Turbulent Times for Mobileye Global Inc

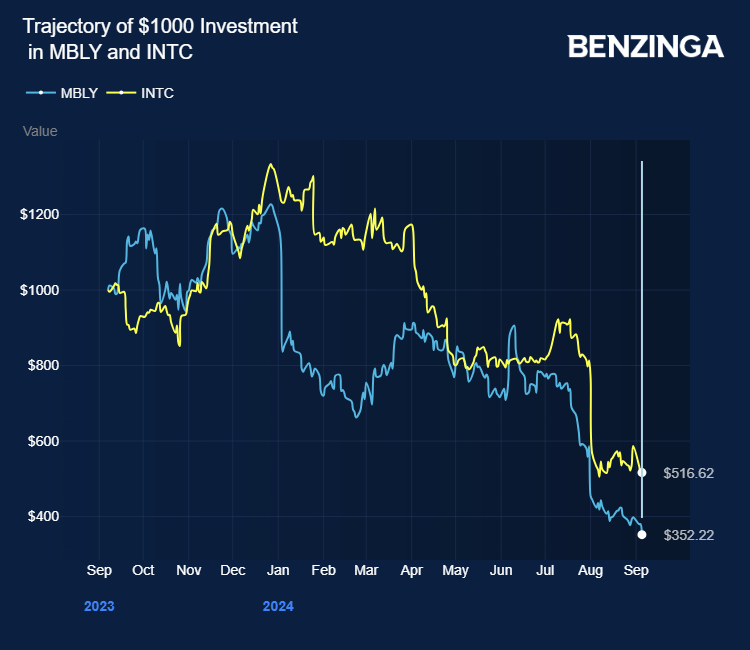

The winds of change are blowing at Mobileye Global Inc with reports swirling that tech giant Intel Corp is contemplating a strategic stake sale of the Israeli autonomous driving company. The market landscape appears stormy, with Mobileye Global stock taking a nosedive of over 65% in the past year. The company, grappling with reduced auto production exacerbated by post-pandemic oversupply, finds itself in turbulent waters.

Intel’s Strategic Maneuver

Rumors suggest Intel could potentially part ways with up to 88% of its stake in Mobileye, a move that is set to be discussed at Mobileye’s upcoming board meeting in New York. This potential stake sale comes at a time when both Intel and Mobileye are navigating through choppy market conditions.

A Closer Look at the Financial Storm

Amid this financial tempest, Mobileye Global Inc has faced challenging times, slashing revenue and adjusted operating income forecasts following a 3% decline in second-quarter revenue. With its stock plummeting and uncertainties looming, the company’s journey through the rough seas seems far from over.

Intel’s Dilemma and Path Forward

Intel’s own ship hasn’t been spared from the financial gale, with its stock value witnessing a significant 48% decline over the past year. The tech behemoth is exploring avenues for reviving its enterprise networking division as well, seeking respite from the current stormy weather.

As Intel navigates through these turbulent financial times, it faces headwinds in its Network and Edge business, which saw a considerable drop in revenue last year. The company’s struggles to capitalize on the AI trend and the challenges posed by competitors further complicate its voyage towards stability.

Navigating Uncertain Waters

Intel is currently in discussions with a dozen potential clients to chart out a course that could steer its contract chip business towards revenue growth by 2027. As the company sets its compass towards a more stable financial future, the choppy waters of the market continue to test its resilience.

Market Watch

In the current market scenario, Mobileye Global Inc stock is down by 4.91% to $12.00 premarket, while Intel Corp stock shows a glimmer of hope with a slight uptick of 0.26% at $19.45. As investors keep a watchful eye on these developments, the market remains unpredictable, making it crucial for both companies to navigate strategically amidst the volatility.

Photo via Wikimedia Commons