The Evolution of IBM

Is International Business Machines (NYSE: IBM) on the brink of a notable resurgence? The company recently surpassed its 2013 peak, heralding a possible comeback. IBM’s shift towards a cloud and artificial intelligence (AI) focus has captured investor attention, propelling its market cap to around $205 billion. With this momentum, speculation arises: could IBM ascend to a trillion-dollar stock by 2030?

To achieve this immense milestone within six years from a $205 billion market cap demands an average annual stock price surge of 30%. Historically, such a feat seemed improbable. Yet, IBM has undergone a remarkable transformation over the past five years. The pivotal acquisition of Red Hat for $34 billion, orchestrated by Arvind Krishna, catalyzed this metamorphosis, albeit with a substantial rise in total debt.

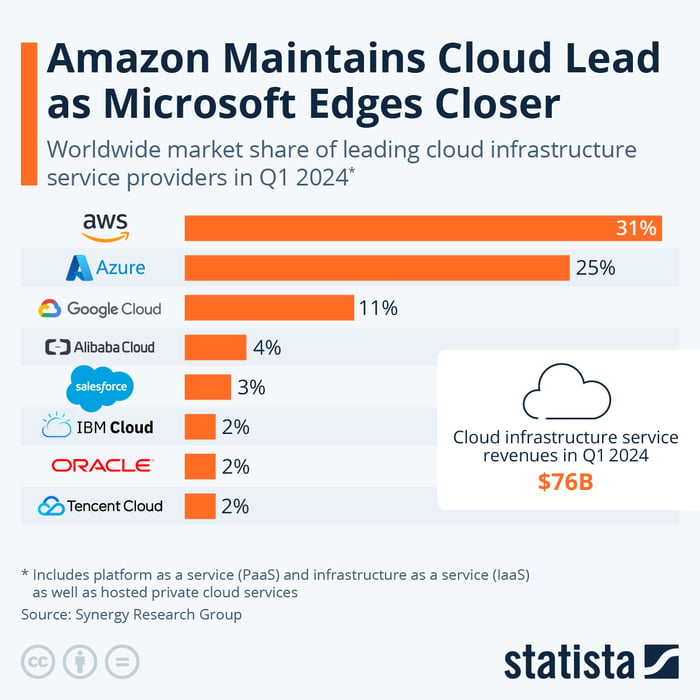

This bold move, however, paid off as IBM continued to expand its cloud portfolio through strategic acquisitions and the spin-off of Kyndryl. Garnering a 2% market share in the cloud infrastructure realm, IBM’s foothold stands poised amidst the global cloud market’s projection to hit $2.4 trillion by 2030.

Moreover, IBM’s foray into generative AI with watsonx signals a promising venture. Within a year, its generative AI business has burgeoned to over $2 billion. The anticipated growth of the generative AI market to $109 billion by 2030 augurs well for IBM, should it mirror this escalation.

Image source: Statista.

While software, consulting, and infrastructure constitute IBM’s revenue pillars, the software division dominates the revenue landscape, underscoring its vital role in the tech domain.

Financial Fortunes of IBM

Despite its strides, IBM’s tepid growth rates may pose a hurdle to the trillion-dollar dream. Revenue nudged slightly over $30 billion in the first half of 2024, with a mere 2% uptick from the previous year. Although software revenue saw a 6% boost, the remaining segments witnessed sluggish progress.

On a brighter note, IBM’s net income for the first two quarters of 2024 surged by 37%, propelled by a $112 million tax benefit. However, this windfall is unlikely to recur, tempering future profitability prospects. While IBM upped its revenue growth guidance to the mid-single digits for the year, this might not suffice to catalyze a rapid stock price escalation.

For investors, the nearly 60% surge in IBM’s stock price over the past year, propelling its P/E ratio to the 25 range, may raise concerns. The historical valuation pattern of IBM, typically surging during profit downturns, hints at potential hurdles for robust growth.

Prospects of IBM as a $1 Trillion Stock

Given the present financial trajectory, IBM’s trillion-dollar market cap within six years seems implausible. Yet, IBM’s tech renaissance, underscored by its cloud presence and the watsonx initiative, positions it as a formidable player in the industry.

While IBM anticipates moderate revenue upswings, the one-off income tax boon that fueled the 37% net income escalation poses a looming challenge. As IBM braces for a probable profit slump upon resuming tax payments, the path to trillion-dollar valuation appears arduous. The investors of Big Blue might need to recalibrate their expectations.

Conclusion

IBM’s odyssey towards trillion-dollar stardom by 2030 is fraught with hurdles. While its transformation narrative is compelling, the financial dynamics paint a more tempered growth outlook. Investors should wield caution and temper their expectations as IBM navigates the arduous path ahead.