Investors often look to the gospel of Wall Street analysts before pulling the trigger on a stock. But does unwavering faith in these recommendations always pay off?

Before delving into the subject of brokerage recommendations and their relevance, let’s peek behind the curtain at what the big shots on Wall Street are saying about the tech giant, Alibaba (BABA).

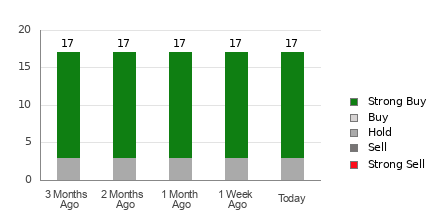

Alibaba currently boasts an average brokerage recommendation (ABR) of 1.35, nudging towards the territory nestled between Strong Buy and Buy on a scale ranging from 1 to 5. This numerical grade is the result of 17 brokerage firms issuing their verdicts – with a staggering 82.4% of those being of the Strong Buy persuasion.

Unveiling Trends in Brokerage Recommendations for BABA

Whether it’s the right time to snap up Alibaba solely based on its ABR is a tale as old as time. Numerous studies suggest that leaning heavily on brokerage recommendations may not always steer you towards the golden path of stock market success.

But why, you may ask? The answer is simple – analysts employed by brokerage firms often sport rose-tinted glasses, dishing out positive ratings more generously than an overzealous dessert chef serves up sweets. For every “Strong Sell” recommendation, there are five “Strong Buy” nods – a revealing statistic casting shadows on the reliability of these predictions.

Thus, it might be wiser to treat these recommendations as a helpful nudge towards conducting your own due diligence or as a checkpoint in a journey where past performance is a more reliable signpost.

Enter the Zacks Rank – a proprietary stock rating tool that has withstood the test of time and external scrutiny. From Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this model categorizes stocks into five cohorts, acting as a harbinger of a stock’s potential price movements in the near term. Using the ABR to corroborate the Zacks Rank might just be the savvy move in the game of investments.

Navigating the Distinctions Between ABR and Zacks Rank

Though the ABR and Zacks Rank share a numerical range of 1-5, they are distinct creatures.

ABR is a reflection of brokerage recommendations in decimal form (e.g., 1.28), while the Zacks Rank dances to a tune of its own, revolving around earnings estimate revisions. The Zacks Rank, unfettered from the conflict of interest inherent in brokerage recommendations, paints a clearer picture of a stock’s true colors.

While brokerage analysts may often spin their yarn with a bias towards optimism, the Zacks Rank stays grounded in reality, capitalizing on the power of earnings estimates to predict stock price movements.

Moreover, unlike ABR, the Zacks Rank is swift-footed, keeping pace with the ever-evolving market landscape. As analysts tweak their earnings estimates to match the shifting tides of the business world, the Zacks Rank stays agile and relevant, remaining a reliable guide in the realm of stock price predictions.

Deciphering Alibaba’s Investment Potential

Turning our gaze upon Alibaba, the Zacks Consensus Estimate for the current year stands unwavering at $8.68, a testament to analysts’ steady beliefs in the company’s financial outlook. This stability in consensus estimates has cemented Alibaba’s position as a Zacks Rank #3 (Hold).

While the winds of change blow gently around the consensus estimate, four other facets related to earnings estimates have contributed to this middle-of-the-road ranking for Alibaba. If you’re in the mood for more, you can check out the complete list of today’s top-notch Zacks Rank #1 (Strong Buy) stocks to keep your investment compass pointing north.

Thus, prudence may be the watchword when it comes to Alibaba’s Buy-equivalent ABR. In a world where self-reliance and critical thinking are the unsung heroes, perhaps it’s time to break free from the shackles of blind faith in brokerage recommendations and march boldly into the horizon of financial independence.