The Royal Swedish Academy of Sciences acknowledged strides in artificial intelligence (AI) this week, awarding two prestigious prizes to researchers shaping the field.

While Bitcoin’s fluctuations underscore its susceptibility to macroeconomic forces, Tesla (NASDAQ:TSLA) unveiled its long-awaited autonomous vehicle, to an audience left underwhelmed.

At OpenAI, financial forecasts project profit remains a distant endeavor.

Stay abreast of the latest tech sector developments with the Investing News Network’s comprehensive coverage.

AI Secures Two Nobel Prizes

The Royal Swedish Academy of Sciences revealed this year’s Nobel laureates, designating two of the three science awards to AI scholars.

During the week, the Nobel Prize in Physics honored Canadian computer scientist Geoffrey Hinton and American physicist John Hopfield. Their work on neural networks laid the groundwork for machine learning technology inspired by the brain’s cognitive processes.

Noteworthy is Hopfield’s brain-like computer, capable of storing patterns for later retrieval, even with partial data. Hinton’s breakthrough enabled computers to identify patterns independently, essentially learning without explicit programming.

Subsequently, Sir Demis Hassabis, CEO of Google DeepMind, and John Jumper, Director of Google DeepMind, clinched the Nobel Prize in Chemistry on Wednesday for their development of AlphaFold 2. This AI model, conceived by Alphabet (NASDAQ:GOOGL) subsidiary in 2020, accurately forecasts a protein’s three-dimensional structure.

Proteins’ functions correspond with their structures, an arduous— and costly—task for human researchers. AlphaFold 2, in July 2021, accurately predicted the structures of nearly all 200 million indexed proteins, using only amino acid sequences as input. This groundbreaking technology has propelled discoveries in science and medicine, hastening drug discovery and development.

However, Alphabet faced adversities this week. A mandate on Monday dictated Google revamp its mobile app store, enabling Android users to procure apps from alternative vendors. This was followed by the US Department of Justice hinting at a court order to segregate Google’s Chrome and Android businesses, subsequent to an antitrust ruling against the tech behemoth on August 5. Consequently, Google’s shares are down by 2.65 percent this week.

Disappointing Debut for Tesla Cybercab

Tesla witnessed an 8.78 percent decline in shares on Friday afternoon subsequent to the automaker’s lackluster presentation of its electric autonomous vehicle.

The Unveiling of Tesla’s Fully Autonomous Cybercab

Tesla Introduces Cybercab at “We Robot” Event

After much anticipation, Tesla revealed its fully autonomous model, the Cybercab, at the “We Robot” event in Burbank. The Cybercab, a revolutionary two-seater with no traditional controls, including a steering wheel or foot pedals, made its debut an hour behind schedule, capturing the attention of attendees.

Elon Musk’s Projections for the Future

During the event, Tesla’s CEO, Elon Musk, announced that the Cybercab would be priced below US$30,000. Musk expressed his optimism about commencing production before 2027 but withheld specific details regarding the production launch. Additionally, Musk hinted at future endeavors, including the development of a fully autonomous 20-passenger Robovan, with both vehicles featuring wireless charging technology.

