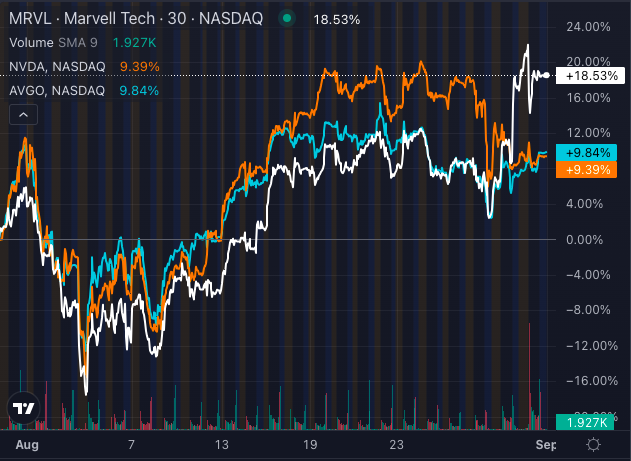

Marvell Technology Inc. MRVL has emerged as a standout performer in the semiconductor

sector, outpacing heavyweight rivals Nvidia Corp. NVDA and Broadcom Inc.

AVGO throughout Aug. 2024.

Chart created using Benzinga Pro

While Marvell stock surged an impressive 18.53% last month, Broadcom and Nvidia followed with gains of 9.84%

and 9.39%, respectively. This outperformance has caught the attention of investors looking to capitalize on

growth opportunities within the semiconductor industry.

Marvell’s Success Story

Marvell’s success can be attributed to its strategic focus as a fabless chip designer with a significant

presence in wired networking. With the second-highest market share in this segment, Marvell serves diverse

end markets, including data centers, automotive, and consumer electronics, making it a formidable player in

the industry.

More Insights: Marvell Technology Stock Climbs On Q2, Strong Q3 Guidance

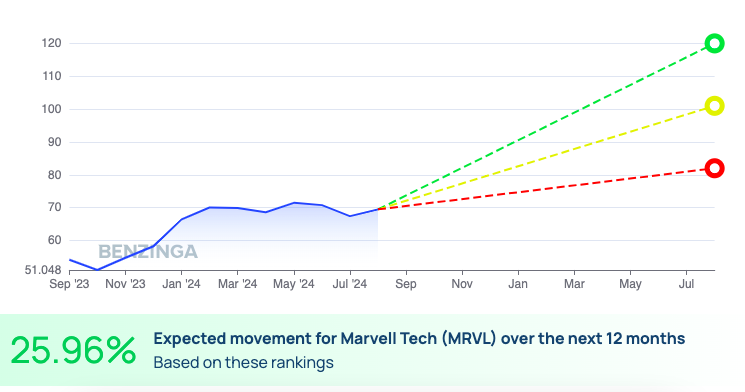

Benzinga Report On Marvell Technology

Analyst sentiment on Marvell remains bullish, with a 12-month price target range of $82.00 to $120.00 and an

average target of $101.00. This suggests an expected upside of 25.96% over the next year, reflecting

confidence in the company’s growth trajectory and market positioning.

Further Reading: Marvell Technology Posts First Beat-And-Raise In 5 Quarters: Analysts Focus On

‘Solid AI Story’

Broadcom’s Diversification Efforts

In contrast, Broadcom, the sixth-largest semiconductor firm globally, has been expanding beyond its core

semiconductor business into software, a move aimed at diversifying its revenue streams. With over $30

billion in annual revenue and a broad product range across wireless, networking, and storage markets,

Broadcom remains a formidable player in the semiconductor space.

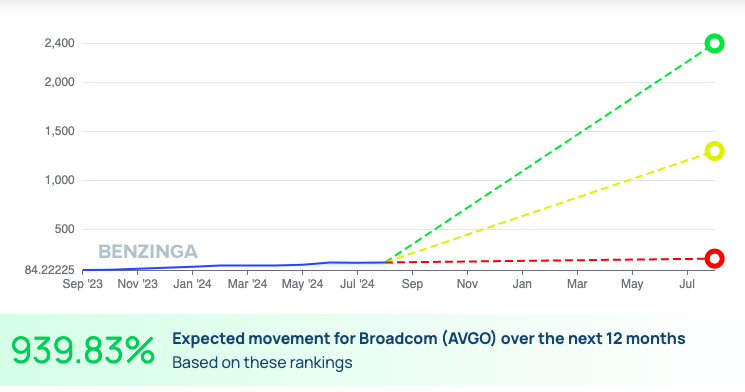

Benzinga Report On Broadcom

Analysts have set a 12-month price target range for Broadcom between $200.00 and $2,400.00, with an average target of $1,300.00, signaling a potential upside of 939.83%. Despite these promising figures, Broadcom’s more modest performance in Aug. compared to Marvell suggests that investors may currently favor pure-play semiconductor stocks with strong market share and focused strategies.

Nvidia’s AI Ambitions

Nvidia, known for its dominance in the GPU market and expanding footprint in AI and data center networking, posted a solid performance in Aug. but fell short of Marvell’s gains.

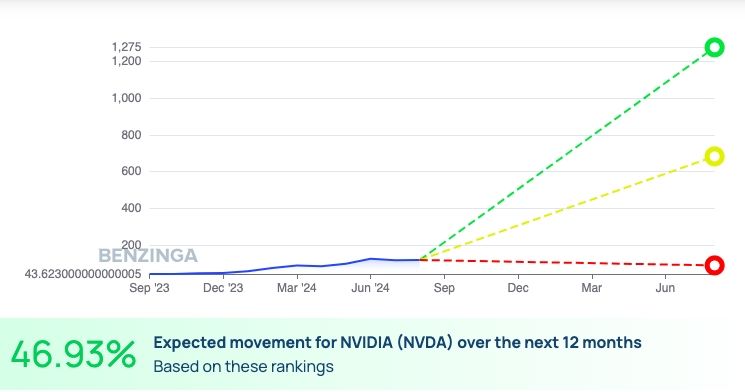

Benzinga Report On Nvidia

Analysts estimate a 12-month price target range for Nvidia from $90.00 to $1,275.00, with an average of $682.50, indicating an expected upside of 46.93%. Nvidia’s long-term growth prospects remain robust, driven by the increasing adoption of AI technologies.

However, in the short term, investors may be cautious given its relatively lower percentage gain compared to Marvell.

For semiconductor investors, Marvell’s recent outperformance is a signal to consider stocks with focused market strategies and high potential for growth.

While Broadcom and Nvidia continue to be strong players, Marvell’s agility and strong market positioning make it a compelling choice for those looking to capitalize on near-term gains in the semiconductor industry.

More Insights: