Ford Motor has announced significant revisions to its Diversity, Equity, and Inclusion (DEI) initiatives amidst mounting pressure from conservative circles, most notably, Robby Starbuck. These initiatives are designed to address workplace disparities. In response to this development, F stock experienced a notable 5% uptick in the after-hours trading session yesterday.

One of the key alterations involves Ford extending access to its employee resource groups to all employees, irrespective of their backgrounds. Furthermore, the company will discontinue its participation in the Human Rights Campaign’s Corporate Equality Index, a well-recognized LGBTQ+ workplace equality assessment.

Firms Pull Back on DEI Strategies Amid Right-Wing Pressure

Ford’s decision is in line with a broader trend where companies are reassessing their DEI programs in response to conservative pushback and legal disputes. Other corporations such as Lowe’s, Home Depot, Harley-Davidson, Tractor Supply, and John Deere have also taken similar steps in recent times.

Advocates like Starbuck are leveraging social media as a platform to urge companies to adjust their DEI policies. These movements typically center around issues like affirmative action, race, gender, and traditional family values.

The escalating pressure on businesses to scale back on DEI initiatives could potentially impact their reputation, brand perception, and recruitment of top-tier talent.

Assessing the Potential of Ford Stock

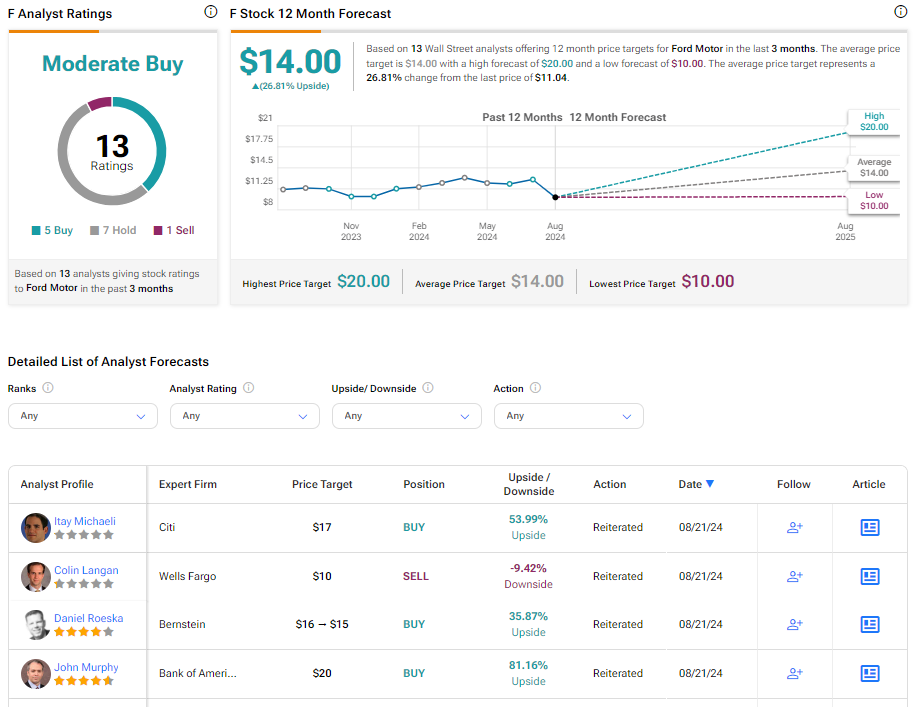

As per TipRanks, Ford currently holds a Moderate Buy consensus rating, with five Buy, seven Hold, and one Sell ratings. The average price target set by analysts for Ford stock stands at $14, indicating a potential upside of 26.81%. Over the past six months, the company’s shares have experienced an 8.8% decline.

Explore more F analyst ratings