Tesla’s Full-Self Driving Technology Updates

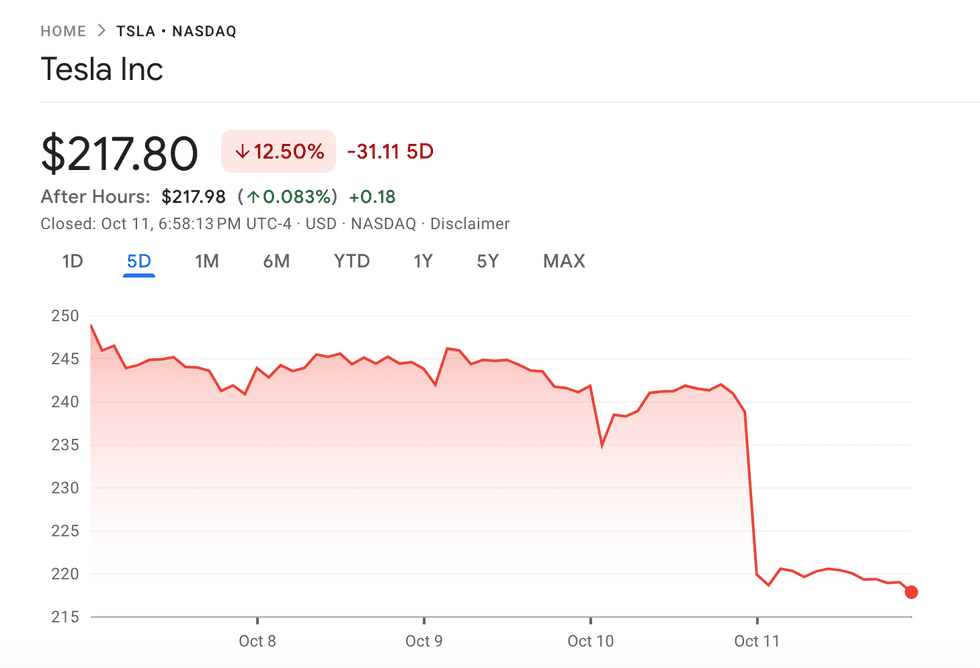

Musk provided insights into Tesla’s full-self driving (FSD) technology, set to debut in China by 2025 but facing regulatory obstacles in the US. Musk highlighted plans to integrate FSD in Model 3 and Model Y Teslas in Texas and California the following year, despite the absence of a firm release date. As of now, Tesla’s stock is down 12.5% for the week and 12.33% year-to-date.

Samsung’s Apology for Disappointing Financial Projections

South Korean tech giant Samsung released its Q3 profit forecast, predicting a 274% surge in operating profits to about 9.1 trillion Korean won (US$6.74 billion). Although this marks substantial growth from the previous year, the figure fell short of LSEG’s expectations, causing a 1.47% drop in share value. Samsung’s vice chairman, Jun Young-hyun, issued an apology attributing the decline to various factors in the company’s memory division.

Young-hyun pledged to stakeholders that Samsung’s leadership would enhance future readiness, emphasizing the company’s historical resilience and ability to transform challenges into opportunities. Despite the setback, Samsung’s shares are down by 3.26% for the week.

OpenAI’s Prolonged Path to Profitability

Recent reports indicate that OpenAI projects significant financial losses in the coming years, estimating up to US$14 billion in losses by 2026 and a total of US$44 billion between 2023 and 2028. The company plans substantial investments in training new AI models, with expenditures reaching up to US$200 billion by the decade’s end.

Following its latest funding round, which amassed US$6.6 billion and involved key players like Microsoft and Nvidia, OpenAI transformed its business model to a for-profit structure, though profitability is not projected until 2029. The company, valued at US$157 billion, aims to generate substantial revenue by then, mainly driven by ChatGPT.

Chart via Google Finance.

Tesla’s price movements for the week ending October 11.

The Rollercoaster Ride of Bitcoin Prices Amid Market Turbulence

Bitcoin’s Price Swings in Response to External Factors

Bitcoin began the week hovering around US$63,000, its valuation swayed by China’s vague stimulus policies and the soaring popularity of meme coins. Ether ETFs experienced stagnant flows, while Bitcoin ETFs recorded their most significant inflows since late September. The cryptocurrency market was in a state of flux, reacting sharply to external stimuli.

Market Reaction to Consumer Price Index Data

As the week progressed, Bitcoin faced a downward trend leading up to the release of the consumer price index (CPI) report on Thursday. The subsequent data announcement caused Bitcoin’s value to plummet below the US$60,000 mark for the first time in October, a typically bullish month. The CPI figures revealed a modest 0.2 percent monthly increase and a meager 2.4 percent rise year-over-year, marking the lowest annual surge in inflation since February 2021.

Bitcoin’s Resilience and Recovery

Despite the initial drop triggered by the CPI report, Bitcoin showed resilience by bouncing back and briefly surpassing the US$63,000 mark by Friday afternoon. The erratic behavior of the cryptocurrency demonstrated its ability to weather storms and regain lost ground, indicating a degree of stability amidst prevailing market uncertainty.