Stock Market Dynamics

Apple Inc. AAPL shares are currently at a critical juncture, facing resistance at a significant historical peak. The likelihood of Apple remaining at this price level for an extended period appears slim, with the possibility of either a breakout to higher levels or a reversal to the downside.

Understanding Price Patterns

Market movements are often influenced by a complex interplay of supply, demand, and investor sentiment. Psychological factors play a crucial role in shaping price patterns visible on charts. For instance, when a stock reaches a price level that had previously acted as a peak or resistance, there is a tendency for it to encounter resistance once again.

The Story Behind Apple’s Resistance

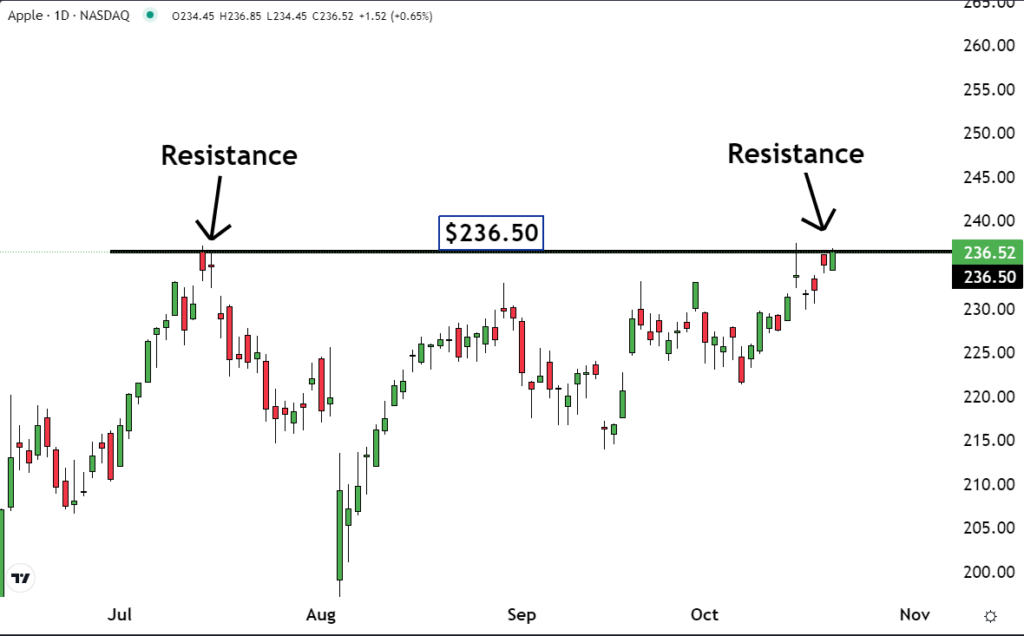

Examining the chart, we observe that Apple shares are facing a significant hurdle at the $236.50 level, which previously served as a resistance point in July. The recurrence of this resistance is not mere coincidence but a result of traders and investors who entered positions during the formation of the earlier peak.

Market Resistance Dynamics

As Apple revisits the $236.50 price point, many disillusioned buyers from the previous peak may opt to exit their positions at breakeven, leading to a concentration of sell orders at this level. This surge in sell orders has effectively created a barrier at the same price level that acted as resistance before.

The Breakout Conundrum

A successful breakthrough of this resistance would signal the departure of the sellers who contributed to the barrier, indicating a potential uptrend where buyers will need to pay higher prices to secure shares. Conversely, failure to breach the resistance could push Apple’s stock lower as selling pressure mounts.

When a stock gravitates toward a crucial price juncture like Apple’s current position, the probability of prolonged stagnation is low. The higher likelihood is of an imminent breakout to higher levels or a reversal and descent to lower territories.

Insightful Market Predictions

Read Also: Goldman Sachs Predicts Bleak Long-Term S&P 500 Returns As Market Concentration Hits ‘Highest Level In 100 Years’

As Apple navigates this precarious pricing landscape, the overarching question remains: Will it defy the resistance or succumb to it?

Read Next:

• Tesla Q3 Earnings Preview: Analyst Says 1.8 Million Unit Estimate ‘Hittable’ For 2024, ‘2 Million+ Number The Focus For 2025’

Photo: Shutterstock