The Unprecedented Ascent of Nvidia

Nvidia Corp NVDA witnessed a 233% surge in its stock price over the past year, closing at $138, reflecting a market cap surpassing $3 trillion. But the whispers circulating among tech enthusiasts speak of even greater heights for this semiconductor giant.

Enthusiasm for Nvidia’s trajectory is palpable across financial circles. Ram Ahluwalia, CEO of Lumida Wealth Management, foresees a potential valuation of $4 trillion, citing robust demand for GPU chips as a key driver.

Industry luminaries echo Ahluwalia’s sentiments, with T. Rowe Price portfolio manager Tony Wang and Dan Niles, founder of Niles Investment Management, projecting a doubling of Nvidia’s stock over the forthcoming years amidst a landscape ripe for AI investment.

Goldman Sachs chimes in, highlighting Nvidia’s strategic advantage in inference compute, suggesting the company is poised to seize exponential growth opportunities. This optimism is mirrored in Bofa Securities’ decision to maintain a ‘Buy’ rating, elevating the price target from $165 to $190.

Bolstering these anticipations, analysts collectively set a consensus price target of $234.49 for Nvidia, painting a resoundingly positive picture for the company’s future trajectory.

The Inexorable Momentum of Nvidia Stock

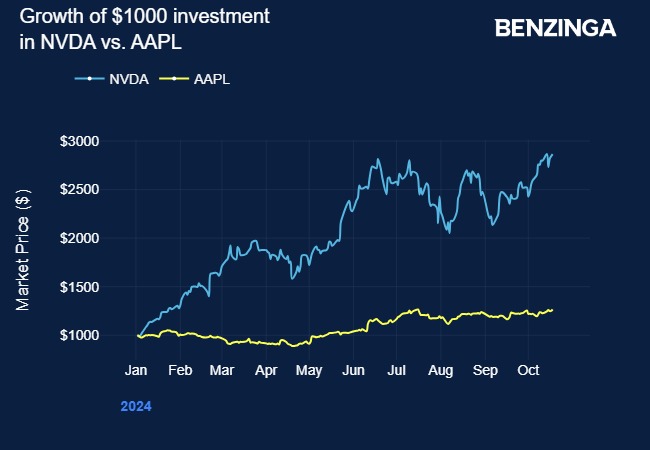

The meteoric rise of Nvidia’s stock, catapulting nearly 186.5% year-to-date, underscores its dominant position in the market, driving its market cap to approximately $3.39 trillion. Notably, Nvidia now stands as the second-most valuable American company, trailing only Apple in market capitalization.

A Spectacular Trip to the Stratosphere

Nvidia’s stellar performance in the past year has been nothing short of remarkable, with its share price vaulting from $41 to $138, mirroring a staggering 233% surge. This astronomical climb has not only captivated investors but also propelled ETFs like GraniteShares 2x Long NVDA Daily ETF (NVDL) and Direxion Daily NVDA Bull 2X Shares (NVDU) to extraordinary gains exceeding 440%.

The upward trajectory of Nvidia’s stock exemplifies a success story that has captured the imagination of the market, setting the stage for a potentially groundbreaking chapter in the company’s evolution.

The legacy of Nvidia’s remarkable rise continues to unfold, leaving investors and industry observers eagerly anticipating the next jaw-dropping leap in its inexorable ascent.