Advanced Micro Devices (NASDAQ: AMD) recently unveiled its latest artificial intelligence (AI) chip in a bid to disrupt Nvidia’s (NASDAQ: NVDA) dominant market position. While AMD has witnessed a surge in AI-related revenue, it still lags behind Nvidia’s GPU revenue.

A Potential AI Challenger Emerging

AMD has seen a steady rise in revenue from data center GPUs this year, with forecasts now exceeding $4.5 billion compared to Nvidia’s staggering $26.3 billion generated in just the last quarter. The introduction of the Instinct MI325X chip aims to narrow the GPU market gap by offering top-tier memory capacity, bandwidth, and compute power that rival Nvidia’s H200 chip. Notably, the comparison is against Nvidia’s Hopper architecture, not its newer Blackwell architecture, which Nvidia claims can deliver significantly higher performance. The production of AMD’s new chip is set to commence in Q4, with widespread availability projected by early 2025.

Image source: Getty Images.

In addition to the new chip, AMD introduced networking solutions such as NICs and DPUs, along with a new line of CPUs – EPYC 5th Gen – aimed at enhancing data center, cloud, and AI workloads.

AMD also bolstered its ROCm open software stack with new features, aiming to rival Nvidia’s CUDA software advantage. While Nvidia’s established platform has been a significant edge, AMD is making strides to level the playing field.

Although no new customer announcements were made, representatives from industry giants like Alphabet, Meta Platforms, Microsoft, and OpenAI discussed their utilization of AMD products at the event. Notably, Meta Platforms acknowledged collaborative efforts with AMD on various training workloads.

Investing in AMD – A Secondary AI Opportunity

While AMD’s announcement may not immediately dent Nvidia’s market share, the rapidly expanding AI infrastructure market and Nvidia’s limited supply capacity present a growth opportunity for AMD. Diversifying AI stock holdings by investing in AMD, a reliable secondary option, can offer solid returns as the AI infrastructure market continues to surge.

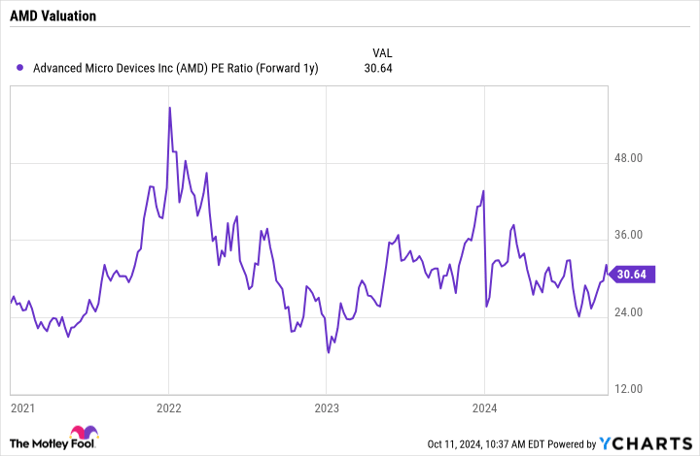

With a forward price-to-earnings (P/E) ratio of approximately 30 based on 2025 analyst estimates, AMD’s valuation appears reasonable considering its growth potential in the AI sector.

AMD PE Ratio (Forward 1y) data by YCharts

While AMD may not outshine Nvidia, it presents a sound investment for those seeking diversification in the AI sector. As long as the AI infrastructure market remains robust, AMD’s stock is poised to deliver consistent performance.

Seizing the Opportunity

For investors eyeing potential growth, AMD’s foray into the AI chip arena offers a compelling opportunity despite the existing market dynamics. The evolving landscape and AMD’s strategic positioning make it a noteworthy contender in the AI space.