Investors often rely on the recommendations of Wall Street analysts to make decisions regarding their stock portfolios. These recommendations, which can shift the market’s perception of a stock, are frequently a focal point for media coverage. But do they truly hold weight?

Before delving into the credibility of brokerage suggestions and strategies for leveraging them favorably, let’s examine what the eminent figures on Wall Street opine about Alibaba (BABA).

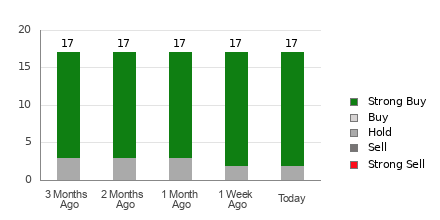

Alibaba currently boasts an average brokerage recommendation (ABR) of 1.24 on a scale from 1 to 5, with ratings ranging from Strong Buy to Strong Sell, based on assessments from 17 brokerage firms. This ABR of 1.24 effectively places it between Strong Buy and Buy.

Of the 17 assessments contributing to the current ABR, an overwhelming 15 are Strong Buy recommendations, making up 88.2% of all suggestions.

Analyzing the Trajectory of Brokerage Recommendations for BABA

The ABR signals a bullish sentiment towards Alibaba, but basing investment decisions solely on this metric may not be prudent. Research indicates that brokerage recommendations have a limited track record of steering investors towards stocks poised for significant price appreciation.

Why you ask? Institutional biases often skew the ratings provided by brokerage analysts due to their firms’ vested interests in the stocks under scrutiny. For every “Strong Sell” recommendation, these firms tend to assign five “Strong Buy” ratings, underscoring the misalignment of their incentives with those of retail investors. Hence, the ABR may not always offer a clear indication of a stock’s future price movement. It’s advisable to cross-reference these ratings with your independent analysis or a reliable forecasting tool.

Backed by a robust record of external validation, our in-house stock rating tool, the Zacks Rank, classifies stocks into five categories, stretching from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), providing a reliable gauge of a stock’s short-term price performance. Hence, correlating the Zacks Rank with ABR could enhance the accuracy of your investment decisions.

Deciphering the Distinction Between ABR and Zacks Rank

While both ABR and Zacks Rank adopt a 1 to 5 scale, they are fundamentally distinct metrics.

ABR hinges solely on broker recommendations, typically denoted in decimals (e.g., 1.28). Conversely, Zacks Rank operates as a quantitative model that leverages earnings estimate revisions, expressed in whole numbers from 1 to 5.

Broker analysts, driven by tugs from their employers, often exhibit a predisposition towards optimism in their ratings, misleading investors more frequently than steering them correctly. In contrast, the Zacks Rank draws its strength from earnings estimate fluctuations, showcasing a strong correlation with near-term stock price movements.

Another disparity lies in the timeliness of ABR versus Zacks Rank. ABR updates can lag behind, while Zacks Rank swiftly integrates analyst revisions to reflect evolving business dynamics, ensuring prompt insight into future price trends.

Is Alibaba (BABA) a Worthy Investment?

From an earnings estimate perspective, the Zacks Consensus Estimate for Alibaba has surged by 1.9% over the last month, now standing at $8.94 for the current year.

Amidst analysts’ burgeoning optimism surrounding Alibaba’s earnings outlook, evidenced by a unanimous uptick in EPS projections, the stock appears poised for a promising upturn in the near future.

Given the significant alteration in the consensus estimate, alongside three other earnings-related factors, Alibaba currently carries a Zacks Rank #2 (Buy). Explore the complete roster of Zacks Rank #1 (Strong Buy) equities here.

Conclusively, the Buy-equivalent ABR for Alibaba may serve as a worthwhile reference point for potential investors.

Zacks Identifies #1 Semiconductor Stock

It’s merely 1/9,000th the size of NVIDIA, which has surged over +800% since our endorsement. While NVIDIA remains robust, our new top chip stock brims with substantial growth potential.

Boasting robust earnings expansion and an expanding clientele base, this stock is strategically positioned to cater to the burgeoning demands for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor industry is anticipated to burgeon from $452 billion in 2021 to $803 billion by 2028.

Explore This Stock for Free Now >>

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report