NVIDIA NVDA stock has catapulted a staggering 155% this year, soaring to a 179% increase in the past year, and a monumental 2600% growth over the last five years. Remarkably, NVIDIA’s market capitalization has reached the stratospheric heights of $3 trillion in the current year.

The stock currently boasts a Price/Earnings (P/E) ratio (trailing 12 months) of 55.59X, significantly surpassing the 8.14X industry benchmark in the Semiconductor – General sector. NVIDIA’s price/book ratio (most recent quarter) stands at 51.82X, a stark contrast to the industry figure of 1.33X. Furthermore, the Price/Cash Flow of NVIDIA stock, at 99.02X, eclipses the industry norm of 11.11X.

The Reign of NVIDIA in the AI Universe

NVIDIA dominates the AI chip design and software landscape, wielding a staggering 80% to 95% market share according to Reuters. Tech juggernauts such as Microsoft MSFT, Google GOOGL, Oracle ORCL, and Meta META are among its esteemed clientele. Companies in the autonomous vehicle realm, like Tesla TSLA, rely on NVIDIA’s chip technology. Notably, NVIDIA’s AI chips, including the H200, power large language models and drive inference, with the burgeoning demand causing GPU shortages.

Incredible Demand for the Blackwell AI Chip

NVIDIA’s CEO Jensen Huang described the demand for the company’s next-generation artificial intelligence chip, Blackwell, as “insane” in a CNBC interview. CFO Colette Kress highlighted in August that the firm anticipates several billion dollars in Blackwell revenue in the fourth quarter of the fiscal year. Jensen also outlined NVIDIA’s plan to enhance its AI platform annually to boost performance two to threefold.

The Impact of NVIDIA’s Stock Split

Following a 10-for-1 stock split on June 7, NVIDIA’s shares became more accessible to a broader spectrum of investors, fostering increased liquidity and sparking a retail buying frenzy. Some analysts even speculate that NVIDIA is poised to attain the milestone of becoming the first $10 trillion company.

Delving into NVIDIA’s Earnings Growth Trajectory

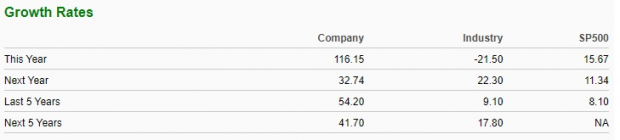

Projections indicate that NVIDIA’s earnings will surge by a remarkable 116.2% in the current fiscal year ending in January 2025, contrasting sharply with the anticipated 21.5% decline in the industry’s growth rate and the 15.67% growth forecast for the S&P 500. Despite an expected moderation in growth next year, NVIDIA is projected to maintain a robust 41.70% growth rate over the ensuing five years, as opposed to the industry average of 17.80%.

Image Source: Zacks Investment Research

Analysts’ Outlook Prior to Earnings Release

Anticipation is high for NVIDIA’s earnings announcement on November 19, 2024. The company presently exhibits an Earnings ESP of -0.27% alongside a Zacks Rank #3 (Hold). Typically, a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 elevates the likelihood of an earnings beat. Traders can leverage our Earnings ESP Filter to uncover prime stocks prior to their earnings disclosures.

Among 15 analysts, one has upped the earnings estimate for NVIDIA’s upcoming quarter over the past 30 days, with a further 10 analysts doing so within the last 60 days. The earnings projection for the current quarter now stands at 74 cents, an increase from 68 cents reported 60 days earlier.

Predictions for NVDA Stock Price Target

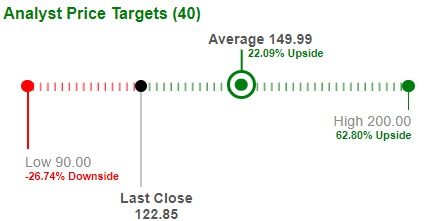

Based on short-term price targets provided by 40 analysts, the average price target for Nvidia hovers at $149.99. Forecasts range from a low of $90.00 to a high of $200.00. This average price target signifies a 22.09% upsurge from the most recent closing price of $122.85 as of October 3, 2024.

Image Source: Zacks Investment Research

Focus on NVDA ETFs

For investors cautious of NVIDIA’s negative Earnings ESP yet keen on tapping into the AI boom and promising growth trajectory, allocating towards semiconductor exchange-traded funds (ETFs) with substantial NVDA exposure can mitigate company-specific risks. Noteworthy NVDA-heavy ETFs include Strive U.S. Semiconductor ETF SHOC, VanEck Vectors Semiconductor ETF SMH, Technology Select Sector SPDR Fund XLK, Grizzle Growth ETF DARP, and TrueShares Technology, AI and Deep Learning ETF LRNZ.

Stay Informed with Zacks’ Fund Newsletter

Keep abreast of key ETF insights straight to your inbox with Zacks’ complimentary Fund Newsletter, delivering top news, analysis, and the best-performing ETFs weekly.