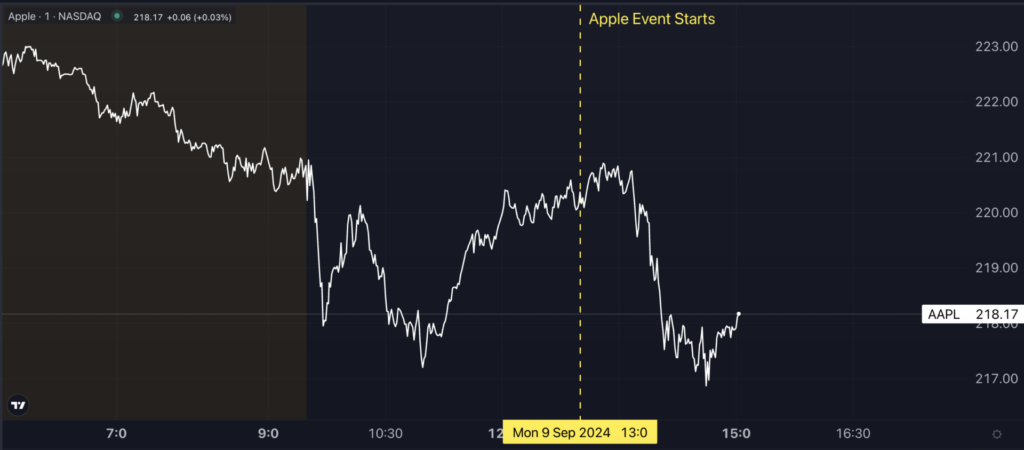

Apple Inc. AAPL experienced a downturn in its stock value, hitting a four-week low on Monday at $218 per share by 3:00 p.m. ET, post the highly anticipated iPhone 16 series launch at Apple Park in Cupertino, California.

Despite introducing multiple new products including the iPhone 16, Apple Watch Series 10, and updated AirPods during the event, investor response was subdued, consistent with historical trends.

Leading up to the launch, Bank of America analyst Wamsi Mohan had foretold a potential recovery window of 30-60 days post-event, based on past stock behavior following similar product unveilings.

iPhone 16 Pricing:

- iPhone 16: Starting at $799

- iPhone 16 Plus: Starting at $899

- iPhone 16 Pro: Starting at $999

- iPhone 16 Pro Max: Starting at $1,199

Apple Watch Series 10 Pricing:

- Apple Watch Series 10: Starting at $399

Apple Watch Ultra 2 Pricing:

- Apple Watch Ultra 2: Starting at $799

AirPods Pricing:

- AirPods 4: $129

- AirPods 4 with Active Noise Cancellation: $179

Chart: Apple Dips On Apple Event

New iPhone 16 Features

The iPhone 16 boasts the all-new A18 Bionic chipset, enhancing processing power and energy efficiency. It introduces an Action Button for personalized shortcuts and dynamic island notifications from the previous models.

Running on iOS 18, the phone offers enhanced customization options and improved privacy features.

The Pro variants feature larger displays of 6.3 and 6.9 inches, with thinner bezels and additional color choices, including a “desert titanium” option. The iPhone 16 Pro also showcases advancements in camera technology, featuring a 48MP primary sensor and 4K 120fps slow-motion video capabilities.

The Pro models are equipped with the A18 Pro chip, a robust processor tailored for demanding applications such as high-end photography and gaming.

The emphasis on artificial intelligence dubbed “Apple Intelligence” marked a significant highlight of the event, promising enhanced user experiences with Siri, now more contextually aware and personalized.

Craig Federighi, Apple’s senior vice president of Software Engineering, explained that the AI system aims to redefine interactions with Siri, offering richer language understanding and personalized engagements.

‘A Multi-Year Software Driven Upgrade Cycle’

Prior to the unveiling, analyst Mohan reflected on the optimistic longer-term outlook for Apple, suggesting that the immediate market response might not encapsulate the company’s future potential.

Historical data revealed a consistent pattern where Apple’s stock performance typically improves 30 to 60 days after a major product launch, despite initial dips post-event.

Mohan cited past iPhone releases where stock rebounds followed once sales data began to materialize, notably with the iPhone 11 series launch in 2019, resulting in a 20% surge within 60 days post-event.

The introduction of advanced features like Apple Intelligence with the iPhone 16 launch signifies the commencement of a potentially significant long-term software-driven upgrade cycle, foretelling sustained growth.

Mohan highlighted the parallel shipment timelines of the iPhone 16 launch and the prior year’s iPhone 15 release, projecting nine shipping days in the current fiscal quarter, providing a crucial window for Apple to report initial sales figures.

Bank of America maintained a Buy rating on Apple with a price target of $256, suggesting an 18% upside potential from current levels.

Read Next:

Photo: Shutterstock