When stocks soar to or approach their all-time highs, it’s a testament to the prevailing bullish sentiment and the dominating presence of buyers in the market. Such momentum often propels stocks to scale even greater heights, especially when backed by positive revisions in earnings estimates by analysts.

SharkNinja: Riding the Wave of Growth

SharkNinja, a prominent Zacks Rank #1 (Strong Buy), stands as a diversified company focused on product design and technology to cater to consumers’ evolving lifestyle needs. The company’s outlook has taken a bullish turn, reinforced by a stellar performance in its latest quarterly results.

Image Source: Zacks Investment Research

During the latest quarter, SN reported a remarkable 34% growth in EPS on a 31% surge in sales, raking in $1.2 billion in revenues and marking the fifth consecutive period of double-digit year-over-year sales growth.

The growth trajectory looks promising, with consensus estimates for the current fiscal year anticipating a 31% rise in EPS alongside a 21% surge in sales. Looking further ahead, projections for FY25 hint at another 14% jump in EPS paired with a 9% increase in sales.

The stock boasts a Style Score of ‘B’ for Growth, and the chart below illustrates the company’s quarterly sales performance:

Image Source: Zacks Investment Research

With a staggering 110% surge in 2024, the stock’s red-hot run is accompanied by a promising outlook for further gains.

DVA: Sparking Interest with Attractive Valuation

DaVita, a major player in dialysis services for patients with chronic kidney failure in the U.S., currently holds the coveted Zacks Rank #1 (Strong Buy), supported by elevating expectations across various timeframes.

Image Source: Zacks Investment Research

The valuation standpoint for DVA appears enticing, with the current forward 12-month earnings multiple of 14.0X aligning closely with historical levels. Furthermore, the current PEG ratio at 0.8X reflects a bargain in relation to the anticipated growth.

A PEG ratio below 1.0 typically indicates a blend of growth and value, with the stock showcasing a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

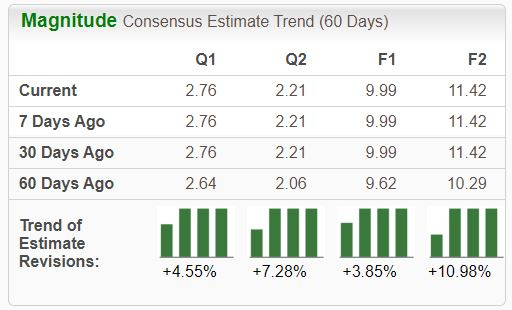

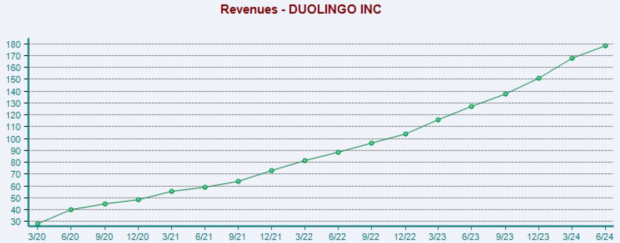

Duolingo: Forecasting Phenomenal Growth

Duolingo, a Zacks Rank #1 (Strong Buy), offers a mobile language learning platform with a robust growth projection. Consensus estimates for the current fiscal year point to a whopping 430% surge in EPS coupled with a 40% increase in sales.

The company has a history of robust growth, consistently maintaining double-digit year-over-year sales growth over its past ten quarters. The chart below depicts DUOL’s sales performance on a quarterly basis:

Image Source: Zacks Investment Research

Despite trading at heightened valuation multiples, the current forward 12-month earnings multiple of 109.3X mirrors investors’ high expectations for growth – expectations that the company is poised to meet.

Wrapping Up

Stocks reaching new highs often pave the way for greater peaks, especially when fueled by positive revisions in earnings estimates.

All three of the aforementioned stocks – Duolingo (DUOL), SharkNinja (SN), and DaVita (DVA) – have enjoyed this upward trajectory, underpinned by favorable Zacks Ranks and trading at or near their 52-week highs.

Infrastructure Stock Boom to Transform the Landscape

A substantial drive to revamp the deteriorating U.S. infrastructure is on the horizon. It’s a bipartisan, pressing, and inevitable initiative that will witness trillions being invested and fortunes being made.

Are you ready to dive into the right stocks at the onset, when their growth potential is at its peak?

Zacks has unveiled a Special Report to guide you in seizing this opportunity – and it’s now available for free. Explore 5 promising companies expected to reap the benefits from the massive scale of construction, repairs, and transformations in infrastructure, cargo transport, and energy on an unprecedented level.

Want the latest insights from Zacks Investment Research? Download the free report on 5 Stocks Set to Double.