Tesla, the iconoclastic electric vehicle leader, has danced a tango with Wall Street for more than a decade. Captivating, unpredictable, and captivating–Tesla’s trajectory has been nothing short of a rollercoaster ride. Back in its pre-IPO days, financial pundit Jim Cramer infamously voiced skepticism, questioning the viability of an American auto startup, let alone one venturing into the uncharted waters of electric vehicles amidst the tumult of a post-recession landscape.

However, Tesla has emerged as a phoenix, rising over 17,000% since its inception. Surpassing industry stalwarts like Toyota, Ferrari, General Motors, and Ford in market capitalization, the company still ranks eleventh in revenue among major automakers. Yet, the sheen dimmed slightly post its split-adjusted peak of $414.50 in November 2021. Is this a sign of Tesla’s decline or a hidden opportunity in the making?

To decipher Tesla’s fate, one must peer into the looking glass of key catalysts and data points:

Unraveling the Enigma of Tesla’s Valuation

A favorite cudgel of Tesla detractors has been its valuation–the perennial bugbear that refuses to abate. “How can Tesla outstrip the revenue giants and claim the lion’s share of market cap?” scoff the naysayers.

Two compelling rationales underpin the lofty valuation of Tesla stocks:

1. Tesla’s Turbulent Innovation and Profitability: Investors are willing to splurge on growth potential, a domain where Tesla reigns supreme. While GM, with a century-old legacy, churned a gross profit of ~$19 billion in 2023, Tesla, not far behind, raked in $13.4 billion. Tesla’s meteoric growth and market infiltration steal the spotlight.

2. Tesla – The Chameleon: Skeptics often overlook Tesla’s multifaceted ventures, spanning solar energy, EV charging stations, and the revolutionary Full-Self-Driving (FSD) technology. Combining the allure of tech firms with traditional automaking, Tesla wields a dual-edged sword.

The Crucible of Robotaxi and Full-Self Driving: Decisive in Tesla’s Destiny

Skeptics assail Elon Musk’s grandiloquent prophecies as mere bluster, accusing him of inflating Tesla’s worth sans substance. Yet, history echoes a different tune. Elon Musk’s track record, from the lauded Model S to the mass-market Model 3, refutes such claims. His ardor often outdistances pragmatic timelines, exemplified in the eagerly awaited Robotaxi debut, now slated for October 10th, at the Warner Brothers hub.

Elon Musk’s bet-the-house gambit on the Full-Self-Driving (FSD) Robotaxi, with shares potentially blooming to $5 trillion by 2030, underscores its transformative potential. This innovation could pivot TSLA vehicles into Uber-esque ride-sharing conduits, relinquishing the need for a human chauffeur and catapulting Tesla into the ridesharing maelstrom. Despite facing fierce competition from Alphabet-owned Waymo, Tesla can carve a niche given ARK Invest’s endorsement of Tesla’s FSD technology as 18 times safer than the average U.S. car.

Diminishing Interest Rates: Tesla’s Bullish Trump Card

Elon Musk’s diatribe against the Federal Reserve for hesitating in slashing interest rates rings loud. Fed Chair Jerome Powell’s affirmation of imminent rate cuts in the September FOMC accentuates Tesla’s allure. Reduced borrowing costs hinge the gateway open for consumers to finance high-ticket items, auguring well for Tesla’s EV offerings.

The Cybertruck Chronicles: Unraveling at the Production Line

The Rise of Tesla: Cybertruck Delivery and Sales Surge

Late last year, Tesla’s futuristic space ship-like Cybertruck began to be delivered to clients in North America. The Cybertruck sightings have become a regular occurrence in places like Miami, signaling an approaching automotive revolution. As Tesla sharpens its production efficiency, the Cybertruck is poised to proliferate across North America, reshaping the vehicular landscape with its trailblazing design.

Tesla’s Remarkable Sales Rebound in China

China, boasting the world’s largest market share in electric vehicle (EV) sales, has been a battleground for Tesla in recent times. Despite facing fierce competition and economic headwinds, Tesla’s August sales figures point towards a potential renaissance in the Chinese market. With over 60,000 vehicles sold in August – a remarkable 37% surge from July – Tesla is demonstrating resilience and adaptability in one of its key territories, setting the stage for a remarkable comeback.

Tesla’s Technical Triumph

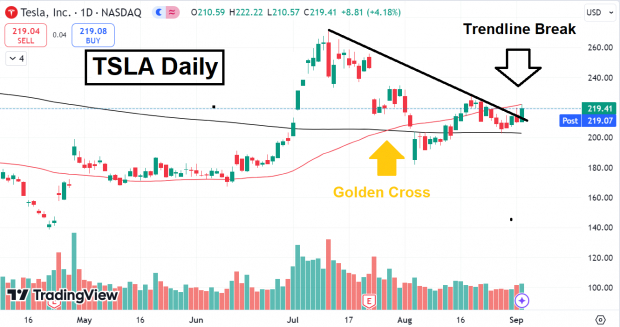

In the realm of stock markets, Tesla’s shares have unveiled a bullish spectacle. Breaking free from a downtrend that lingered since July, Tesla’s stock charted a new trajectory with the crossing of its 50-day moving average over the 200-day mark – an event labeled as the “Golden Cross.” This technical feat showcases Tesla’s resilience and investor appeal, paving the way for potential stock market success.

Image Source: TradingView

In Retrospect

Since its inception, Tesla has defied expectations and silenced critics, with Elon Musk leading the charge towards innovation. While the recent past may have posed challenges, the current indicators hint at Tesla emerging as a standout performer as we transition into 2025, showcasing the enduring spirit of this electric vehicle pioneer.