As Corporate America braces for another earnings season, all eyes are on the tech giants dominating the artificial intelligence (AI) arena. These industry leaders typically outshine the overall market in terms of revenue and earnings growth, making Microsoft’s upcoming financial performance crucial for investors.

Microsoft (NASDAQ: MSFT) is set to unveil its results for the first quarter of fiscal 2025, ending on September 30, on October 30. Analysts and investors alike will be laser-focused on Microsoft’s ability to capitalize on its expanding array of AI products and services.

However, buried within Microsoft’s financial report lies a single AI statistic that could outshine them all.

Image source: Getty Images.

Scrutiny Intensifies on Microsoft’s Diverse AI Ventures

In a groundbreaking move last year, Microsoft sent shockwaves through the tech sector by pledging an additional $10 billion to ChatGPT innovator OpenAI. This investment has since fueled the creation of various cutting-edge AI solutions, including the revolutionary Copilot virtual assistants capable of producing textual content, images, and coding sequences based on simple cues.

While Copilot seamlessly integrates into Microsoft’s flagship software suite, such as Windows, Edge, and Bing, it commands a premium subscription when added to the Microsoft 365 productivity platform. With over 400 million 365 subscriptions globally, the potential for Copilot upgrades presents a substantial revenue opportunity for Microsoft. The surge in corporate clients purchasing more than 10,000 Copilot add-ons within three months in the last fiscal quarter underscores this potential. The upcoming earnings release should provide further insights into Copilot’s traction.

Nonetheless, the Azure cloud platform, notably Azure AI, is poised to steal the spotlight in the financial report. Azure AI, leveraging state-of-the-art chips from Nvidia and Advanced Micro Devices, offers businesses and developers computing resources to construct their AI models. Moreover, developers can harness the latest large language models (LLMs), including OpenAI’s GPT-4o, through Azure AI to expedite the development of AI applications like chatbots and virtual assistants. Azure AI’s customer base surged by 60% year-over-year in the previous quarter, boasting 60,000 users.

The Vital Metric for Microsoft Shareholders to Track

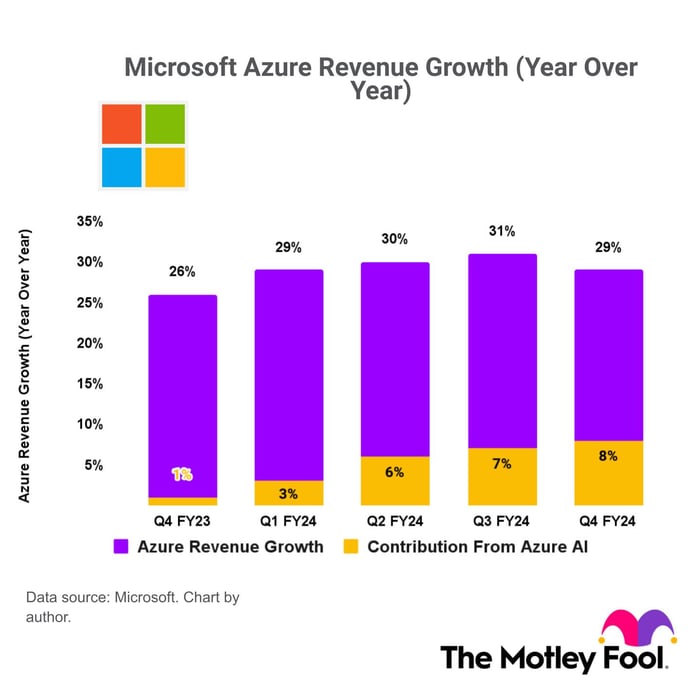

The Azure platform has consistently been Microsoft’s fastest-growing segment, garnering significant investor attention. In the last quarter, Azure revenue climbed 29% year-on-year, accelerating from 26% in the corresponding period.

Azure’s growth narrative is increasingly steered by Azure AI. Notably, Azure AI’s contribution accounted for 8 percentage points of Azure’s overall 29% growth, a record high. This exponential surge marks an eightfold increase from its impact on revenue growth a year before, where Azure AI merely contributed 1 percentage point.

Microsoft’s hefty $55.7 billion expenditure on capital investments in fiscal 2024, primarily directed at AI data center infrastructure and chips, magnifies the importance of Azure AI’s revenue generation. The trajectory of Azure AI’s contribution to Azure’s growth will be a litmus test for Microsoft’s returns on these substantial investments.

Should Azure AI continue to amplify its influence on Azure’s performance, signaling robust demand for computing resources and cutting-edge LLMs among enterprises and developers, this trajectory could bolster investor confidence in Microsoft’s premium valuation. Conversely, any stumble or stagnation in Azure AI might trigger a market correction for Microsoft shares.

That’s why, in my estimation, monitoring Azure AI’s impact on Azure’s overall revenue growth stands out as the quintessential figure to watch on October 30.

Seizing a Second Shot at a Potentially Lucrative Bet

Ever regret not hopping on the bandwagon of the most successful stocks?

Insightful Stock Recommendations You Shouldn’t Miss

Discover the Power of “Double Down” Stock Recommendations

Every now and then, a team of expert analysts boldly proclaims a “Double Down” stock recommendation, signaling that the highlighted companies are on the brink of significant growth. If you’re apprehensive about missing out on lucrative investment opportunities, the present moment is ripe for you to seize the day. The historical successes of such recommendations underscore this sentiment:

- Amazon: A hypothetical $1,000 investment made at the time of a “Double Down” call in 2010 would have ballooned to $21,139!*

- Apple: Picture investing $1,000 in 2008 following a “Double Down” endorsement; today, it would have blossomed into $44,239!*!

- Netflix: For those who took a gamble with $1,000 in 2004 after a “Double Down” recommendation, the returns would now stand at an astounding $380,729!*!

The latest buzz in the financial realm surrounds three remarkable companies as they receive the coveted “Double Down” accolade, signifying a rare opportunity that demands immediate attention.

Curious to know more? Explore these 3 “Double Down” stocks now »

*Stock Advisor returns as of October 14, 2024