” and extended an invitation to invest in the company. However, Harrelson, then, chose to forego the proposal, a decision he now deems as one of his significant investment missteps. Notably, his declining to invest in Tesla serves as just one among a cluster of regrets, as noted by the actor.

“This guy came up to the house and he had this really fancy, superfast car. Almost like a race car. Not an actual race car, but it was like a Ferrari-type car and it was super fast. We took a ride in it. He’s like, ‘You want to invest [in the company]?’ And I’m like, ‘Nah, I don’t think so.'”

The “Ferrari-type car” referenced by Harrelson likely points towards the company’s inaugural vehicle – the original 2008 Roadster.

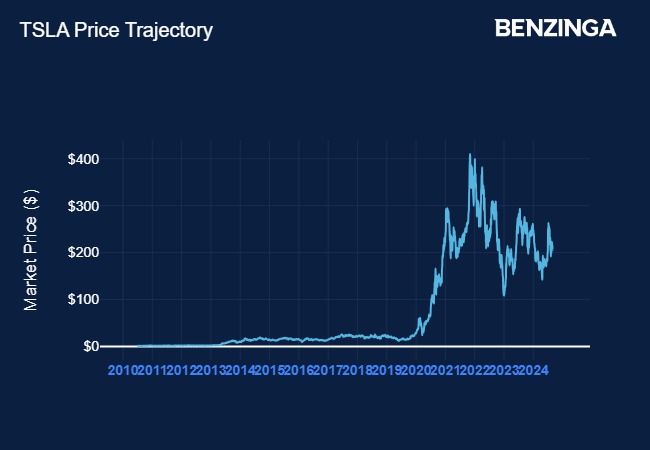

Significance of the Decision: Established in 2003, Tesla finally made its public debut in 2010. On its first day of trading on the Nasdaq exchange on Jun. 29, 2010, Tesla’s shares concluded at a split-adjusted price of $1.59.

Fast forward to Friday, Tesla’s shares ended the day at $214.11, showcasing a remarkable surge of about 135 times in value since its IPO. Notably, the company’s stock even breached the $400 mark in November 2021.

However, reflecting current market trends, the stock has encountered a 13.8% depreciation year-to-date, based on data sourced from Benzinga Pro.

Explore more of Benzinga’s captivating coverage on the Future Of Mobility by clicking here.

Continue Reading:

Photo courtesy: Flickr