Backup cameras have become a must-have in modern vehicles, a technological wonder that has seamlessly integrated into our driving experience. Yet, for the venerable automaker Ford (NYSE:F), these cameras have become a source of concern, triggering a recall. Ford’s shares experienced a slight dip in the final minutes of trading on September 20.

The recall centers around approximately 144,500 Maverick pickup trucks, where some backup cameras are displaying static images instead of the expected live feed. This anomaly could lead to potential safety risks as important visual cues may not be properly conveyed to the driver and those in the vehicle’s vicinity.

Ford has identified the root cause as “improper memory handling” within the vehicle’s Connected Touch Radio system, as reported by Fox Business. Fortunately, the issue has been rectified in newer models, offering relief to potential buyers. Affected Ford owners simply need to visit a Ford or Lincoln dealership for a software update that addresses this concern.

New Innovations and Retirements

Aside from addressing recalls, Ford is actively enhancing its offerings by introducing new features while bidding adieu to legacy functions. Among the upcoming features is “soiled surface monitoring,” a cutting-edge technology still in its nascent stages but promising to detect wet or dirty surfaces within the vehicle. This system can even determine if a surface has been adequately cleaned.

In a strategic move to streamline costs, Ford has decided to phase out its automated parking system, the enhanced active park assist feature that facilitates parallel parking. As parallel parking isn’t as commonplace as anticipated, the system often remained idle, just like a neglected tool in a shed.

Assessing F Stock’s Appeal

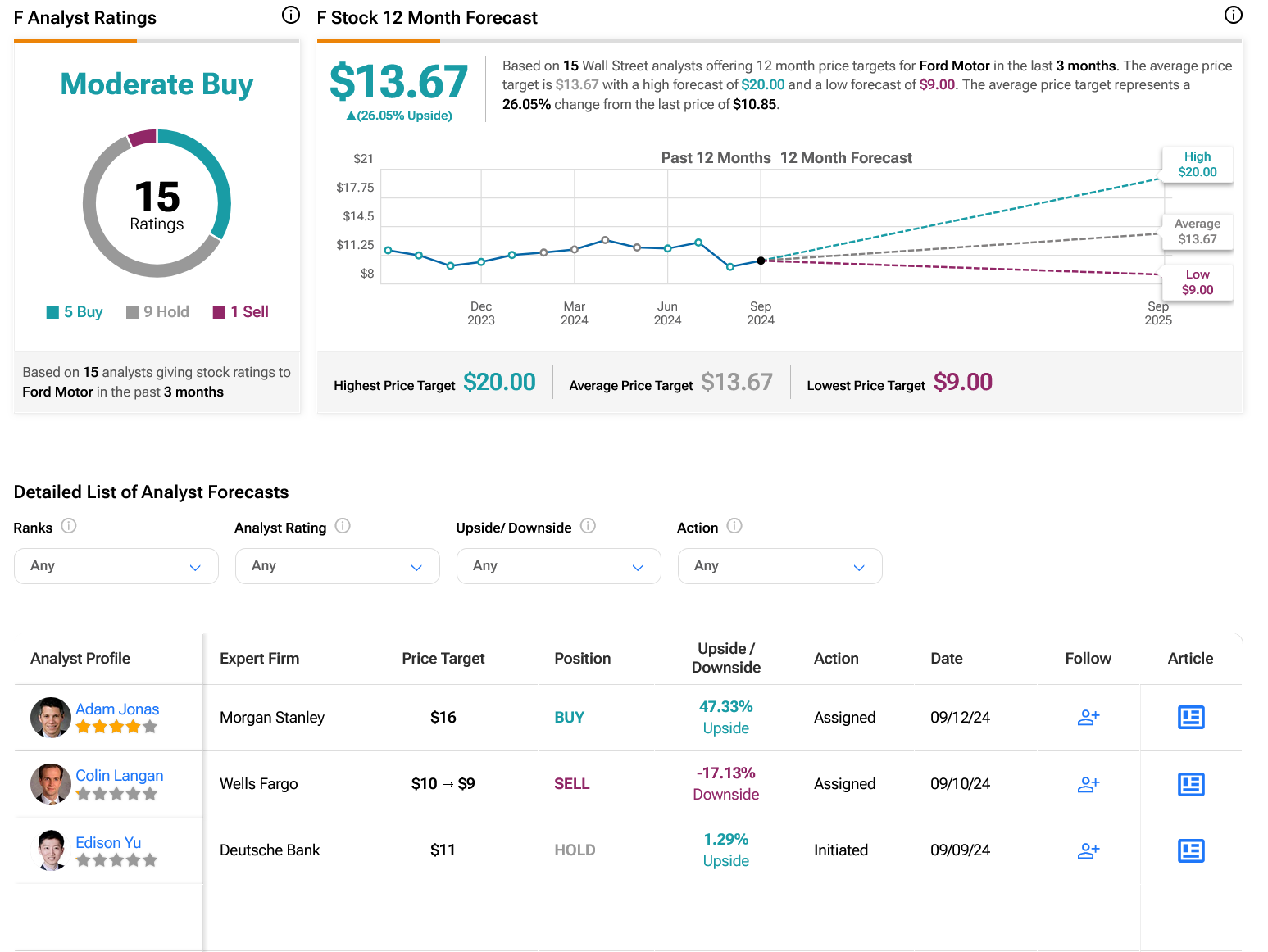

Delving into the financial realm, Wall Street analysts maintain a Moderate Buy consensus on F stock, with recent data showcasing five Buy ratings, nine Holds, and one Sell over the past quarter. Despite a 4.57% dip in share value over the previous year, the average price target of $13.67 per share foresees a potential upside of over 25% for investors.